Global| Feb 14 2008

Global| Feb 14 2008GDP Slows on a Very Broad Front

Summary

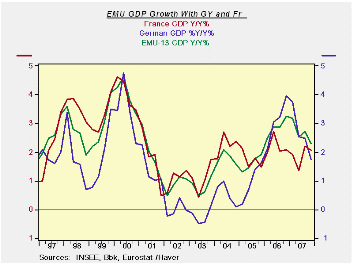

GDP growth is slowing on a broad front. German GDP is slowing year/year for four straight quarters. For most other countries Q3 growth brought an up tick that quarter and interrupted what would have been similar long strings of GDP [...]

GDP growth is slowing on a broad front. German GDP is slowing year/year for four straight quarters. For most other countries Q3 growth brought an up tick that quarter and interrupted what would have been similar long strings of GDP deceleration. GDP growth year/year in 2007-Q4 slowed everywhere except in the Netherlands. Quarter-to-quarter GDP growth rates slowed everywhere except Japan.

With the European releases on GDP we have no detail on GDP, except for France. There weaker consumption and inventory reduction brought GDP growth lower. We have seen the reduction in the growth rates of the industrial sectors in recent months even though some of the industrial indicators have displayed some firmer signals. The EU sentiment indexes have marked this slowdown correctly.

The fact of the matter is that GDP here and now is slowing. The recent rhetoric of the ECB is sounding much less certain and much more like it is about to really keep its options open. Remember that when the credit problems hit in the US at first the Fed did not think that they would be so bad. Now UBS, a large Swiss bank, has just reported larger subprime losses than expected and more exposure to leverage type loans of the variety that have fallen into disregard.

German unions (IG Metall) are using feisty rhetoric to justify pay hikes even saying that ECB is wrong and that policy should be accommodative. Professional EMU forecasters (see ECB survey) now look for weaker growth and more inflation in the Euro Area. Eurogroup Chairman Jean-Claude Juncker has admitted that the situation is ‘not completely clear any more’. Guy Quaden, ECB council member, has said that the economy could decelerate faster than the ECB previously thought. All of this suggests a situation, outlook and policy in flux.

| Euro Area and Main G-10 Country GDP Results | |||||||

|---|---|---|---|---|---|---|---|

| Quarter over quarter | Year/Year | ||||||

| GDP | Q4-07 | Q3-07 | Q2-07 | Q4-07 | Q3-07 | Q2-07 | Q1-07 |

| EMU-13 | 1.7% | 3.1% | 1.2% | 2.3% | 2.7% | 2.5% | 3.2% |

| France | 1.4% | 3.2% | 1.4% | 2.1% | 2.2% | 1.3% | 1.9% |

| Germany | 1.1% | 2.7% | 0.7% | 1.7% | 2.5% | 2.6% | 3.7% |

| Italy | -- | 1.7% | 0.2% | -- | 1.9% | 1.8% | 2.4% |

| The Netherlands | 4.7% | 7.7% | 1.1% | 4.3% | 3.9% | 2.4% | 3.2% |

| UK | 2.5% | 2.5% | 3.3% | 2.9% | 3.2% | 3.2% | 3.2% |

| US | 0.6% | 4.9% | 3.8% | 2.5% | 2.8% | 1.9% | 1.5% |

| Japan | 3.7% | 1.3% | -1.4% | 1.8% | 1.9% | 1.7% | 2.9% |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.