Global| Jun 13 2006

Global| Jun 13 2006German Investors Lose Confidence in Economic Outlook, While Industrialists Remain Sanguine

Summary

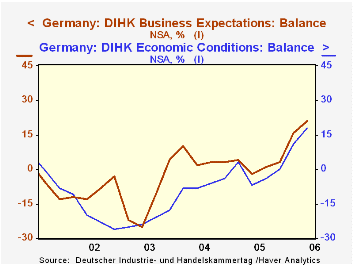

Two recent indicators of confidence in Germany show a mixed picture. Yesterday, the German Chamber of Commerce reported that a June survey of industrialists in some 25,000 companies showed that the balance of those expecting [...]

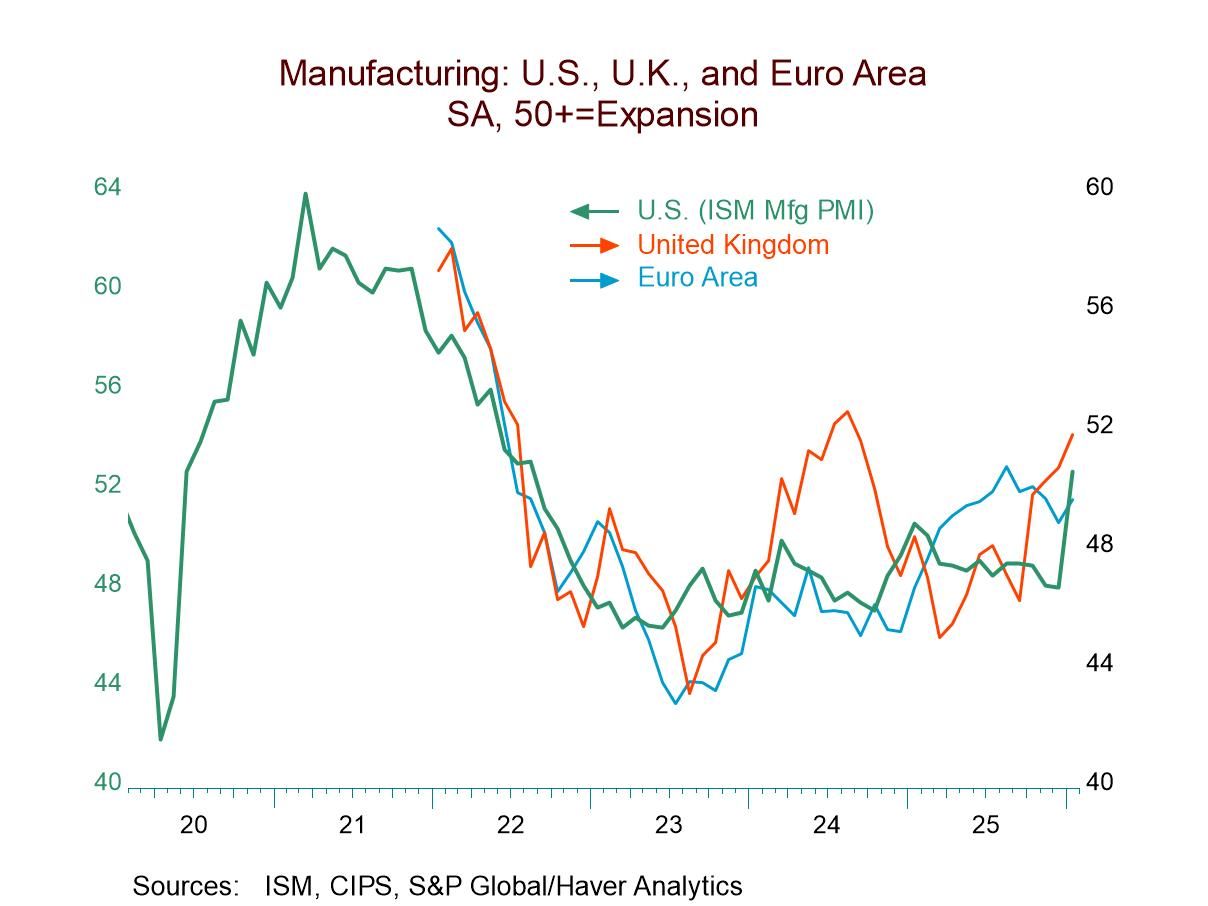

Two recent indicators of confidence in Germany show a mixed picture. Yesterday, the German Chamber of Commerce reported that a June survey of industrialists in some 25,000 companies showed that the balance of those expecting improvement in the outlook over those expecting worsening conditions rose to 21% from 16% in the February survey. There was an even greater increase from 11% to 18% in the industrialists appraisal of current conditions. The first chart shows the DIHK's (Deutscher Industrie und Handelskammertag) measures of confidence in the current situation and expectations for the future. (Since the surveys are conducted in only three months, February, June and October, we have interpolated the data in the chart.)

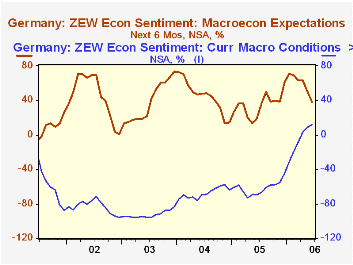

While industrialist remain positive about the prospects for the economy, the financial community in Germany is becoming increasingly concerned. The ZEW Center for European Economic Research announced today that its measure of confidence in the outlook, which polls some 350 institutional investors and analysts, dropped to 37.8% in June from 50.0% in May. The measure, which is the balance of optimists over pessimists, has been declining in each month since a recent peak of 71.0% was reached in January and it is the lowest value since July 2005. At the same time that fears over the outlook have risen, these investors continue to acknowledge that current conditions are improving. The second chart shows the balances of optimists over pessimists viewing the current situation and the outlook.

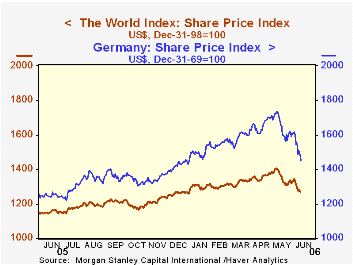

Perhaps the main reason for the loss of confidence among the financial community is the fear that further increases in interest rates may be necessary to counteract inflation. Already this fear has resulted in sharp declines in world stock markets. From May 8 to June 12, world stock prices as measured by MSCI (Morgan Stanley Capital International) fell by almost 10%. Stock prices in Germany fell by an even greater amount--14.5%. The third chart compares the MSCI indexes of world stock prices and those of Germany. (We have indexed both series to a common base--12/98=100).

| Germany | Jun 06 | May 06 | Apr 05 | Mar 06 | Feb 06 | Jan 06 | Oct 05 |

|---|---|---|---|---|---|---|---|

| DIHK Current Conditions | 18 | 11 | 0 | ||||

| DIHK Expectations | 21 | 16 | 3 | ||||

| ZEW Current Conditions | 11.9 | 8.7 | 2.9 | -8.4 | -19.5 | -31.6 | |

| ZEW Expectations | 37.8 | 50.0 | 62.7 | 63.4 | 69.8 | 71.0 | |

| Jun 12 | May 8 | Pct Chg | |||||

| MSCI World Stock Price (12/31/98=100) | 1269.595 | 1406.276 | 9.72 | ||||

| MSCI German Stock Price (12/31/69=100) | 1482.815 | 1734.694 | 14.52 |