Global| Aug 06 2013

Global| Aug 06 2013Germany: the Leader That Is a Strong Follower?

Summary

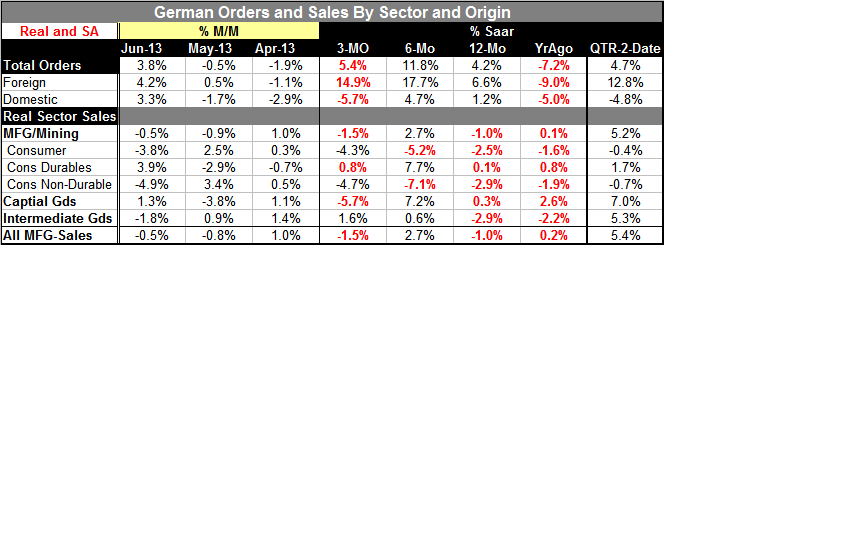

Germany is the strong economy of Europe. However, Germany is a strange strong economy. As the table above shows, in June, German orders are rebounding, rising by 3.8% after falling for two months in a row. Foreign orders have now [...]

Germany is the strong economy of Europe. However, Germany is a strange strong economy. As the table above shows, in June, German orders are rebounding, rising by 3.8% after falling for two months in a row. Foreign orders have now risen for two months in a row while domestic orders are rising after having fallen for two months in a row.

Germany is the strong economy of Europe. However, Germany is a strange strong economy. As the table above shows, in June, German orders are rebounding, rising by 3.8% after falling for two months in a row. Foreign orders have now risen for two months in a row while domestic orders are rising after having fallen for two months in a row.

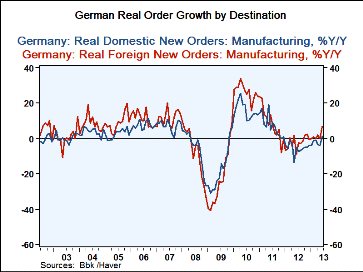

In the current month, foreign orders at 4.2% are stronger than domestic orders which are up by 3.3%. Over three-months foreign orders are up at a 14.9% annual rate while German domestic orders are falling at a 5.7% annual rate. Over six-months the divergence is still large with foreign orders up at a 17.7% annual rate and domestic orders up at a 4.7% annual rate. Year-over-year foreign orders are up 6.6% while domestic orders are up by just 1.2%.

Clearly, the foreign sector is leading the German manufacturing sector higher, not the other way around.

The German economy, the strong man of Europe, is an export led growth economy. The German domestic economy is doing better because its exports are doing better. It's Germany's competitiveness which allows it to grow faster when the rest of the world begins to stir. Thus, despite the fact that Germany is the strong economy of Europe, it is not providing the role of locomotive.

Apparently large orders, including some from the recent Paris airshow, helped to boost orders in Germany. Without major contracts included, German orders declined by 0.7% in June.

In its just released annual Article IV report on Germany, the IMF did not change its growth forecasts, leaving them at a weak +0.3% for this year and a somewhat improved +1.3% in 2014, while citing that there still are risks to the downside. Consumption is driving the German economy as exports and investments expand more gradually, the IMF said -- yet this is not the picture we get in this month's data.

German retail sales are up by 1.1% year-over-year in June and ex autos real retail sales are lower. Q2 German GDP details are as yet unreleased but as of Q1 German private consumption was 'driving' GDP in the sense that real private consumption rose by 0.6% year over year as GDP fell by 0.3% Year-over-year. It was not much of a driver. In June at least export orders have a strong year-over-year growth rate and can reasonably be called a driver of growth.

Still, the IMF also remarked that, "The outlook for the remainder of 2013 and next year is heavily dependent on a gradual recovery in the rest of the euro area and a sustained reduction in uncertainty."

Germany is not the robust platform of growth that will drive the euro-Zone higher. It is somewhat fragile with German consumer sentiment still the best in the e-Zone but with consumers who know that what happens in the rest of Europe matters for them and these are consumers aware of what is happening in the rest of Europe.

Thus Germany has a very important feedback loop from Europe that keeps it from having faith that Germany can go it alone. German orders are doing better. The strength in foreign orders is helping the domestic economy to regain its footing. Still, a wholly domestic sector like construction eased its performance to a diffusion reading of 51.5 in July from 54.5 in June. While those readings would be the envy of many other countries in Europe there is enough weakness and backtracking there to remind us that the German economy has its frailties, too.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.