Global| Jan 09 2008

Global| Jan 09 2008German Orders in Surprise Spurt

Summary

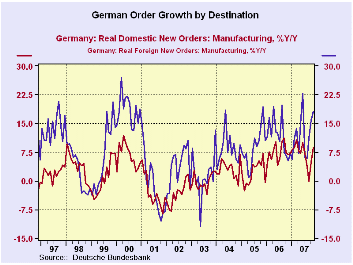

German real new orders are flying high again in November after another surprising spurt in October. After the October rise, a drop off in November orders had been expected - quite the opposite is the result. Orders are now growing at [...]

German real new orders are flying high again in November after

another surprising spurt in October. After the October rise, a drop off

in November orders had been expected - quite the opposite is the

result. Orders are now growing at an annualized rate of 28% in the

fourth quarter over Q3; domestic orders are up at a 16% pace. As in

October bulk orders are responsible for the spurt in November. And a

relatively new metric tells us that German new orders from outside the

Euro Area fell last month. So, despite the spurt, it may be that the

strong euro is taking some toll after all. German foreign orders use

the definition of ‘foreign to Germany’ not to its currency area. That

is one complication when looking at ‘foreign’ data of any sort for Euro

Area members. Even so, the strength within the Area that German orders

imply is quite remarkable, and it is in stark contrast with other

measures that show a backtracking in confidence and in activity of

various sorts in Germany and throughout the Euro Area.

| German Orders and Sales By Sector and Origin | ||||||||

|---|---|---|---|---|---|---|---|---|

| Real and SA | % M/M | % Saar | ||||||

| Nov-07 | Oct-07 | Sep-07 | 3-Mo | 6-Mo | 12-Mo | Year Ago | ||

| Total Orders | 3.4% | 4.0% | -1.6% | 25.4% | 12.0% | 13.6% | 6.0% | |

| Foreign | 2.8% | 5.3% | -0.8% | 32.8% | 15.2% | 18.2% | 5.2% | |

| Domestic | 4.2% | 2.5% | -2.4% | 18.1% | 8.7% | 8.8% | 6.9% | |

| Sector Sales | ||||||||

| Manufacturing/Mining | -0.6% | 1.3% | -0.3% | 1.6% | 0.8% | 4.4% | 8.0% | |

| Consumer Goods | -0.7% | 0.8% | -0.3% | -0.8% | -0.4% | 1.1% | 3.8% | |

| Consumer Durables | -0.6% | -1.3% | -4.0% | -21.5% | -11.4% | -1.5% | 8.2% | |

| Consumer Nondurable | -0.7% | 1.1% | 0.5% | 3.8% | 1.9% | 1.5% | 3.0% | |

| Capital Goods | -2.1% | 3.3% | -0.2% | 3.4% | 1.7% | 5.5% | 8.6% | |

| Intermediate Goods | 1.5% | -0.6% | -0.2% | 2.3% | 1.1% | 5.1% | 10.1% | |

| All Manufacturing Sales | -0.7% | 1.2% | -0.2% | 1.3% | 0.7% | 3.9% | 7.5% | |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates