Global| Oct 18 2005

Global| Oct 18 2005Germany's ZEW Results Are Disappointing: Political Uncertainty and Inflation Causes?

Summary

The results of Germany's latest ZEW survey, released today, were below consensus, showing only a slight improvement in October in the balances between optimists and pessimists among German institutional investors and analysts [...]

The results of Germany's latest ZEW survey, released today, were below consensus, showing only a slight improvement in October in the balances between optimists and pessimists among German institutional investors and analysts regarding current economic conditions and those expected six months ahead. The disappointing results of the survey may be due, in part, to the uncertainty arising out of the inconclusive election held last month. A coalition government between the CDU/CSU (Christian Democratic Union, and Christian Social Union), with their narrow victory of four seats, and the SPD (Social Democratic Party) has been agreed upon with Angela Merkel as Chancellor.However, the process of selecting a cabinet, now underway is revealing what may be potentially serious differences among the possible candidates. The process is not expected to be over much before November 17 when the Bundestag formally installs the new Chancellor and pronounces the new government operational.

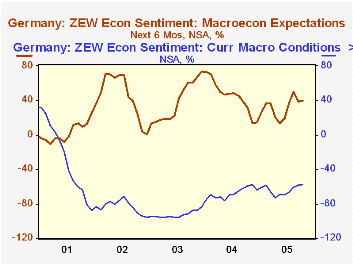

Pessimists continue to outweigh optimists in their appraisal of current conditions. The balance between those expecting current conditions to improve and those who expect them to worsen rose a mere one-tenth of one percent from -58.1% to 58.0%. When they look ahead, the respondents to the survey are more optimistic. The balance between those expecting better conditions six months ahead and those expecting worse conditions rose by 0.8% in October to 39.4% from 38.6% in September. The contrast between the respondents' appraisal of current conditions and their appraisal of expectations six months ahead is shown in the first chart.

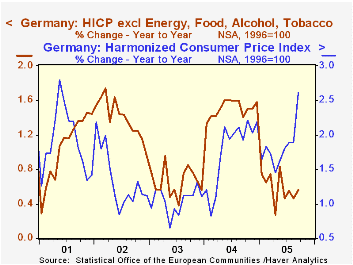

Inflation is another factor that may be influencing sentiment among institutional investors and analysts.Eurostat published today the Harmonized Consumer Prices Index for the Euro Zone and the individual countries of the area. In addition, indexes of core inflation, defined as the total index excluding, energy, food, alcohol and tobacco, are also published. For Germany, the year to year increase in the total index was 2.61%, up from 1.89% in both August and July. Although core inflation also rose, it remains at low levels, lower than in some of the earlier months of the year. Core inflation was 0.56% in September, compared with 0.46% in August and 055% in July. The Harmonized Consumer Price index and its related Core Inflation index are shown in the second chart.

| Percent Balance of Opinion German ZEW Survey | Oct 05 | Set 05 | Aug 04 | M/M Dif | Y/Y Dif | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|---|---|

| Current Conditions | -58.0 | -58.1 | -58.9 | 0.1 | 0.9 | -67.7 | -92.6 | -83.3 |

| Expectations 6-months ahead | 39.4 | 38.6 | 31.3 | 0.8 | 8.1 | 44.6 | 38.4 | 45.3 |

| German Harmonized Consumer Price Index | Y/Y % | Y/Y % | Y/Y % | Y/Y % | Y/Y % | Y/Y % | Y/Y % | Y/Y % |

| Sep 05 | Aug 05 | July 05 | Jun 05 | May 05 | Apr 05 | Mar05 | Feb 05 | |

| Harmonized CPI total | 2.61 | 1.89 | 1.89 | 1.81 | 1.63 | 1.45 | 1.72 | 1.82 |

| Harmonized CPI core | 0.56 | 0.46 | 0.55 | 0.46 | 0.84 | 0.28 | 0.74 | 0.65 |