Global| Nov 16 2010

Global| Nov 16 2010Germany's ZEW Survey Shows More Optimism

Summary

The 277 financial analysts and institutional investors who participated in the November ZEW survey have become more optimistic than their counterparts in October about the prospects for Germany and the whole Euro Area. The balance of [...]

The 277 financial analysts and institutional investors who participated in the November ZEW survey have become more

optimistic than their counterparts in October about the prospects for Germany and the whole Euro Area. The balance of

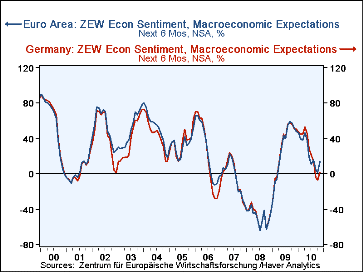

opinion on the outlook for the German economy rose 9 percentage points from a -7.2% in October to 1.8% in November. The

balance of opinion on the outlook for the Euro Area as a whole rose 12 percentage points from 1.8% in October to 13.8% in

November. The first chart compares the balances of opinion on the outlook for Germany and the Euro Area as a whole. Currently,

the analysts are more optimistic on the prospects for the Euro Area as a whole than they are for Germany, reflecting, perhaps,

the past relative performance of the two areas. The German economy has been exceptionally strong in comparison with the rest of

the Euro Area. Perhaps the analysts see more room for improvement in the Euro Area outside of Germany than in Germany itself.

The 277 financial analysts and institutional investors who participated in the November ZEW survey have become more

optimistic than their counterparts in October about the prospects for Germany and the whole Euro Area. The balance of

opinion on the outlook for the German economy rose 9 percentage points from a -7.2% in October to 1.8% in November. The

balance of opinion on the outlook for the Euro Area as a whole rose 12 percentage points from 1.8% in October to 13.8% in

November. The first chart compares the balances of opinion on the outlook for Germany and the Euro Area as a whole. Currently,

the analysts are more optimistic on the prospects for the Euro Area as a whole than they are for Germany, reflecting, perhaps,

the past relative performance of the two areas. The German economy has been exceptionally strong in comparison with the rest of

the Euro Area. Perhaps the analysts see more room for improvement in the Euro Area outside of Germany than in Germany itself.

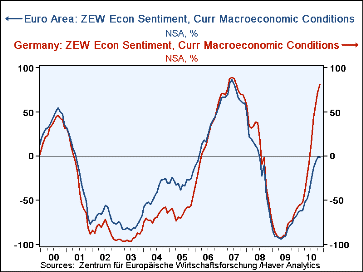

There has been only a very slight improvement in the balance of opinion on current conditions in the Euro Area from -1.1% in October to -1.0% in November. In sharp contrast, the balance of opinion on current conditions in Germany, rose 8.9 percentage points from 72.6%in October to 81.5% in November. The second chart compares the balances of opinion on the outlook for Germany and for the Euro Area as a whole. The present difference of opinion regarding current conditions in the two areas is striking.

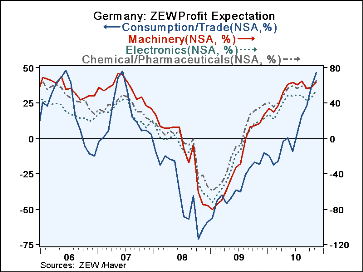

The analysts have also raised their expectations of profits in the next six months. They continue to increase their expectations of profits in Germany's traditional strongholds--chemicals and pharmaceuticals, machinery and electronics, but more recently there has been a significant increase in the expectation of higher profits in the Consumption/Trade sector as can be seen in the third chart.