Global| Oct 06 2017

Global| Oct 06 2017German Orders Jump in August But Only for German Joy

Summary

The overview Although German orders are plagued by volatility and both headline and total orders fell in July, the surge in August orders of 3.6% based on strong domestic-sourced and foreign-sourced demand confirms that order trends [...]

The overview

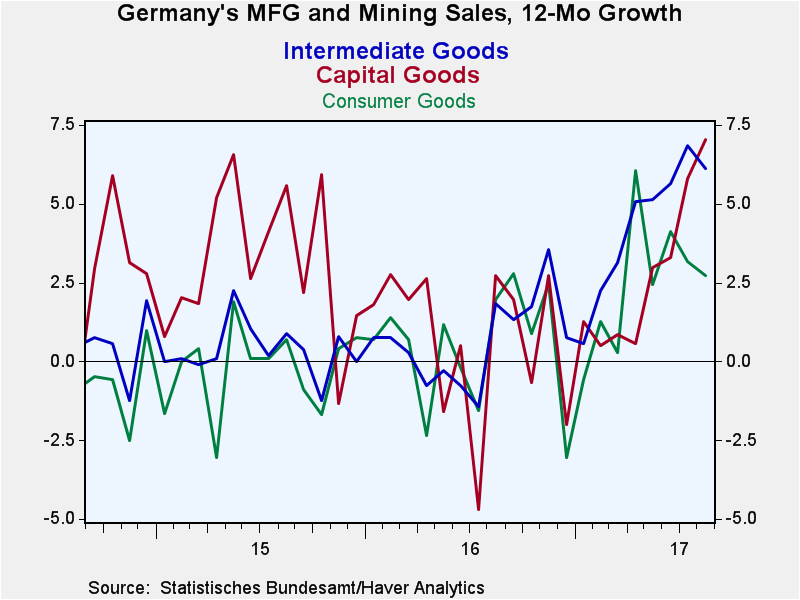

Although German orders are plagued by volatility and both headline and total orders fell in July, the surge in August orders of 3.6% based on strong domestic-sourced and foreign-sourced demand confirms that order trends are on the rise. Year-over-year order growth calculations take some of the volatility out of the order series. That trend for domestic and foreign orders is presented in the chart to the left. There we see both series on their best accelerating runs of the past several years. Moreover, these gains are underpinned by sales trends (see the chart to the right) which also show sales clearly accelerating for consumer goods, capital goods and intermediate goods. These orders and sales data underpin some of the robust results we have seen in the PMI data for Germany.

The facts

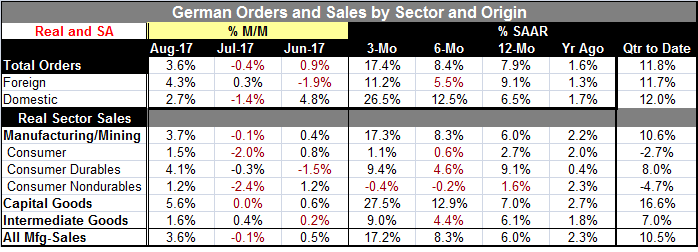

In August German order rose by 3.6% after a 0.4% decline in July. Foreign orders shot-up by 4.3% in August, after a milquetoast gain of 0.3% in July that followed a drop of nearly 2% in June. Domestic orders in August gained 2.7%, more than reversing a drop of 1.4% that itself followed a huge rise of 4.8% in June.

Sequential rates of growth build momentum

Sequential rates of growth accelerate from 12-month to six-month to three-month, but the speed-up from 12-month to six-month is small. Yet, the acceleration over three months is large to a pace of 17.4%. Foreign orders, looked at separately, do not have a consistent accelerating path, but orders are growing consistently at strong rates of growth and build to an annualized pace of 11.2% over three months. Domestic orders are the source of the consistent acceleration in overall orders. They rise by 6.5% over 12 months then at a strong 12.5% pace over six months and then ramp up to a 26.5% pace over three months.

In the quarter-to date, the pace of sales is nearly the same for foreign and domestic orders despite their widely different monthly patterns as foreign orders are up at an 11.7% pace compared to a 12.0% pace for domestic orders two months into the third quarter.

New orders by region show that orders from the euro area dropped by 1% in August, while demand from other countries increased sharply by 7.7% compared to July. The weakness in the euro area is a counterpoint to the strength showed in the euro area to this point. And Germany itself is displaying strength; the weak demand from inside the rest of the euro area is not comforting.

The chart to the right shows real sales demand by type product. Year-on-year growth rates are rising across all three sectors led by capital goods with consumer goods trailing. Still, all types of sales on all three horizons show consistent growth. Manufacturing sales are up at a 10.5% pace in the quarter-to-date. On that basis, capital goods sales are up at a 16.6% pace and intermediate goods sales are up at a 7.0% pace. However, consumer goods sales falter and are falling at a 2.7% pace in the quarter-to-date even though over three months consumer goods sales are up at a 1.1% annualized rate. There is still good strength in consumer durable goods, but there has been encroaching weakness in nondurable consumer goods sales.

On balance, the German orders report is encouraging and it shows sales gains that are reasonably consistent widespread. The sales data show solid ongoing strength as well and they tend to confirm the strength in orders which are more volatile and harder to read. The fly in the ointment this month concerns what German orders tell us about the rest of the euro area. There, orders from within the euro area were lower in August and that is a bit of a concerning development.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates