Global| Jan 24 2008

Global| Jan 24 2008Germany’s IFO Index Bounces on Improved Expectations

Summary

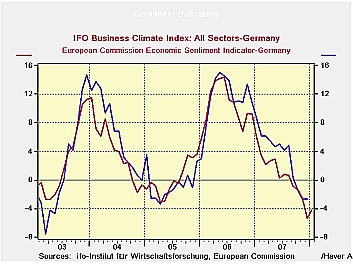

Bounce raises the question of EMU-US de-coupling. Apparently Germans agree… They agree with the ECB that weakness does not threaten Germany or Europe and they see better times ahead as the IFO expectations index that looks six months [...]

Bounce raises the question of EMU-US de-coupling.

Apparently Germans agree… They agree with the ECB that

weakness does not threaten Germany or Europe and they see better times

ahead as the IFO expectations index that looks six months into the

future rose enough to kick the climate index higher. No wonder Axel

Weber, Bundesbank president, was saying that markets do not understand

the ECB and are too driven by short-term horizons. Weber, in comments

today, hinted that the next ECB move could be to tighten, not to ease

as markets had expected just yesterday.

These events raise the question of whether markets have

de-coupled or whether either Europe’s or the US central bankers are

just plain wrong about the outlook. Can Europe be so strong that it may

need to tighten if the US is as weak as all the fiscal and monetary

stimulus in train seem to expect? Or is Germany and the ECB simply

wrong in their outlook? Or is the Fed and Congress wrong and just too

wrapped up in the needs of US short-term presidential election year

politics?

We can’t tell here and now, but time will tell.

The respondents to the IFO survey did see somewhat weaker

current conditions, but not much weaker. At a value of 107.9 the

current index is still in the top quartile of its range. It slipped by

just 0.2 points in January, less than in December. It is still well

above its average value of 95.0. It is lower year/year by 4.2%, less

than the 6.2% drop registered on that basis in December.

Business expectations improved by 0.8% in Germany. This

propelled the overall climate index up to 103.4 from 103.0 in December.

Expectations are still lower by 4.1% Yr/Yr less than the 4.3% drop

registered in December. But the IFO survey is hardly a report ringing

warning bells in the ears of the ECB.

The overall EU index for Germany had already slowed its rate

of descent in December. Now the IFO actually has improved. We seem to

have a decoupling in progress if the actions of the ECB and the Fed are

each correct. The question is: are they?

| IFO Survey: Germany | ||||||||

|---|---|---|---|---|---|---|---|---|

| Jan-08 | Dec-07 | Nov-07 | Oct-07 | Sep-07 | Aug-07 | Jul-07 | Jun-07 | |

| Biz Climate | -4.2% | -5.3% | -2.5% | -1.4% | -1.0% | 0.7% | 0.8% | 0.3% |

| Current Situation | -4.3% | -6.2% | -3.2% | -2.1% | -1.3% | 2.5% | 2.4% | 1.6% |

| Biz Expectations | -4.1% | -4.3% | -2.0% | -0.8% | -0.4% | -1.1% | -0.9% | -1.3% |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.