Global| Jul 19 2011

Global| Jul 19 2011German Financial Community Lowers Expectation for the Next Six Months

Summary

The financial community in Germany represented by 288 institutional investors and analysts in the ZEW July survey has become more guarded in its expectations of macroeconomic developments over the next six months as the excess of [...]

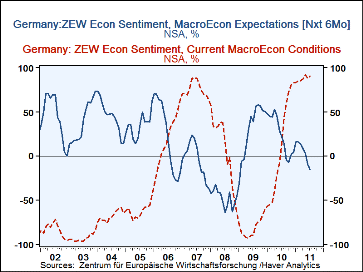

The financial community in Germany represented by 288 institutional investors and analysts in the ZEW July survey has become more guarded in its expectations of macroeconomic developments over the next six months as the excess of pessimists over optimists rose from 9.0% in June to 15.1% in July. This excess is, however, well below 63.9%, the low point of the past ten years recorded in July 2008. At the same time, these analysts saw some improvement in current conditions as the excess of optimists over pessimists rose from 87.6% in June to 90.6% in July to a balance only slightly below 91.5%, the peak reached in May of this year. The macroeconomic expectations and appraisals of the current situation are shown in the first chart. The July results reflect the continued good economic conditions in Germany, on the one hand; but the increasing concerns over the public debt problems of some countries in the Euro Area and political and economic conditions in the U. S., on the other hand.

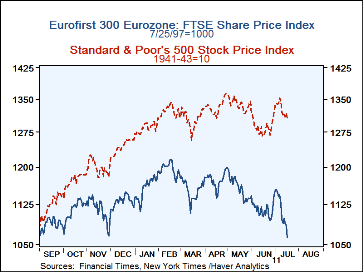

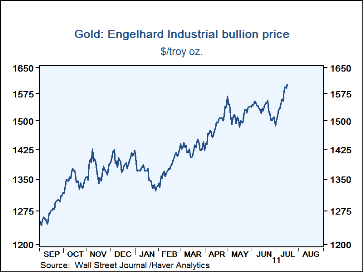

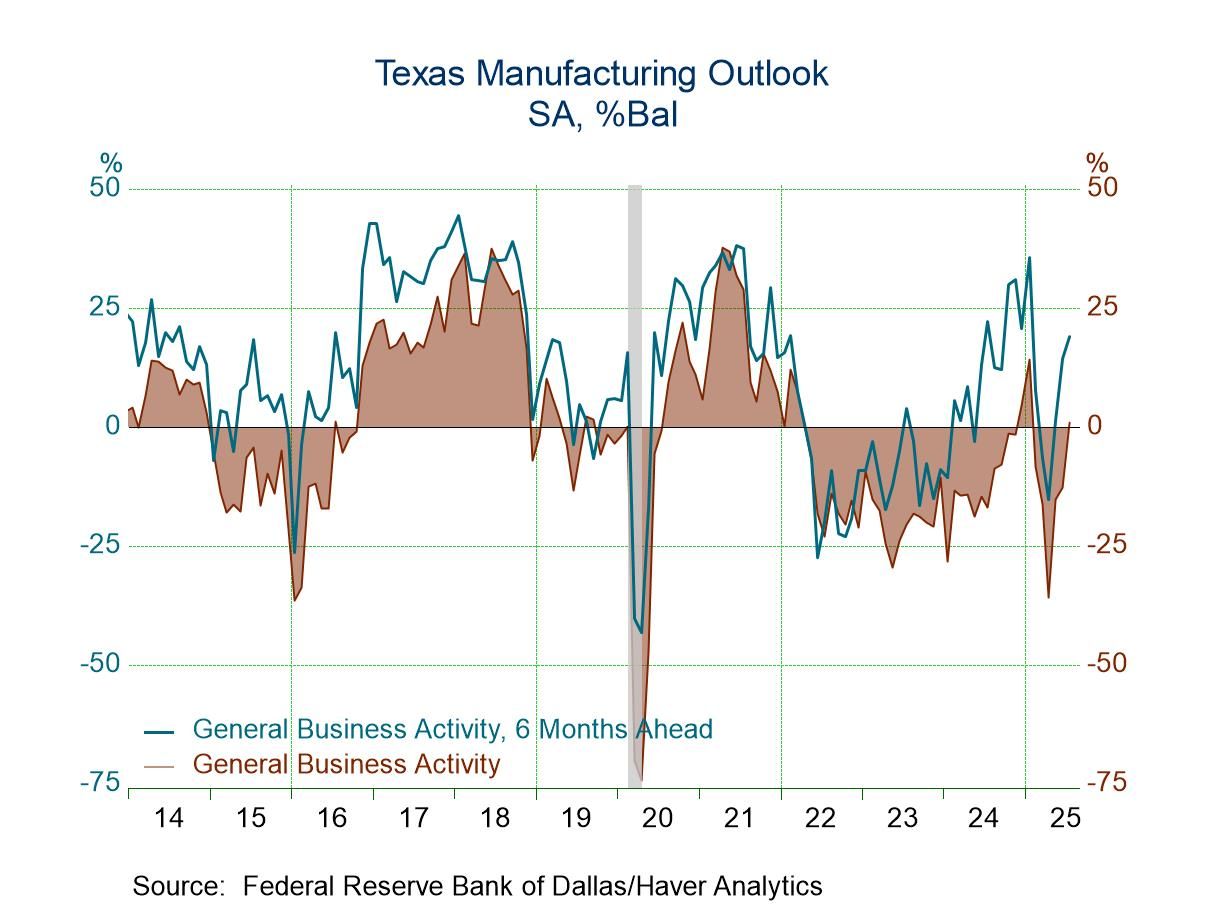

During the period when the survey took place, July 4 through July 18, these increasing concerns were reflected in declines in stock prices in the U. S. and the Euro Area, a sharp rise in the price of gold to an all time high, and a decline in the euro against the dollar, the Japanese yen and the Swiss franc. In the second, third and fourth charts we show the day by day movements in these variables since the beginning of this year. The second chart shows stock prices in the U. S. and Euro area. The U. S. is represented by the S&P 500 Index for the U.S. and the Euro Area, by the Eurofirst 300 Eurozone: FTSE Share Price Index. Stocks in the U. S. declined 2.7% in the July 4-July 18 period and stocks in the euro area, 7.9%. The third chart shows the price of gold, which rose 6.9% in the period to an all time high of $1,602.50 a troy ounce.The fourth chart shows the value of the euro in terms of the dollar, the yen and the Swiss franc. The decline in the euro against the dollar was 3.4%, but much larger declines were registered against the yen--5.4%--and and the Swiss franc--6.8%.

| July 18,11 | July 4, 11 | % Change | |

|---|---|---|---|

| S&P 500 | 1339.67 | 1305.44 | -2.56 |

| Euro-Area FTSE | 1154.46 | 1062.80 | -7.94 |

| Price of Gold | 1602.5 | 1499.7 | 6.85 |

| Yen/Euro | 111.0 | 117.3 | -5.37 |

| US$/Euro | 1.4026 | 1.4512 | -3.35 |

| Swiss Franc/Euro | 1.1476 | 1.2319 | -6.84 |