Global| Aug 20 2020

Global| Aug 20 2020German PPI Make Second Monthly Gain and Sixth Straight Year-on-Year Drop

Summary

The German PPI rose month-to-month for the second month in a row. However, its year-on-year change fell for the sixth month in a row. The monthly upward pressure is still modest with prices rising by only 0.2% in July after tacking [...]

The German PPI rose month-to-month for the second month in a row. However, its year-on-year change fell for the sixth month in a row. The monthly upward pressure is still modest with prices rising by only 0.2% in July after tacking higher by 0.1% in June. Yet, in the background, there is a huge push higher from oil prices as Brent crude oil prices are up in each of the last three months for a net gain of nearly 59% over that period. However, that same oil price series is lower by 22% over the last five months. Oil has been through a significant period in which prices collapsed but are now on the rebound. Over the past year, the German PPI fell by 1.7% while the ex-energy PPI fell by 0.4%. So price weakness has transcended the oil contribution.

The German PPI rose month-to-month for the second month in a row. However, its year-on-year change fell for the sixth month in a row. The monthly upward pressure is still modest with prices rising by only 0.2% in July after tacking higher by 0.1% in June. Yet, in the background, there is a huge push higher from oil prices as Brent crude oil prices are up in each of the last three months for a net gain of nearly 59% over that period. However, that same oil price series is lower by 22% over the last five months. Oil has been through a significant period in which prices collapsed but are now on the rebound. Over the past year, the German PPI fell by 1.7% while the ex-energy PPI fell by 0.4%. So price weakness has transcended the oil contribution.

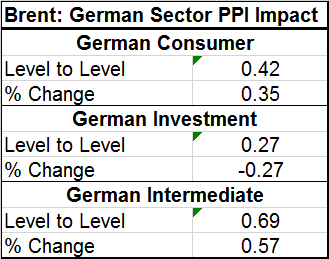

The small table shows correlations by sector with Brent oil prices. For each PPI sector, the table shows the correlation between the Brent index and the sector index as well as between the 12-month percentage change for each series and Brent. The correlation on the impact between price levels tend to be larger or the same as the impact in percentage change terms. Not surprisingly intermediate goods have the highest correlation with Brent since there is the least amount of fabrication in that sector. Consumer prices have the second highest correlation, with capital goods having the lowest correlation.

The small table shows correlations by sector with Brent oil prices. For each PPI sector, the table shows the correlation between the Brent index and the sector index as well as between the 12-month percentage change for each series and Brent. The correlation on the impact between price levels tend to be larger or the same as the impact in percentage change terms. Not surprisingly intermediate goods have the highest correlation with Brent since there is the least amount of fabrication in that sector. Consumer prices have the second highest correlation, with capital goods having the lowest correlation.

The correlations between the PPI headline and the ex-energy measure both vs. Brent are nearly the same at a correlation value just above 0.5. There is, however, a bigger step down in correlation as we look at the CPI correlations. The German CPI headline has a 0.5 correlation to Brent crude price percentage changes over 12 months while the CPI ex-energy has a negative correlation of -0.2 to the 12-month percent change in Brent crude prices.

The upshot here is two-fold: One is that, for policy purposes, the recent surge in Brent prices should not be much of an issue for German inflation of the sort that the Bundesbank watches and that feeds into the inflation measure targeted by the ECB. Second, is that, while various sector pressures may yet arise, oil is in a turbulent period having fallen sharply and is now in the process of regaining its footing. Oil has still not fully regained its footing compared to where it was five months ago, let alone longer so there is little to fear on the inflation front from oil regardless of the size of its short-term rebound.

Ongoing issues involving the coronavirus make it difficult to tell how robust German, European and global growth will be, and that fact makes it hard to handicap where oil prices are headed and how fast they will get there. For the moment, after a bit of jackrabbit start, most world economies have seen pitfalls arise and as a result have scrapped any idea of extrapolating the early growth success too far into the future. Recovery will continue but not so much ‘apace.’ A Reuter news poll shows that there are now concerns that labor market progress could even backtrack by the end of the year as skepticism about the virus and its impact has spread. Initially there seemed to be countries that were winners and others that were losers in dealing with the virus, but since those early days there have been broad-based relapses that simply show that all countries seem to be at risk and that flare ups can come in places that previously had seemed to have handled things so successfully.

On balance, the outlook continues to hang on what the virus does. The U.S. Federal Reserve in its policy minutes released yesterday refused to give any forward guidance other than saying that its policy was going to depend on the virus and how other national policies responded to it. The Federal Reserve usually has tried to offer policy guidance. But in this case, it found the future so unpredictable it did not venture any guess about the future. That is a rare case in which telling is made quite clear by saying nothing. The future remains frosted-crystal obscure.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates