Global| Jan 09 2008

Global| Jan 09 2008German Retail Sales are a DISASTER in November

Summary

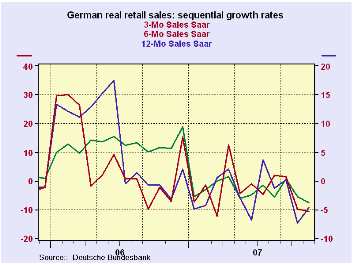

So much for strong German orders…. there is no carry over to the consumer. Retail sales in Germany are a disaster. We are 10 months away from the phase in of the VAT hike in January of 2007. That is why the Yr/Yr decline is still so [...]

So much for strong German orders…. there is no carry over to

the consumer. Retail sales in Germany are a disaster. We are 10 months

away from the phase in of the VAT hike in January of 2007. That is why

the Yr/Yr decline is still so severe on the chart – the base is a pre

VAT base in Nov of 2006. It is not really not comparable to the 3-Mo

and the 6-Mo results which are both with base periods that are well

beyond the VAT hike period. Still 3-Mo and 6-Mo real retail sales

growth rates are weaker that their 12-month pace. This is not a good

sign.

Two months into Q4 German real retail sales (ex autos) are

declining at an 8.2% annual rate. Nominal clothing and footwear

spending is off in the quarter at a 23% rate. November sales were a

disaster.

| German Real and Nominal Retail Sales | New Qtr | |||||||

|---|---|---|---|---|---|---|---|---|

| Nominal | Nov-07 | Oct-07 | Sep-07 | 3-Mo | 6-Mo | 12-Mo | Year Ago | SAAR |

| Retail excl Auto | -0.6% | -1.9% | 1.1% | -5.7% | -1.5% | -1.7% | 6.1% | -8.2% |

| Motor Vehicle and Parts | #N/A | 0.2% | -2.0% | #N/A | #N/A | #N/A | 21.0% | #N/A |

| Food Beverages & Tobacco | -2.3% | 0.1% | 1.4% | -3.2% | -2.0% | 0.2% | 3.2% | -1.4% |

| Clothing footwear | -0.8% | -8.3% | 5.6% | -15.1% | 1.1% | -1.2% | 5.7% | -23.0% |

| Real | ||||||||

| Retail excl Auto | -1.3% | -2.3% | 0.8% | -10.7% | -4.6% | -3.8% | 5.6% | -12.6% |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates