Global| May 09 2007

Global| May 09 2007Gulf of Mexico Deepwater Oil and Gas Data Added to Haver Offerings; Crucial Cushion to Energy Supplies

Summary

On April 30, the Department of Energy released supplementary detail on natural gas and crude oil reserves and production through 2005. Included in this report are data for "Federal Offshore Gulf of Mexico Deepwater Reserves", which [...]

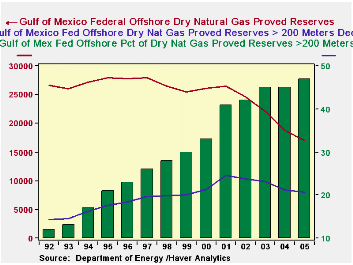

On April 30, the Department of Energy released supplementary detail on natural gas and crude oil reserves and production through 2005. Included in this report are data for "Federal Offshore Gulf of Mexico Deepwater Reserves", which Haver has just added to our OGJANN database. Over the year 2005, proved reserves of dry natural gas -- the standard "consumer grade" gas -- declined from 18.8 trillion cubic feet in the Gulf to just over 17.0 trillion or 9.6%. These reserves have fallen in eight of the 13 years for which there are data, and over the past four years, these declines have averaged 10.5%. "Proved Reserves" are the quantities that geologists and engineers deem usable -- "recoverable", in industry parlance -- in known reservoirs under existing economic and operating conditions. Obviously, recovering the gas reduces the reserves, while finding a new reservoir increases them. Notably, economic and operating conditions apply, so if prices rise, reserves might go up because the economics of production would be more favorable. Also, if drilling techniques improve, reserves could also increase, since the more efficient or highly skilled process would make it easier to reach substances in difficult locations.

In that regard, these new series in Haver's databases also include reserves and production of gas and oil that lie more than 200 meters below the surface. So while total reserves of dry natural gas peaked in 1997 at 27.9 trillion cubic feet, reserves below 200 meters continued to increase until 2001. In 2005, even while both total and deepwater reserves were decreasing, the deepwater portion rose to 47% of the total.

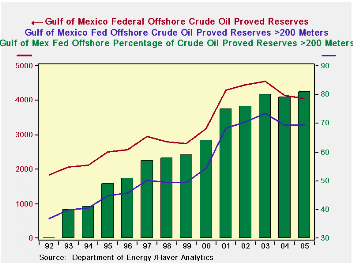

Similar data exist for crude oil and for natural gas liquids in the Gulf of Mexico. Data for crude oil are shown in the table below.

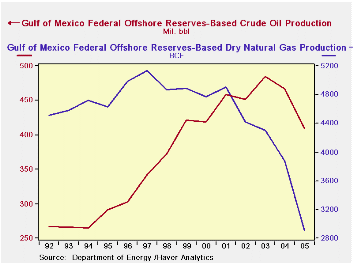

The Energy Department's information also includes the associated production data: how much is withdrawn and processed. There are technical differences between these production data and the regular monthly "marketed" concept; for natural gas, so-called flared and vented gas is included in these figures, but not in the "marketed" production.

The simple annual figures illustrate pretty clearly the impact of Hurricanes Katrina and Rita on production. Oil production in the Gulf was off 12.4% in 2005, pretty steep considering that the storms hit in late August and mid-September, two-thirds through the year. But natural gas was hit harder still, plunging almost exactly 25%. Both gas and oil produced in shallower waters were off about 30%, while deepwater natural gas had only a 12.5% decline and oil at those depths barely decreased, just 1.6%. Clearly, the deepwater reserves are crucial to the US petroleum supply in the next several years.

| 2005 | 2004 | 2003 | 2000 | 1992 | |

|---|---|---|---|---|---|

| Dry Natural Gas Proved Reserves* (Bil.cu.ft.) | 17,007 | 18,812 | 22,059 | 26,172 | 26,649 |

| Below 200 meters | 8,043 | 8,379 | 9,835 | 8,506 | 3,225 |

| Dry Natural Gas Production (Bil.cu.ft.) | 2,906 | 3,874 | 4,306 | 4,773 | 4,508 |

| Below 200 meters | 1,069 | 1,222 | 1,513 | 1,165 | 162 |

| Crude Oil Proved Reserves* (Mil. Barrels) | 4,042 | 4,144 | 4,554 | 3,174 | 1,835 |

| Below 200 meters | 3,272 | 3,280 | 3,627 | 2,021 | 557 |

| Crude Oil Production (Mil. Barrels) | 409 | 467 | 485 | 419 | 267 |

| Below 200 meters | 305 | 310 | 336 | 234 | 46 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates