Global| May 30 2014

Global| May 30 2014German Retail Sales Fall Off Escalation Path

Summary

German retail sales were revised higher in March but still show weakness in April as sales dropped by 1% month-to-month. The profile of German growth rates shows year-over-year growth in sales at 1.2% with 3-month growth at a 1.1% [...]

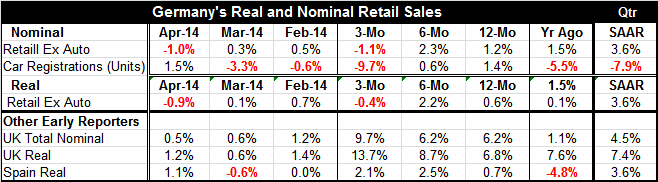

German retail sales were revised higher in March but still show weakness in April as sales dropped by 1% month-to-month. The profile of German growth rates shows year-over-year growth in sales at 1.2% with 3-month growth at a 1.1% annual rate of decline. Car registrations that were up in April are still falling at a 9.7% annualized rate over three-months. Real German sales show the same trends.

German retail sales were revised higher in March but still show weakness in April as sales dropped by 1% month-to-month. The profile of German growth rates shows year-over-year growth in sales at 1.2% with 3-month growth at a 1.1% annual rate of decline. Car registrations that were up in April are still falling at a 9.7% annualized rate over three-months. Real German sales show the same trends.

The UK and Spain are also early reporters of retail sales, but their experiences are different from Germany's as sales in the UK and in Spain each rose in April. Sequential growth rates for sales are either firm or accelerating for Spain and the UK.

Germany has continued to perform well. Its PMI readings for May show services doing well with a slight set back to manufacturing, which is still at a relatively firm level. The services sector is doing well and is the important source of jobs. But there is still some weakening in retail sales in April.

There are two ongoing concerns in Germany. One is about the state of the rest of the euro area that continues to lag German performance. The other is the ongoing tension over Russia's meddling in the affairs of Ukraine. In both cases, things seem to have cooled down. PMI data for the rest of the EMU are not more ragged or diffused than they have been. Ukraine has had elections and a new president who is vigorously trying to contain the unrest in the east. Russian troops have for the most part backed off from Ukraine's border. That threat seems to have lessened.

Still, it's possible that Germans are still impacted by the actions in Ukraine and the ongoing sanctions on Russia. There are risks associated with a return of the cold war. The United States with its ongoing tough negotiations with BNP is showing how it deals with entities that flaunt sanctions. Germany trades a good deal with Russia, enough to make a difference in the short run.

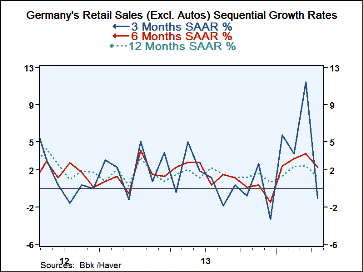

However, the downshift in retail sales may not have a fundamental cause. This may just be a pullback after what has been a surge in retail sales in Germany as the 3-month growth rate spiked at an 11.3% annual rate in March. While the 3-month growth rate in April has dipped, the broader growth rate calculations still show growth. The April 6-month rate of sales growth is the second strongest rate since December 2011. The back to back 12-month growth rates in March and February were the strongest pair since February 2011. By its own metrics, German sales are still solid and April is a one-month set back. Germany's fundamentals are still strong and we expect retail sales to return to a path of growth.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates