Global| Dec 06 2007

Global| Dec 06 2007German Orders JUMP!

Summary

German orders jumped in October rising by 4% after an upward revised drop of 1.6% in Sept. The gain saw the domestic orders component rise by 2.7% as foreign orders rose by 5%. Foreign orders are now rising at a 33% pace over three [...]

German orders jumped in October rising by 4% after an upward

revised drop of 1.6% in Sept. The gain saw the domestic orders

component rise by 2.7% as foreign orders rose by 5%. Foreign orders are

now rising at a 33% pace over three months and clearly accelerating

while domestic orders post a slightly stronger three month growth rate

of 2.9%. Sales of consumer and intermediate goods remain weak while

capital goods sales surged in October.

Order detail shows that bulk orders account for the surge in

October. Bulk orders were behind the 8.1% surge in investment goods

orders that saw domestic investment goods orders rise by 6.4% and

foreign orders rise by 9.4%. Basic goods orders fell by 0.4% in October

and consumer goods order volumes fell by 0.8%. Orders from outside the

Euro Area increased by 4.2% while Ex-German Euro Area orders rose by a

sharp 6%.

For the quarter underway orders are not tremendously strong

with overall orders rising at an annual rate that exceeds 20%.

On balance German institutes are still cutting their forecasts

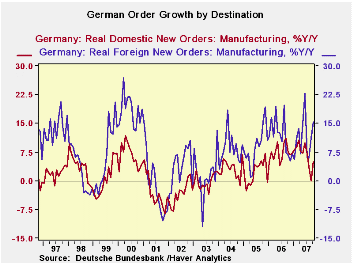

for 2008. The chart (above) shows that even with this new surge, orders

are in lower trajectory than they were in their hey-day. It is unclear

what this surge means for the outlook. It may be a fluke of orders

clumping since most other measures continue to show slowing. I do not

think it is a revival.

| German Orders and Sales By Sector and Origin | |||||||

|---|---|---|---|---|---|---|---|

| Real and SA | % M/M | % Saar | |||||

| Oct-07 | Sep-07 | Aug-07 | 3-MO | 6-Mo | 12-Mo | Yr Ago | |

| Total Orders | 4.0% | -1.6% | 1.9% | 17.9% | 8.6% | 10.3% | 7.1% |

| Foreign | 5.0% | -0.8% | 3.2% | 33.6% | 15.6% | 15.5% | 6.7% |

| Domestic | 2.7% | -2.4% | 0.4% | 2.9% | 1.4% | 5.1% | 7.4% |

| Sector Sales | |||||||

| MFG/Mining | 1.2% | -0.3% | 1.3% | 9.2% | 4.5% | 6.6% | 6.4% |

| Consumer | 0.2% | -0.3% | 1.7% | 6.8% | 3.3% | 1.9% | 2.9% |

| Consumer Durables | -1.7% | -4.0% | 4.2% | -6.8% | -3.4% | -0.9% | 7.8% |

| Consumer Nondurables | 0.6% | 0.5% | 1.2% | 9.5% | 4.7% | 2.5% | 2.0% |

| Capital Goods | 3.4% | -0.2% | 1.1% | 18.2% | 8.7% | 9.9% | 7.2% |

| Intermediate Goods | -0.7% | -0.2% | 1.3% | 1.3% | 0.7% | 5.6% | 7.5% |

| All Manufacturing Sales | 1.2% | -0.2% | 1.3% | 9.7% | 4.7% | 6.4% | 5.8% |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates