Global| Jan 21 2008

Global| Jan 21 2008German PPI: Oh, BEHAVE! …and it does

Summary

The German PPI was flat in December after a 0.9% surge in November. The ex energy PPI rose by 0.1% after rising by 0.1% in November and by 0.2% in October. No sign of second round effects here. While the EBC is worried about building [...]

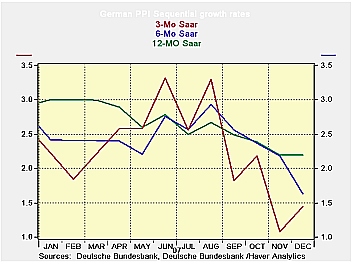

The German PPI was flat in December after a 0.9% surge in November. The ex energy PPI rose by 0.1% after rising by 0.1% in November and by 0.2% in October. No sign of second round effects here.

While the EBC is worried about building pressures in the monetary union this evidence of a break in inflation in Germany at the PPI level is good news. It is not surprising that the PPI, an index that should be more susceptible to the impact of the strong euro, is staying in line even with the reverberations of the spiking oil prices vibrating through it. The news is good news but it is not decisive. The price indexes that the ECB cares most about are the broader ones, especially the HICP. But this news is at least hopeful on the inflation front and good news there has been lacking lately.

| Germany PPI | |||||||

|---|---|---|---|---|---|---|---|

| %m/m | %-SAAR | ||||||

| Dec-07 | Nov-07 | Oct-07 | 3-mo | 6-mo | 12-mo | 12-moY-Ago | |

| MFG | 0.0% | 0.9% | 0.3% | 5.1% | 2.9% | 2.5% | 4.3% |

| Ex Energy | 0.1% | 0.1% | 0.2% | 1.4% | 1.6% | 2.2% | 2.9% |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates