Global| Nov 15 2011

Global| Nov 15 2011German Real GDP Rose 0.5% In Q3, But Investors are Wary

Summary

Amid the turmoil over the debt crisis in the euro area, the German Economy managed to show a 0.50% increase in real GDP in the third quarter compared with a 0.27% increase in the second quarter. The news, however, is not all good. [...]

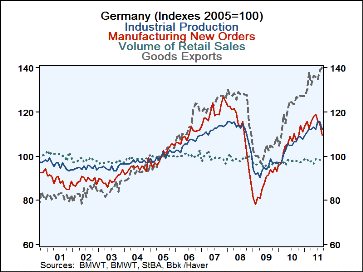

Amid the turmoil over the debt crisis in the euro area, the German Economy managed to show a 0.50% increase in real GDP in the third quarter compared with a 0.27% increase in the second quarter. The news, however, is not all good. Monthly data show weaknesses developing during the quarter. A good increase in the exports of goods and a small increase in the volume of retail sale offset the sharp declines in industrial production and new orders during the quarter. The first chart shows the divergent monthly trends in industrial production, manufacturing new orders, exports of goods, and retail sales in the third quarter. The ability of exports continuing to offset domestic weakness in Germany is in some doubt as the effects of the debt crisis begin to spread to Germany's trading partners. Is Germany heading to a recession?

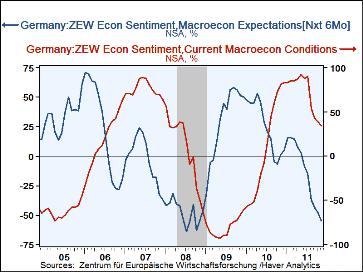

The institutional investors and analysts who participate in the surveys conducted by the ZEW institute apparently think so. They began to be express some doubts about the outlook back in early 2010 and except for a brief spurt of optimism early this year, the doubts have intensified. In November there were 55.2% more pessimists than optimists regarding the outlook.& At the same time, the balance of opinion on actual conditions has declined from favorable balance of 91.5% in May of this year to one of 34.2% in November. The current ZEW readings are close to those in April 2008, when Germany last entered into recession. At that time, the balance of opinion on current conditions was 33.2% compared with November's 34.2% and the balance of opinion on expectations was -40.7% compared with November's -55.2%. The second chart shows the balances of opinion by the ZEW participants on current conditions and on expectations together with recession shading.

| Sep'11 | Aug'11 | Jul'11 | Q3'11 | Q2'11 | Q1'11 | |||

|---|---|---|---|---|---|---|---|---|

| Real GDP Q/Q % Chg | 0.50 | 0.27 | 1.35 | |||||

| Industrial Production (2005=100) | 112.2 | 115.3 | 115.8 | 114.5 | 112.5 | 110.9 | ||

| Mfg New Orders (2005=100) | 109.6 | 114.5 | 116.1 | 113.4 | 117.6 | 113.9 | ||

| Goods Exports (2005=100) | 139.4 | 138.4 | 134.4 | 137.7 | 134.7 | 131.7 | ||

| Retail Trade (2005=100) | 98.5 | 98.2 | 98.9 | 98.5 | 97.7 | 98.2 | ||

| ZEW (% balance) | Nov'11 | Oct'11 | Sep'11 | Aug'11 | Jul'11 | Jun'11 | May'11 | Feb'11 |

| Current Conditions | 34.2 | 38.4 | 43.6 | 53.5 | 90.6 | 87.6 | 91.5 | 85.2 |

| Expectations | -55.2 | -48.3 | -43.3 | -37.6 | -15.1 | -9.0 | 3.1 | 15.7 |