Global| Apr 05 2012

Global| Apr 05 2012German Industrial Output Shrinks Year-Over-Year

Summary

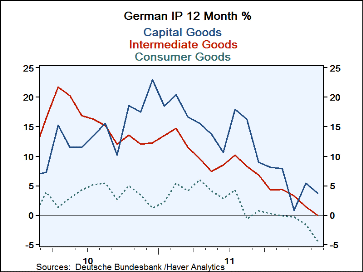

German industrial output is off year-over-year for the first time in this up-cycle. Its sequential growth rates show that output is falling at an increasingly fast pace over shorter periods of time. While there have been negative [...]

German industrial output is off year-over-year for the first time in this up-cycle. Its sequential growth rates

show that output is falling at an increasingly fast pace over shorter periods of time. While there have been

negative signals in place for a while for orders and indicators like the PMI series this is the first piece of

hard data on output that shows that the quantity being produced is lower than it was one year ago. German

unemployment has still been trending lower, but then we know jobs are a lagging indicator.

German industrial output is off year-over-year for the first time in this up-cycle. Its sequential growth rates

show that output is falling at an increasingly fast pace over shorter periods of time. While there have been

negative signals in place for a while for orders and indicators like the PMI series this is the first piece of

hard data on output that shows that the quantity being produced is lower than it was one year ago. German

unemployment has still been trending lower, but then we know jobs are a lagging indicator.

The IP trends are also queuing up for a weak quarter. Two months into the new quarter the average of IP in Q1 is falling at a 5.6% annual rate over the average level for Q4 Consumer goods output is leading the way lower dropping at a 10.1% annual rate in the quarter. Intermediate goods output is contracting at a 3.5% annual rate. But capital goods output is on the rise, expanding in Q1 over Q4 at a 0.4% annual rate. And Germany is the country in the Zone that will be affected last by regional weakness since it is the most competitive.

Germany’s construction sector took huge hit in February fell 17% and is down at 31% annual rate in the Q1 compared to Q4.

The manufacturing output alone fell in February and is dropping at a 2.7% annual rate in Q1 over Q4. Real manufacturing orders are still shrinking in the new quarter but their pace of contraction has slowed down.

On balance Germany has been Europe’s strongest economy and it is also Europe’s largest economy. Its MFG sector is now showing output declines not just near term but year-over-year. While Germany has one of the few service sectors in EMU that is expanding its services sector PMI index for March slipped relative to its value in February. Germany’s manufacturing sector PMI once the stalwart of Europe stands in the 21st percentile of its historic queue. That means it is lower than its March value only 21% of the time. The EMU metric for the region’s overall MFG PMI is in the 17th percentile. In some since Germany is no longer providing a regional boost, or not much of one. Ireland, followed by Austria, has the relative strongest PMIs. Ireland’s index it stands in the 52rd percentile of its queue; Austria stands in the 40th percentile. The Euro-Area is in a tangle and it has lost leadership.

The difficult times are back in markets as well, as now Spanish auctions are in the news every day. Draghi has made it clear that the ECB is not going to pull support away from needy EMU members. For now there is new erosion but no new crisis. Still Germany makes it clear that Europe’s growth no longer has a strong shoulder to lean on. After a brief run up, Germany’s MFG PMI is back below the breakeven level of 50 in March. The Euro-Area looks like it is making a real slip and amid the economies already in recession and afflicted with severe requirements of unrelenting austerity things can only get worse. There is no stimulus.

| Total German IP | |||||||

|---|---|---|---|---|---|---|---|

| SAAR Except M/M | Feb-12 | Jan-12 | Dec-11 | 3Mo | 6Mo | 12Mo | Q-2-D |

| IP total | -1.3% | 1.2% | -2.6% | -10.2% | -8.4% | -0.9% | -5.6% |

| Consumer | -2.1% | -0.4% | -0.9% | -12.6% | -5.2% | -4.3% | -10.1% |

| Capital | 0.3% | 1.9% | -2.7% | -2.0% | -7.5% | 3.8% | 0.4% |

| Intermed | -0.3% | 0.6% | -1.7% | -5.4% | -7.1% | 0.0% | -3.5% |

| Memo | |||||||

| Construction | -17.1% | 4.7% | -6.5% | -56.6% | -29.2% | -15.1% | -31.2% |

| MFG IP | -0.3% | 1.0% | -1.9% | -4.8% | -6.7% | 0.9% | -2.7% |

| Real MFG Orders | 0.3% | -1.8% | 0.0 | -1.1% | -9.9% | -6.0% | -9.4% |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates