Global| Sep 24 2018

Global| Sep 24 2018German IFO Index Marks Time

Summary

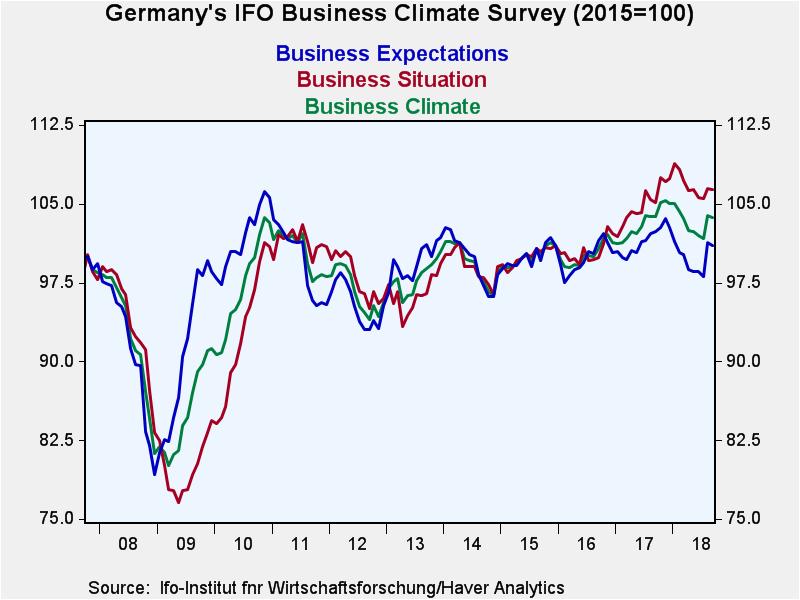

The German IFO Institute index has gone sideways in September. The basic indexes that are plotted in the chart show that climate is unchanged at an index value of 105.3. The current situation is slightly weaker on a reading of 108.2, [...]

The German IFO Institute index has gone sideways in September. The basic indexes that are plotted in the chart show that climate is unchanged at an index value of 105.3. The current situation is slightly weaker on a reading of 108.2, down from 109.4 in August. The current index has slipped for two months in a row. The expectations index, however, is stronger with a reading of 102.5 and it is up for the second month in a row.

The German IFO Institute index has gone sideways in September. The basic indexes that are plotted in the chart show that climate is unchanged at an index value of 105.3. The current situation is slightly weaker on a reading of 108.2, down from 109.4 in August. The current index has slipped for two months in a row. The expectations index, however, is stronger with a reading of 102.5 and it is up for the second month in a row.

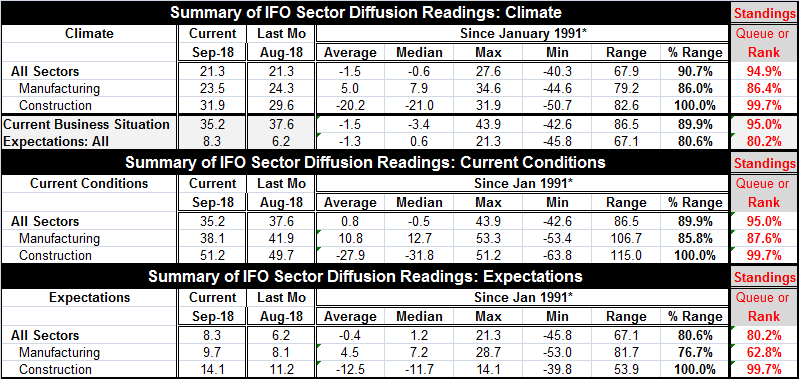

The all-sector climate index expressed in diffusion terms is still very strong with a reading that has a 94.9 percentile rank standing (i.e., since 1991, it has been this strong or stronger only 5.1% of the time). The manufacturing sector climate reading stands in its 86.4 percentile with construction in its 99.7 percentile, which is also an all-time high reading. The current business situation has a 95th percentile standing while expectations have an 80th percentile standing.

The diffusion readings by sector show manufacturing a bit weaker in September and construction a bit stronger. For current conditions manufacturing has an 87th percentile reading while construction is in its 99th percentile, at an historic high for current conditions.

For expectations both manufacturing and construction are stronger in September. Once again the construction sector is at an all-time high reading. Manufacturing, despite its improvement, is considerable weaker with a 62nd percentile standing, a quite moderate reading. That is still a positive reading (anything above 50 is above its median), but it falls well short of being labeled ‘strong.’ For manufacturing, current conditions are far stronger than are expectations.

In Germany, Angela Merkel apologized for her role in the German spymaster affair. Beyond Germany’s borders, in the U.K., new factory orders backtracked. Brexit back and forth continues and the U.K. keeps trying to see what it can get while the EU keeps stonewalling it. Regarding politics in the U.K., the Labor party is trying to dismantle Thatcherism and proposing that companies ‘transfer as much as 10 percent’ of their share ownership to workers.

Iran blames the U.S. and Israel for a bloody attack on its military parade and vows revenge. China alleges that the U.S. is using bullying tactic in its trade negotiations. China has made the Hong Kong independence party illegal for the first time ever. Russia is giving Syria surface to air missiles in the wake of the errant Russian plane shot down by friendly fire there. Tensions are escalating across a broad front.

On balance, the global geopolitical and economic framework has become much shakier. Donald Trump is using rhetoric to try to get OPEC to reduce prices to no avail. And the geopolitical climate is becoming more hostile. The U.S. has run a sort of Japanese lunch-box policy with China in the past by segregating the various aspects of policy where the U.S. and China have common interests from those where they clash. If China is now afraid that tariffs are going to do it damage and is worried about it and if that has caused it to begin to make mischief in Hong Kong, that would be a new wrinkle in U.S.-China relations. While U.S. President Trump says he has a great relationship with China’s Premier Xi and has tried to get a collaborative effort on North Korea with China, the U.S. has continued to press its case on the treatment of U.S. companies and goods in China, in opposing China’s South China Sea grab and by largely supporting Taiwan. Recently, U.S. policy has shifted to try to counter China’s influence in large global infrastructure programs under which it has spread its financial control of participating nations under its ‘Belt and Road’ program. Are the U.S. and China headed for a more pointed clash? This could really upset markets were it to evolve because markets have been more or less dismissive of U.S. tariff policy and have viewed it as a device or antecedent to getting a new trade deal. If that view is replaced by a more hostile one, the repercussions could be quite severe for financial markets.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates