Global| Feb 07 2008

Global| Feb 07 2008German Orders Still Strong, but More Are Disbelieving

Summary

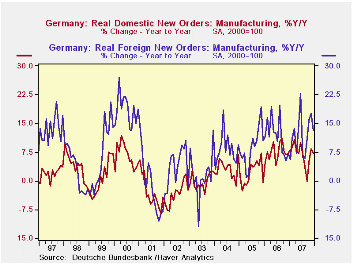

German orders for December were stronger than expected, a mild positive surprise to markets. With the economy showing weakening signals and the euro strong, sentiment is shifting to look for some weaker results. As a result the spin [...]

German orders for December were stronger than expected, a mild

positive surprise to markets. With the economy showing weakening

signals and the euro strong, sentiment is shifting to look for some

weaker results. As a result the spin on the numbers reported today was

to sort of set them aside as though they were something that would not

last. And, indeed, they may not last.

The German foreign orders series showed that foreign orders

from non-German Euro Area countries fell by 6.8% after a 6.7% rise in

November. This also raises questions about what is going on within the

Euro Area (EA). Foreign orders at German firms from outside the EA rose

by 0.8% in the month after falling in November.

One thing to understand is that Germany is the STRONGEST of

the EA economies. Other EA countries will be feeling pain before

Germany does. We can see this by looking at one measure of

competitiveness, prices. HICP prices in Germany have fallen by 11.5%

relative to the EA average since January of 1996. Compare this to Italy

where its HICP has risen by 3.7% or Spain where its prices have risen

relative to the average by 12.2%. That sort of result implies a huge

difference in competitiveness for trade both within the EA and outside

it. It should come as no surprise that confidence in Italy and Spain

has been lagging.

German data are reliable and timely. For other countries we are not always so lucky. But if we piece together the things we know about Germany and the geographic data in reports like today’s orders, there is a real reason to be wary of EA growth going forward. There is the additional unsavory point that Germany itself may be living a bit on borrowed time. Its firms may have employed FX hedges to lock in past more favorable exchange rates on which to do business. But these devices eventually fail in their ability to afford a safe haven or even partial escape. A lot of hedging is done on a six-month horizon and six months ago the euro value Vs the dollar was at $1.34 Compared to the current $1.45 to $1.50 rate. A year ago, a fairly long period over which to hedge the euro rate Vs the dollar was at $1.30. Obviously if hedges set at those times are running off German firms would have to begin to confront business prospects at current exchange rates. Interestingly it is the intra-EA orders that are the weakest for Germany. But it still has a good chunk of business in capital goods that might be a bit less price elastic in Eastern Europe and in Russia. It is no surprise in view of these emerging risks, that ECB president Trichet softened the rhetoric in his remarks today.

| German Orders and Sales By Sector and Origin | |||||||

|---|---|---|---|---|---|---|---|

| Real and SA | % M/M | % Saar | |||||

| Dec-07 | Nov-07 | Oct-07 | 3-MO | 6-Mo | 12-Mo | YrAgo | |

| Total Orders | -1.7% | 3.0% | 4.0% | 22.5% | 10.7% | 10.2% | 7.3% |

| Foreign | -2.8% | 2.3% | 5.3% | 20.1% | 9.6% | 13.2% | 7.2% |

| Domestic | -0.5% | 3.7% | 2.5% | 25.3% | 11.9% | 7.3% | 7.2% |

| Sector Sales | |||||||

| Manufacturing/Mining | 0.2% | -0.7% | 1.3% | 3.0% | 1.5% | 4.4% | 7.8% |

| Consumer | -0.4% | -0.6% | 0.8% | -0.8% | -0.4% | 1.7% | 3.4% |

| Consumer Durables | 2.6% | -0.2% | -1.3% | 4.1% | 2.1% | 1.3% | 10.0% |

| Consumer Nondurables | -0.9% | -0.6% | 1.1% | -1.5% | -0.8% | 1.8% | 2.1% |

| Capital Goods | -0.2% | -2.1% | 3.3% | 3.4% | 1.7% | 6.8% | 6.7% |

| Intermediate Goods | 0.9% | 0.8% | -0.6% | 4.3% | 2.1% | 3.0% | 12.1% |

| All Manufacturing Sales | 0.2% | -0.9% | 1.2% | 2.0% | 1.0% | 3.8% | 7.4% |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.