Global| Jan 26 2017

Global| Jan 26 2017German Consumer Confidence Will Continue Higher in February

Summary

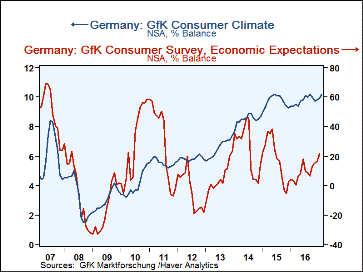

The GfK month-ahead survey for German consumer confidence has reached its highest reading on record for the third time. It first reached this level in June 2015 then matched it in September 2016. This is its third peaking in the last [...]

The GfK month-ahead survey for German consumer confidence has reached its highest reading on record for the third time. It first reached this level in June 2015 then matched it in September 2016. This is its third peaking in the last 21 months. The components for the report lag its release.

The GfK month-ahead survey for German consumer confidence has reached its highest reading on record for the third time. It first reached this level in June 2015 then matched it in September 2016. This is its third peaking in the last 21 months. The components for the report lag its release.

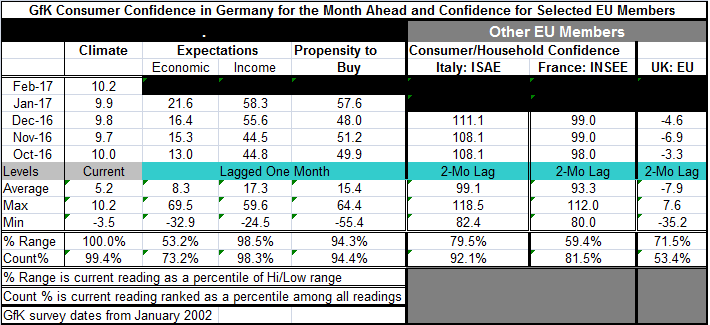

In January the bump up in the index (when it rose to 9.9 from 9.8) was led by a sharp rise in the propensity-to-buy index and a strong gain in the economic index while supported by a rise in income expectations. The strong gain in the propensity-to-buy index in January was the 13th largest month-to-month rise in that series' history, making it a 'top-ten' percentile event.

The German confidence index has been this strong only 0.6% of the time. Income expectations (in January) have been this strong or stronger less than 2% of the time. The propensity-to-buy reading has been this strong or stronger less than 6% of the time. The economy index is considerably less elevated than the other components as it has been this strong or stronger about 27% of the time, marking economic of performance as not quite a top quartile condition. However, the ongoing push has demonstrated that the Berlin terror attack has not diminished consumer expectations or plans to spend. Neither the upcoming German elections seem to have spawned any anxiety.

Comparing Germany to the three other largest European economies, we find that confidence in other large economics is mostly stable and strong. In Italy, despite uneven economic performance and political instability, the consumer confidence ranking is as that strong or stronger than its December reading only 8% of the time. In France, the confidence reading is as that strong or stronger than its December reading less than 19% of the time. But in the U.K. where Brexit events are unfolding consumer confidence is more mid-range at its 53rd queue percentile, marking it as that strong or stronger less than 47% of the time.

U.K. confidence has taken a huge hit under Brexit concerns as the pound sterling has plunged. But U.K. growth has held up and in Q4 it posted the same 0.6% quarterly gain that it had posted in each of the two prior quarters. To date, a loosening in monetary policy has helped to support the economy. But the assessment of household financial conditions survey has showed what the confidence index also reveals and that is concern about the future. The uncertainties over Brexit have come home to roost in the mind of the consumer if not in other economic measures.

Italy rejected a key referendum proposed by its former prime minister that led to his resignation. Italian banks are in terrible shape and need of much more help. Yet, neither of these issues seems to faze the Italian consumer at all. The Five Star Movement, a secessionist political group in the U.K. has been gaining strength, but most Italians, restive as they are, still want to remain in the single currency block. Italy has a complicated situation to unravel.

The French economy has been struggling and France is in the middle of its own election cycle. Recently, French economic metrics have been on a modest upswing. But France is still walking a fine line over the performance of its budget and its precarious position under EU budget mandates.

On balance, Germany is still performing with excellence. The few hic-ups that might have side-tracked German consumers have simply been steamrolled by ongoing optimism. German growth is unspectacular but steady. Unemployment is at a reunification low. The biggest concern likely to spread that could undermine confidence is that German inflation is rising faster than inflation in the EMU and the ECB may not raise rates as fast as German tastes would prefer. Still, it is unclear if that would be enough to unseat German consumer perceptions. There are a lot of pressures and there is a lot of transitioning that various EMU nations have to accomplish, the Germans included. And a number of key European elections are in train. So far, economic performance and consumer expectations are undaunted, save those over Brexit in the U.K.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates