Global| Aug 08 2017

Global| Aug 08 2017German Trade Surplus Is Back on a Growth Trend

Summary

The German trade surplus, once looking like it was diminishing, is now riding a seven-month trend to high values. The surplus on the trade account in June is only marginally higher than in February of this year and was last this large [...]

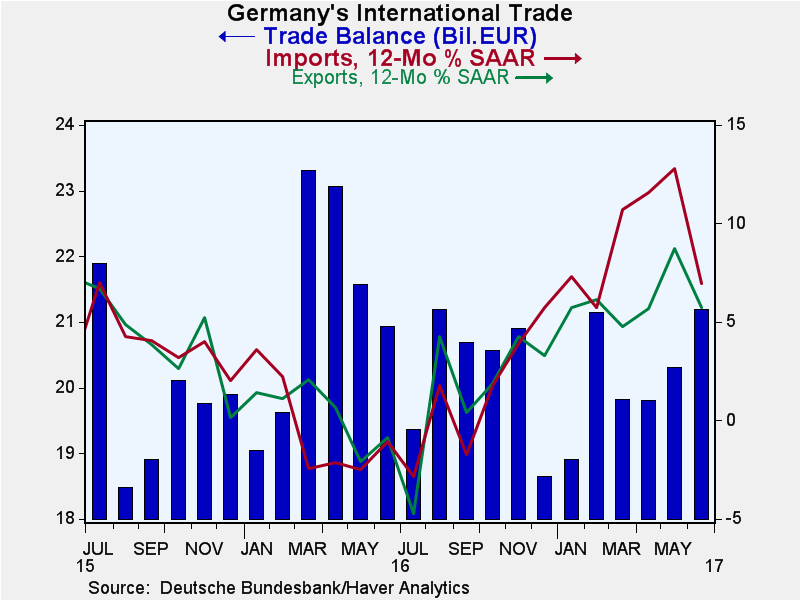

The German trade surplus, once looking like it was diminishing, is now riding a seven-month trend to high values. The surplus on the trade account in June is only marginally higher than in February of this year and was last this large in August of last year. But it is still a surplus that has been higher historically only six times.

The German trade surplus, once looking like it was diminishing, is now riding a seven-month trend to high values. The surplus on the trade account in June is only marginally higher than in February of this year and was last this large in August of last year. But it is still a surplus that has been higher historically only six times.

Since U.S. President Donald Trump has made fair trade a keystone of his policy, this trade result and Germany's globally high current-account-surplus-to-GDP ratio is not going to ease any of the tensions that exist between the United States and Germany.

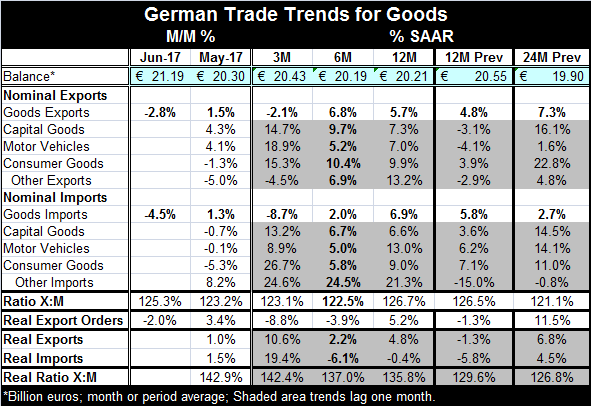

In June, German exports broke lower but imports fell by more; thus, pushing the trade account into larger surplus. The surplus has ballooned to 21.19 billion euros. June has been a bit of a rough spot for German economic data as industrial production fell unexpectedly in June and now both export and import flows are also lower on balance. German sector PMI data from Markit up to date through July have seen both the German manufacturing and services gauges weaken. Still, German economics activity appears to be still quite solid, but there is some sort of a slowing or moderation in train in Germany.

German exports are still up by 5.7% over 12 months and by 6.8% over six months as the three-month growth rate has soured to fall at a 2.1% annual rate. Imports over three months are weaker, falling at an 8.7% annual rate, but they are rising at a 2% pace over six months and by 6.9% over 12 months. Weakening oil prices are contributing to the view of imports as weak.

If we switch over to look at real exports and imports, we also have to shift gears on the horizon to look at data only current through May. On that basis, the nominal data are stronger too, and the real data show exports rising at a 10.6% pace over three months and imports up at a 19.4% annual rate, accelerating from negative growth rates over six months and 12 months. Real exports also are accelerating from soft but positive growth rates over six months and 12 months.

German nominal exports are growing over 12 months and German real exports are strong over 12 months as of May. German real export orders through July show a year-on-year gain of 5.2% comparable to the real export gain through May of 4.8%. But real export orders are falling on balance over three months and over six months. As was the case with German industrial output in June, the fall-off in exports and imports seems to be more of a moderating factor that addresses the trend or speed of growth than a real reversal or some sort of a negative signal. German trends are still quite firm.

The June results for Germany mirror in some ways the trade results for China just announced. In China, exports and imports both slowed and its trade surplus grew. China's international reserves are growing again as they have now gained for the sixth straight month. China appears to have got control of its capital flight problem.

Trade continues to be a touchy subject globally. Asian economies are generally designed to piggyback on growing trade tends and to ride the export-led growth model of development. Yet, the large U.S. trade deficit and ongoing loss of manufacturing jobs in the U.S. has finally touched a nerve and has become a key reason for the election of a President with ambitions to change the trade trends around. So far, it does not appear to be working although the U.S. trade deficit recently has moved lower. But the U.S. will find trade progress hard to achieve and sustain if countries with the largest surpluses are not also making adjustments. And so far, they are not.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates