Global| Nov 22 2005

Global| Nov 22 2005Gasoline Prices Fell In A Competitive Market

by:Tom Moeller

|in:Economy in Brief

Summary

Last week, the US average retail gasoline price continued lower to $2.20 per gallon from $2.30 during the prior week and from $2.73 one month earlier. As of yesterday, the spot market price for gasoline was $1.44 per gallon and has [...]

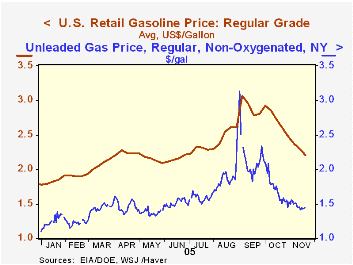

Last week, the US average retail gasoline price continued lower to $2.20 per gallon from $2.30 during the prior week and from $2.73 one month earlier. As of yesterday, the spot market price for gasoline was $1.44 per gallon and has roughly held that level for seven days.

Retail gasoline prices peaked in early September at $3.07 per gallon and have since fallen 72 cents or 28%. During that period spot gasoline prices are down $1.18 or 45%. The implied rise in gasoline retailers' margins has restored profitability. However, that rise in the retail price of gasoline versus the spot price followed several years of margin decline.

During the past month margins have fallen roughly 20%, in part reflecting a decline in gasoline demand of up to 3.5% versus the year ago level. In turn, lower prices seem to have revived demand which spiked last week and raised the four week average level of gasoline demand to roughly even with a year earlier after declining sharply through September & October.

Crude oil prices have continued lower as well. WTI crude yesterday at $57.21 per barrel was down versus an average of $62.50 during October and was 18% lower than the late August high of $69.82.

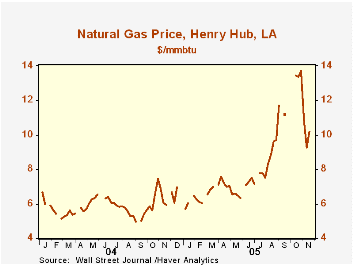

In November, natural gas prices reversed some of the strength of the prior three months. During the last three weeks gas prices averaged $10.08/mmbtu versus the high of $13.53 averaged during October. Nevertheless, prices still are up 71% versus all of last year.

| Energy Prices | 11/21/05 | 12/31/04 | Y/Y | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|

| US Retail Gasoline, Regular ($/Gal.) | $2.20 | $1.79 | 13.0% | $1.85 | $1.56 | $1.35 |

| Domestic Spot Market Price: West Texas Intermediate ($/Barrel) | $57.21 | $41.78 | 18.0% | $41.78 | $32.78 | $31.23 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.