Global| May 14 2020

Global| May 14 2020German Inflation, COVID-19 and Beyond

Summary

Inflation is under a double dose of downward diversions. The COVID-19 has knocked growth down. Slowing GDP usually is associated with some inflation weakening as demand pressures abate. However, activity has been reduced- demand and [...]

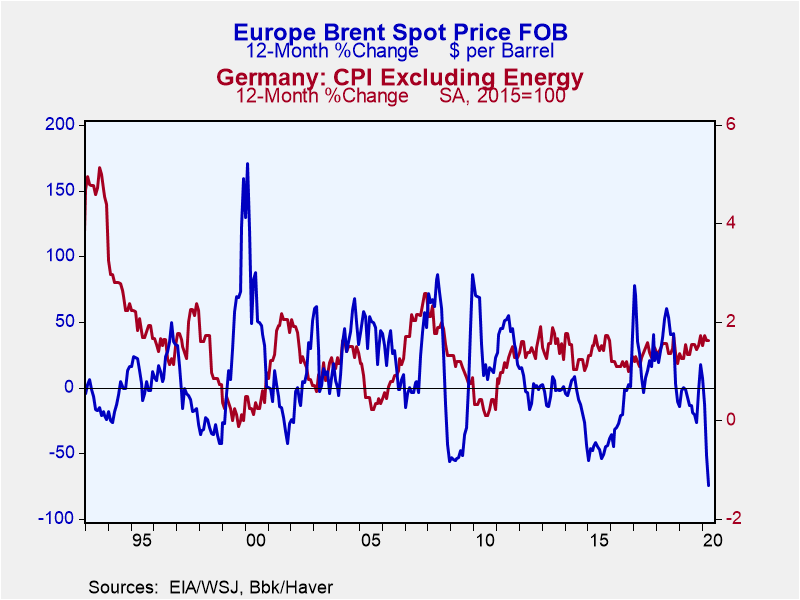

Inflation is under a double dose of downward diversions. The COVID-19 has knocked growth down. Slowing GDP usually is associated with some inflation weakening as demand pressures abate. However, activity has been reduced- demand and output- so sharply that there is a strongly induced supply side excess that has put downward pressures on oil and other commodities further lowering inflation pressures.

Inflation is under a double dose of downward diversions. The COVID-19 has knocked growth down. Slowing GDP usually is associated with some inflation weakening as demand pressures abate. However, activity has been reduced- demand and output- so sharply that there is a strongly induced supply side excess that has put downward pressures on oil and other commodities further lowering inflation pressures.

Inflation was tame before the coronavirus struck and before the struck there had been also weak oil prices. Since striking, however, separate supply side issues within OPEC have fostered a dynamic that simply crushed global oil process.

The U.S. futures markets for oil produced very odd results for a while. The full-to-overflowing state of oil storage facilities and the U.S. oil-futures contract requirement that futures traders had to ‘take physical delivery’ of oil actually turned the near futures contract for WTI to a negative number as storage considerations dominated the value of a barrel of crude. That extreme situation has abated but oil is still in a massive surplus situation and global growth is still weak although reopening is now beginning on a relatively broad front.

But reopenings are going to be slow and modest as countries are wary of a second wave of infections. Inflation pressures are not – NOT- coming back any time soon despite all the concerns about all the government spending and all the central bank liquidity. Remember that despite all of that effort, growth is still weak and unemployment is spiking. All that debt is going to have to be serviced and that will constrain government spending in the future.

Because countries met the first wave of corona by sheltering and using social distancing, the virus was not very well spread. That was by design to limit deaths. But in doing that the infection was not spread widely and so immunity was not conferred on much of the population. As countries now prepare to send citizens forth into the world to work and consume again, the risks of a second wave lurk and they are nearly as great as before except now there is more public awareness. Having said that, Spain is already experiencing some increase in infections. Spain's daily coronavirus death toll rose on Thursday to its highest in a week as authorities warned that a second wave of the outbreak was possible. Reopening is not without risk.

