Global| Jun 21 2006

Global| Jun 21 2006Gold Prices Crater, Oil Off a Bit But Inflation Pressure Up

by:Tom Moeller

|in:Economy in Brief

Summary

Gold prices at $567.00 per ounce yesterday were more than 20% lower than their high during May. (Since 1980 there has been a 56% correlation between the level of gold prices and the y/y change in consumer prices.) In addition, the [...]

Gold prices at $567.00 per ounce yesterday were more than 20% lower than their high during May. (Since 1980 there has been a 56% correlation between the level of gold prices and the y/y change in consumer prices.)

In addition, the price of WTI crude oil at $68.94 per barrel is off 8% from the May high. These declines, however, seem more attributable to an easing of political tensions (Iran) than to some bona fide drop in inflation pressure. Measured price inflation is up, industrial commodity price inflation is up, inflation expectations are higher as well.

Consumer prices YTD have risen at a 5.2% annual rate in 2006 versus last year's 3.4% gain. The 3.1% rate of advance in "core" consumer price inflation is up from 3.3% growth last year, the 3.8% gain in core services prices is up one percentage point from last year and even the soft 1.2% rise in core goods prices is up from 0.5%.

The JoC-ECRI Industrial Metals Prices Index is up 25.2% this year due to higher prices for aluminum (up 35.4%), copper scrap (up 65.5%) and stainless steel scrap (up 17.6%). High grade copper prices have eased quite a bit from the earlier high but remain up 44.1% since year end '05.

Growth in industrial production is behind these gains. U.S. output gains have wobbled in recent months but factory production is up at a 3.9% annual rate this year, the same rate growth as during all of 2005. Output in the OECD Major Seven countries also is firm at 3.2% y/y through March. That's comparable to growth during the prior three years but quite the improvement from a range of 0.8% to -3.0% during 2001-2003. During the last ten years there has been a 49% correlation between the level of industrial metals' prices and the y/y change in OECD Big Seven industrial production.

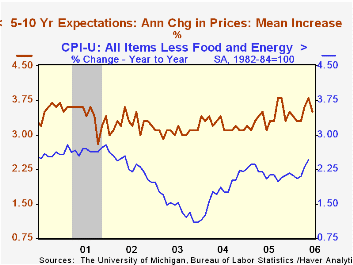

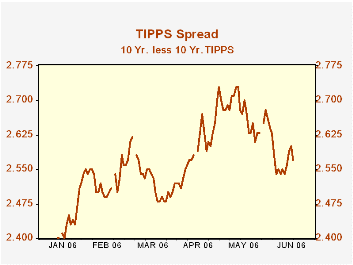

Inflation expectations as measured in the University of Michigan survey slipped from the highs in the June survey but the trend is clearly up. And in the market for Treasury securities, the so called TIPPS spread is down as well, but the trend remains elevated.

The Fed's Inflation Objective from the Federal Reserve Bank of St. Louis can be found here.

| Weekly Prices | 06/20/06 | 12/27/05 | Y/Y | 2005 | 2004 | 2003 |

|---|---|---|---|---|---|---|

| Light Sweet Crude Oil, WTI (per bbl.) | $68.94 | $58.16 | 21.1% | $58.16 | $41.78 | $32.78 |

| U.S. Retail Gasoline (per gallon) | $2.87 | $2.20 | 32.9% | $2.27 | $1.85 | $1.56 |

| Gold: Handy & Harmon (per Troy Oz., EOP) | $567.00 | $507.40 | 30.3% | $507.40 | $443.40 | $416.25 |

| High Grade Copper (Comex, /Lb., EOP) | $3.29 | $2.28 | 94.9% | $2.28 | $1.54 | $1.04 |

| Stainless Steel Scrap (/ton, EOP) | $2,158 | $1,268 | 30.2% | $1,268 | $1,558 | $1,265 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates