Global| Mar 28 2007

Global| Mar 28 2007German CPI Picks Up, Pushed by Energy and Non-Energy Factors

Summary

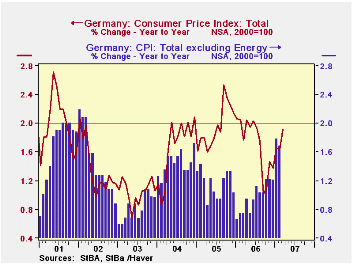

CPI inflation in Germany increased 0.3 percentage point this month to 1.9% (year/year % change) from 1.6% in February. A year ago this broad measure was 2.1%. In between, as is evident in the first graph, the German CPI held near a 2% [...]

CPI inflation in Germany increased 0.3 percentage point this month to 1.9% (year/year % change) from 1.6% in February. A year ago this broad measure was 2.1%. In between, as is evident in the first graph, the German CPI held near a 2% rate, then plunged during September and October when energy prices broke. Over the last five months, the total CPI resumed a near-2% pace as both energy and non-energy prices began to accelerate.

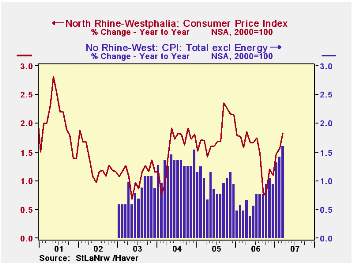

Today, only the total index is available for March for all of Germany. But several individual Länder published their full array of CPI data. Our table below lists the Länder maintained in Haver's GERMANY database and their CPI performances excluding energy. (We've also included the names of their capital cities to aid in identifying the specific territory. These areas constitute 64% of the weight in the Pan-German CPI) In each case, these data show that inflation aside from energy has picked up noticeably. For example, in the largest Länd (by population), North Rhine-Westphalia, the total CPI in the last few months looks to have simply resumed the pace of 1.6-1.8% year-on-year that prevailed before last autumn's energy drop. But more significantly, even as energy prices have picked back up again, prices excluding energy have accelerated substantially. In early 2006, they were increasing at a pace well below 1% in that region, touching as low as 0.4% year-on-year last May, but they rose 1.6% this month. Similarly, in Bavaria, the total index has risen 2.1% in March, hardly different from 2.0% in March 2006. However, the index excluding energy was also up 2.1% this March, compared with just 1.0% in the same month a year ago.

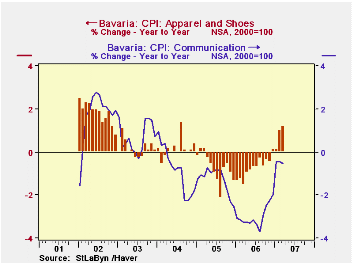

In both of these regions, the distribution of the ex-energy price increases has been broad. Food prices have accelerated, as have lodging and restaurants, recreation and "other" (mostly personal care goods and services). Two other seemingly unrelated categories are seeing noticeable changes: clothing and communication had both been falling sharply but are no longer doing so. Clothing prices have turned upward, not rapidly, but much different from the declines seen earlier. Communications prices are still falling, but again, much less than they were through the middle of last year.

So while overall inflation looks no worse, for either Germany as a whole or for the two Länder we have described here, it is much broader in scope than experienced until a few months ago. And two sources of price weakness, the technology revolution in communications and the shift toward inexpensive production of clothing in Asia, are apparently playing out. These conditions generate good questions about prospects for the course of inflation going forward.

| Germany (NSA, Yr/Yr % Change) | Mar 2007 | Feb 2007 | Jan 2007 | March 2006 | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|

| Pan-Germany | 1.9 | 1.6 | 1.6 | 2.1 | 1.7 | 2.0 | 1.7 |

| ex Energy | -- | 1.7 | 1.8 | 0.8 | 1.0 | 1.2 | 1.4 |

| Energy | -- | 2.2 | 1.6 | 11.8 | 8.5 | 10.3 | 4.1 |

| Excluding Energy:Baden-Württemberg (Stuttgart) | 1.8 | 1.8 | 1.8 | 0.9 | 1.1 | 1.0 | 1.7 |

| Bavaria (Munich) | 2.1 | 1.9 | 1.9 | 1.1 | 1.3 | 1.5 | 1.8 |

| Hessen (Frankfurt) | 1.8 | 1.6 | 1.9 | 0.7 (May) | -- | -- | -- |

| N. Rhine-Westphalia (Düsseldorf) | 1.6 | 1.4 | 1.3 | 0.5 | 0.7 | 1.0 | 1.3 |

| Brandenburg (Potsdam) | 1.8 | 1.9 | 1.9 | 1.1 | 1.4 | 1.5 | 1.7 |

| Saxony (Dresden) | 2.2 | 2.2 | 2.4 | 1.1 | 1.5 | 1.3 | 1.4 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.