Global| Apr 19 2007

Global| Apr 19 2007Gasoline Prices Head for $300

Summary

Gasoline prices are rising inexorably, surpassing $3.00/gallon in some high-tax areas by last week, and almost certainly due to cross that line imminently for the nation as a whole. In the week ended this past Monday, April 16, [...]

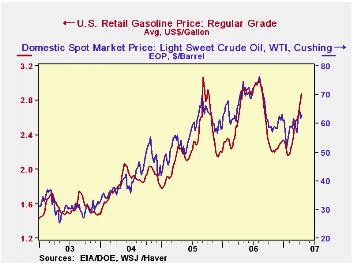

Gasoline prices are rising inexorably, surpassing $3.00/gallon in some high-tax areas by last week, and almost certainly due to cross that line imminently for the nation as a whole. In the week ended this past Monday, April 16, Department of Energy data put regular gasoline at $2.876 a gallon, up 7.4 cents on the week, following 9.5 and 9.7 cent increases the week of April 9 and April 2 respectively. The price is up 29.9 cents from four weeks ago. From the same week a year ago, the price is up 9.3 cents, or 3.3%.

On Tuesday, the price of crude oil was $63.11 per barrel, up $1.21 from the week before and $6.37 from four weeks ago. However, the price is down from the extremes of the year-ago period, when the effects of Hurricane Katrina were still impacting availability.

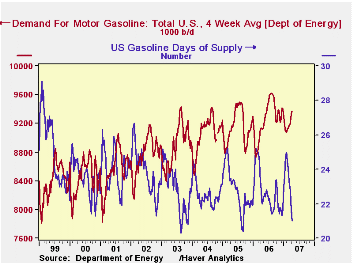

Three weeks ago, when we last looked at these price patterns, we noted that prices were rebounded from a mid-winter lull. Then we cited the new information on the days' supply of gasoline inventories, which was lower at its winter peak than in prior years. Now we see that figure has dropped to 21.0 days, an unprecedentedly short period for the spring, ahead of the summer driving season. In fact, it's low for anytime, with only the Katrina period and the mid-summer of 2003 showing weaker supplies of gasoline relative to current demand.

This is likely related to calm weather and the reduced number of storms over the winter. According to the National Climate Data Center in figures released yesterday, the national average amount of precipitation in Q1 was the second smallest for that period since 1988. So people could drive more and they used more gasoline over the winter. The distinctive plunge in demand during those months of prior years was simply not repeated this year, as is clear in the second graph.

Meantime, data from the Oil and Gas Journal show that gasoline was above $3.00 in a number of cities by last week: San Francisco, Portland, San Diego and Chicago, most notably.

In this commentary, the data on gas prices, demand and inventories come from Haver's OILWKLY database. The price of crude oil is in WEEKLY, with another version of the same product also in OILWKLY and national average precipitation is in USECON. Most of the energy data is sourced from the Department of Energy, but gasoline prices in various cities are compiled by the Oil and Gas Journal publication.

| GASOLINE PRICES & DEMAND | 4/16/07 | 4/9/07 | 3/19/07 | 2/19/07 | 4/17/06 | Annual Averages||

|---|---|---|---|---|---|---|---|

| 2006 | 2005 | ||||||

| Retail Price, Regular Gasoline, $/gal | 2.876 | 2.802 | 2.577 | 2.296 | 2.783 | 2.572 | 2.270 |

| Spot Price, West Texas Intermediate, $/bbl | 63.11 | 61.90 | 56.74 | 58.08 | 71.36 | 66.10 | 56.47 |

| Gasoline Demand (000 b/d, 4-wk Avg)* |

9,365 | 9,363 | 9,178 | 9,121 | 9,134 | 9,259 | 9,146 |

| Inventory: Days' Supply* | 21.0 | 21.3 | 22.9 | 24.4 | 22.2 | 22.4 | 22.0 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates