Global| Aug 31 2007

Global| Aug 31 2007German IFO Detail Slows Some Slippage Amid Strength

Summary

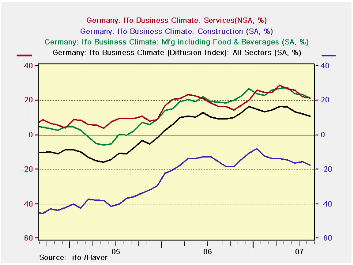

In the German IFO framework the biggest slippage seems to be in orders on hand, month-to-month demand, and business expectations. These measures have dropped into the 60th to 70th percentile ranges of their respective histories. These [...]

In the German IFO framework the biggest slippage seems to be in orders on hand, month-to-month demand, and business expectations. These measures have dropped into the 60th to 70th percentile ranges of their respective histories. These are still firm readings but not so strong. One continuing feature of interest in this report is the strength of foreign orders on hand. Foreign orders are still near their peak reading in the 98th percentile of their range. Despite this the current situation is still evaluated as strengthening and is in the 95th percentile of its range.

The IFO’s three month outlook survey is also mixed. Only order expectations for retailers are weakening and they have been crumbling steadily and rapidly for months. Employment expectations are guarded.

The IFO’s diffusion measures by sector show a sharp drop for wholesalers with conditions eroding across most sectors. Construction and retail continue to post net negative signals and they too are fading.

| Percent: Yr/Yr | INDEX NUMBERS | ||||||||

| Aug-07 | Jul-07 | Jun-07 | May-07 | Apr-07 | CURRENT | Average | Curr/Avg | Percentile | |

| Biz Climate | 0.7% | 0.8% | 0.2% | 2.8% | 2.6% | 105.8 | 95.7 | 110.6% | 87.7% |

| Current Situation | 2.5% | 2.4% | 1.7% | 4.7% | 6.3% | 111.5 | 94.8 | 117.7% | 88.2% |

| Biz Expectations: Next 6-Mos | -1.2% | -0.9% | -1.2% | 1.0% | -1.0% | 100.4 | 96.7 | 103.9% | 76.5% |

| Aug-07 | Jul-07 | Jun-07 | May-07 | Apr-07 | CURRENT | Average | Curr/Avg | Percentile | |

| Current Situation | |||||||||

| MFG | 4.4% | 4.5% | 4.4% | 6.7% | 7.6% | 111.3 | 92.2 | 120.7% | 95.3% |

| Biz Expectations: Next 6-Mos | |||||||||

| MFG | -1.9% | -0.4% | -2.8% | 0.9% | -1.4% | 99.1 | 96.4 | 102.8% | 73.1% |

| Activity (m/m) | |||||||||

| MFG | 1.0% | -1.9% | -3.7% | 2.0% | -0.5% | 104.7 | 96.9 | 108.0% | 85.4% |

| Demand M/M | |||||||||

| MFG | -2.8% | -3.3% | -7.0% | 0.5% | -3.7% | 99.3 | 97.1 | 102.3% | 62.2% |

| Orders on hand | |||||||||

| MFG | -2.4% | -2.7% | -3.6% | -0.9% | -3.0% | 102.2 | 96.4 | 106.0% | 72.7% |

| Foreign orders on hand | |||||||||

| MFG | 2.5% | 1.9% | 2.0% | 2.5% | 1.9% | 112.1 | 94.3 | 118.8% | 98.1% |

| Yr/Yr percentage changes in underlying Indices | |||||||||

| IFO outlook for 3-Months ahead | |||||||||

| 3-Mos ahead | Percent: Yr/Yr | INDEX NUMBERS | |||||||

| Expected Activity | Aug-07 | Jul-07 | Jun-07 | May-07 | Apr-07 | CURRENT | Average | Curr/Avg | Percentile |

| MFG | 2.5% | 1.0% | 3.4% | 0.5% | 0.7% | 102.5 | 96.7 | 106.0% | 91.5% |

| Orders expectations | |||||||||

| Retail Orders Expectations | -1.1% | -11.6% | -10.9% | -4.6% | -10.9% | -10.5 | -17.5 | 59.9% | 72.9% |

| Wholesale | 0.8% | 7.1% | 5.7% | 15.7% | 15.0% | 7.8 | -14.0 | -55.8% | 84.5% |

| Export Biz Expectations | |||||||||

| MFG | 0.9% | 0.0% | 0.5% | -0.5% | -1.1% | 102.8 | 98.4 | 104.5% | 85.6% |

| Employment Expectations | |||||||||

| MFG | 4.1% | 7.4% | 8.4% | 7.5% | 6.4% | 105.0 | 96.0 | 109.4% | 57.1% |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.