Global| Jun 09 2017

Global| Jun 09 2017German Import Growth Outstrips Export Growth But That's Only on the Surface

Summary

German trade trends show that the massive German trade surplus is being worked down as imports rise faster than exports. That rise seems to have a lot to do with oil and energy imports where prices have been rising rapidly, but then [...]

German trade trends show that the massive German trade surplus is being worked down as imports rise faster than exports. That rise seems to have a lot to do with oil and energy imports where prices have been rising rapidly, but then recently began to cool.

German trade trends show that the massive German trade surplus is being worked down as imports rise faster than exports. That rise seems to have a lot to do with oil and energy imports where prices have been rising rapidly, but then recently began to cool.

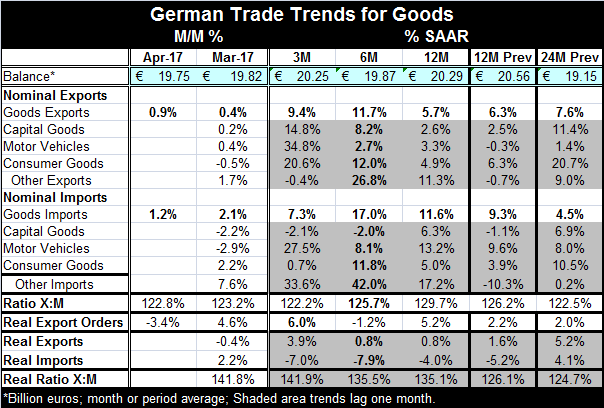

German nominal exports grew by 0.9% in April, compared to nominal imports that rose by 1.2%.

The trends referred to below (and in the table) cater to the quirks of German data availability. The headline export and import nominal growth rates are for up-to-date flows through April. The sequential growth rates for the export and import detail are for trade flows current through March.

German imports outpace German exports by a factor of nearly two to one on a growth rate basis as exports are up by 5.7% over 12 months and imports are up by 11.6%. Imports also out-last exports over six months with a growth rate of 17%, compared to 11.7% for exports. Over three months, however, exports are faster-growing at an annual rate of 9.4%, compared to 7.3% for imports.

German exports show a speeding up for capital goods, motor vehicles and consumer goods. For other goods exports, the growth rate has turned negative over three months but is still robust at double digits over six months and 12 months.

For imports the nominal growth rate balloons over six months largely on the imports of 'other goods' but consumer goods imports also accelerate on that horizon. Import trends are hard to describe as different categories are showing different trends. German capital goods imports are up by 6.3% over 12 months but declining over six months and three months. German consumer goods are up by 5% over 12 months, accelerate over six months then decelerate over three months to a growth rate of under 1% at an annual rate. Motor vehicle imports are at a robust 13.2% over 12 months, then slow to 8.1% over six months then surge at a 27.5% annual rate over three months. 'Other imports' show consistent strong growth but without any clear acceleration pattern. Still, the growth rates clearly are strong and even if they are not technically accelerating the pace over six months at 42% and over three months at 33.6% is prodigious. Much of this, however, is on the back of energy prices that surged and have since faded.

Real export and real import data also are up-to-date only through March. These flows show imports stronger in March (+2.2%) than exports (-0.4%). Real export sequential growth rates show steady growth just under 1% over 12 months and six months which rises to nearly 4% over three months. Real imports show declines on all timelines and hint at deceleration but fall short of a true confirmation of that trend. Still, imports log -4% over 12 months and a -7.9% pace over six months with three-month growth at a slightly lesser pace at -7%.

Comparing the real import data to the nominal data, it becomes clear that Germany is not ramping up domestic demand. Germany is not putting the size of its economy or its strong financial standing in the service of creating more demand for fellow EMU members. Its huge trade surplus has come down only because oil prices have run up so sharply. German domestic demand is actually pulling back while exports continue to expand in real terms.

German real export orders are lower in April falling by 3.4% but gained 4.6% in March. The export orders reported previously showed that orders for German exports from the rest of the EMU region were weakening.

On balance, German nominal trade data paint a more robust picture of the German economy and of German trade flows than do the inflation-adjusted data. Year-on-year German nominal flows show stable growth, but that is misleading since year-over-year German real exports barley rise and real imports fall by 4%.

Oil continues to mask the real goings on with trade and with trade flows just as it has distorted the unfolding inflation picture and confused central bank policy. On world markets, oil is still weak and recent troubles with Qatar have injected a note of uncertainly into the natural gas market that the German economy is very dependent upon. On a deeper inspection, German trade flows are not really doing any of the things they need to do to assist the development of growth in Europe and in the global economy.

Of course, the new news on the trade front is going to be that the pound sterling has dropped again this time as Theresa May's power consolidation gambit has failed. The Conservatives lost seats in the just concluded elections and she is looking to form a government from a less than majority position. Some in Germany see this development as something that will be good for Brexit negotiations. It does appear to weaken May's position but all that means is that once she gets whatever deal she is comfortable with she may have a harder time selling it at home to her coalition. Basically, the Brexit problems remain fully in play but with an even weaker pound sterling.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.