In the U.S., coronavirus task force leader Anthony Fauci testified before Congress giving a warning about opening too soon that did not please the President. Opinion on the issue of reopening is quite divided. Many look at the results in Sweden and view the number with completely different opinions of them…

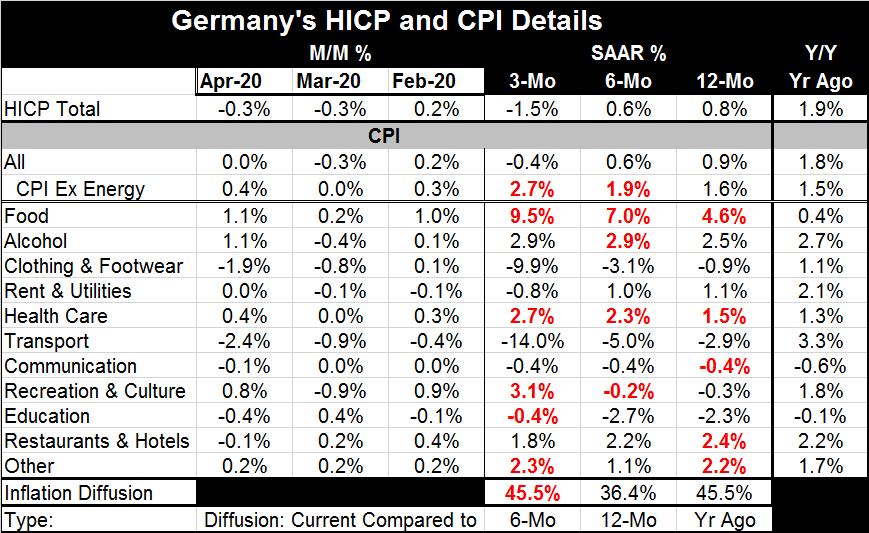

The drag on growth will in all likelihood continue for some time, and that means inflation will continue to undershoot as it has been. First it was the Great Recession and its financial crisis and then the aftermath. In Europe, it was also the imposition of austerity that weakened many especially Southern European economics. And now those same weakened economics are hit again and struggling. The inflation news through all of this remains quite good, quite low, quite excellent... but increasingly quite irrelevant.

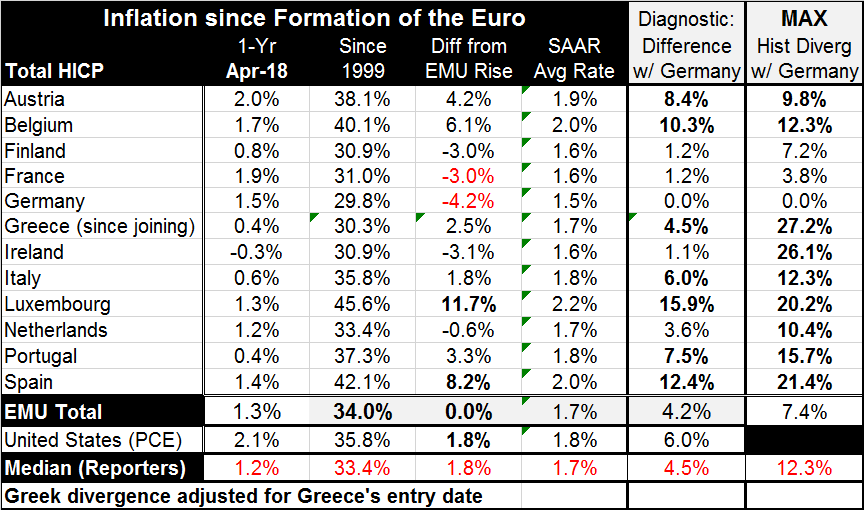

Inflation trends in Germany are so good. It is even hard for the Germans to complain, but they continue to complain about the policies of the ECB that are geared to help most of the euro area even though Germany does not need the assistance. Inflation in the EU continues its chronic undershoot. Italy is strained in all of this and questions are arising again of whether Italy can stay in the euro area. Italians are not making any threats, but onlookers are simply watching trends and weighing the facts. After having imposed austerity on Italy which is now in technical violation of Maastricht rules again to fight the COVID-19 the Germans are in no mood to help. Italy has been afforded relief from Maastricht violations, but everyone is wary.

Right now France, Belgium and Germany rank as the three highest inflation countries among the longest-standing members of the EMU based on year-on-year trends. Ireland, Portugal, Greece and Italy are the three lowest inflation countries on the same metric. If I had offered that such lists would exist for these countries 30-years ago, no one would have believed me. German style austerity did knock down the inflation rates among the countries in the South that were burdened with austerity. But the cost is that the austerity has also crippled their economies. Such is the cost of membership in the EMU. Yet, some countries are still clamoring to get in. Of course, the cost of EU membership is to aspire to EMU membership as well…so maybe we should reserve judgement on who really wants to be in the EMU after all.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates