Global| Oct 08 2007

Global| Oct 08 2007German Orders Still Strong but Definitely Fading…

Summary

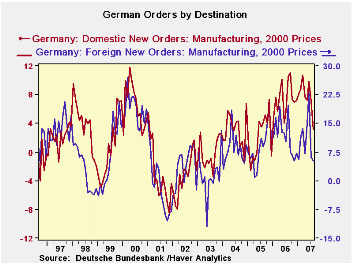

Both the chart and the table tell the story of waning German order strength. We have followed Euro-orders series closely as the euro has gained strength. What we see is that there is a clear loss in momentum. That loss is more severe [...]

Both the chart and the table tell the story of waning German order strength. We have followed Euro-orders series closely as the euro has gained strength. What we see is that there is a clear loss in momentum. That loss is more severe if we compartmentalize German orders into a quarterly habitat. Viewed that way orders for Q3 are coming up quite weak. TWO full months into the new quarter overall German orders are falling at a 6.9% annualized rate. Foreign orders are off at a 13% annual rate. Domestic orders scratch out a feeble 0.1% gain in Q3. These are weak results. The blow is only somewhat softened by the strength that the components showed in 2007Q2 when orders rose at an annualized pace of 18.0% led by 29.3% for foreign orders and 7.3% for domestic orders.

The real question is which of the trends lies ahead? On that ground the slower one seems to have become dominant… These results fall back into perspective on the Yr/Yr calculation where total order volumes are up by 4.2% on 5.1% for foreign orders and 3.2% for domestic orders. The Y/Y figures are solid, but they show that much of the earlier momentum has been lost.

Other German indicators have showed this from the IFO report to the ZEW survey to the EU indexes. Europe once rocked and now it is being rocked as financial ministers try to decide what to do.

Let’s understand this as a logical outcropping of the desire to make the euro a main reserve unit. The more it comes into demand the stronger that euro will be and that more that will disrupt the export sector in EMU countries. Europe is much more export dependent than the US. So this is a problem for the euro area. While there is great prestige and some gain to being the reserve currency (segniorage: The difference between the value of money and the cost to produce it), there is also cost. Europe is too export dependent and not flexible enough for the euro to be a main reserve unit. Being a reserve currency is an honor and a challenge: you can’t have one without the other.

In a two reserve currency system, when the dollar is weak, of course, past dollar hoarders want to switch into a stronger reserve unit. But unless Europe can absorb such flows it isn’t going to work. To put it another way, the euro and its financial sector may be prepared to be a reserve unit but the euro area economy is not. Just look at the complications to US policy to see what Europe must be able to sustain to truly compete with the dollar. After all it is fair to argue that if certain disequilibrium conditions have been thrust onto the dollar some of those will now come to rest on the euro as it takes up more of the burden of being the reserve unit.

The US current account deficit is at about 5 ½% of GDP. Blame the US if you will, but how can you ignore the consequences of its having been the reserve unit? Look at the massive reserve accumulations in Japan and in China (Hong Kong and Taiwan) and Korea. What of their obvious impacts on FX values? How can you ignore the fact that China wants to maintain a peg at an undervalued level? How can you argue that Japan has not been doing the same? The center country in reserve system is the one that is the numeraire and loses its policy independence. Every other currency pegs to it or floats against it. If some countries choose a balance of payments ‘result’ (such as running persistent surpluses) the reserve country is stuck with the flip-side of those actions. I just don’t see how Europe can do it. Germany and EMU already are stressed and previous little reserve shifting has occurred. What we are seeing in Europe is what happens when you are unprepared to experience your dream. The good news: the Euro is strong and has become a more important reserve unit internationally. The bad news? It’s the same.

| German Orders and Sales By Sector and Origin | |||||||

|---|---|---|---|---|---|---|---|

| Real and SA | % M/M | % Saar | |||||

| Aug-07 | Jul-07 | Jun-07 | 3-MO | 6-Mo | 12-Mo | YrAgo | |

| Total Orders | 1.2% | -6.1% | 5.4% | 0.6% | 0.3% | 4.2% | 15.1% |

| Foreign | 2.4% | -10.8% | 10.0% | 2.1% | 1.1% | 5.1% | 19.7% |

| Domestic | 0.1% | -0.8% | 0.4% | -1.1% | -0.5% | 3.2% | 10.4% |

| Sector Sales | |||||||

| Mfg/Mining | 0.7% | 0.2% | -0.2% | 3.0% | 1.5% | 5.3% | 8.5% |

| Consumer | 1.5% | -1.6% | -0.9% | -4.5% | -2.3% | 1.6% | 3.9% |

| Consumer Durables | 4.1% | -1.5% | 1.4% | 16.9% | 8.1% | 2.3% | 12.8% |

| Consumer Nondurables | 1.0% | -1.6% | -1.5% | -8.3% | -4.2% | 1.5% | 2.2% |

| Capital Goods | 0.2% | 1.6% | -0.9% | 3.7% | 1.9% | 7.1% | 8.0% |

| Intermediate Goods | 1.1% | -0.6% | 1.1% | 6.7% | 3.3% | 5.5% | 11.8% |

| All Mfg Sales | 0.8% | -0.2% | 0.0% | 2.4% | 1.2% | 5.0% | 7.9% |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates