Global| Jan 15 2008

Global| Jan 15 2008HICP is Rising in Many ECB Countries

Summary

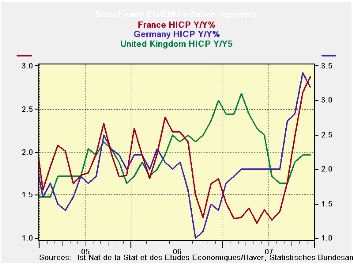

Inflation is above the ECB top allowed mark in seven of nine early reporters in December, nearly 80% if them. Through November, 92% of the central 12 members of EMU have inflation running over 2%. That compares to 80% in October and [...]

Inflation is above the ECB top allowed mark in seven of nine

early reporters in December, nearly 80% if them. Through November, 92%

of the central 12 members of EMU have inflation running over 2%. That

compares to 80% in October and 50% in September 2007. From September

2006 to September 2007 headline inflation was at or below 2% in most of

these countries. But prior to September 2006 above 2% inflation rates

were more common in Euro Area member countries.

As for Core inflation, in November the core HICP was rising in

9 of 12 key EMU countries (75%). In October the core rate was above 2%

in 66% of these countries and in September 50%. Before that, from

September 2006 through April 2007, that percentage stayed pretty much

at 42% with one tick up in the proportion to 50%.

The Core HICP for EMU did not go up above 2% until recently,

in Sept. 2007. But the headline inflation rate is another story. Since

February 2006, the headline HICP has exceeded 2%; in 19 of those 23

months. The core rate was up in 10 of those 22 months (a December HICP

core is not yet available).

This is why the ECB is nervous. There has been a long run of

the HICP above 2% while the core has only moved up there again,

recently and somewhat sporadically. Core inflation is moving up now

with two of the Big Three EMU economies (Germany and Italy) posting

core rates above 2%. Only France, The Netherlands and Finland have core

inflation persistently holding below the 2% mark.

While there is a debate about how much Europe will slow, and

there is a strong euro in place to help fight inflation, the ECB is

concerned about the structural entrenchment of inflation above 2%.

Above 2% inflation in the core, although the ECB does not exactly say

it that way, has become a problem. Just as inflation has gotten a bit

more worrisome, concerns about growth have escalated as well. This

leaves the ECB in no man’s land. Its response has been to take a harder

rhetorical line against inflation. We’ll see if there is anything more

to it than that in the coming months.

| Euro Area & Friends: Headline Inflation Yr/Yr and trends | |||||||

|---|---|---|---|---|---|---|---|

| Year/year | Mo/Mo | 3-Mo:AR | 6Mo:AR | ||||

| Core HICP | Dec-07 | Nov-07 | Oct-07 | Dec-07 | Nov-07 | Jul-07 | Jun-07 |

| Belgium | 3.1% | 2.9% | 2.2% | 0.5% | 1.0% | 9.1% | 5.1% |

| Finland | 2.0% | 2.2% | 1.9% | -0.1% | 0.6% | 2.7% | 1.6% |

| France | 2.8% | 2.6% | 2.1% | 0.4% | 0.8% | 6.0% | 3.9% |

| Germany | 3.1% | 3.3% | 2.7% | -0.2% | 0.9% | 3.5% | 3.3% |

| Greece | 3.7% | 3.9% | 3.1% | 0.1% | 1.0% | 6.1% | 5.6% |

| Italy | 2.7% | 2.5% | 2.3% | 0.4% | 0.3% | 5.5% | 3.5% |

| Luxembourg | 4.3% | 4.0% | 3.6% | 0.5% | 0.7% | 7.6% | 4.0% |

| The Netherlands | 1.6% | 1.8% | 1.6% | 0.1% | 0.5% | 3.9% | 1.3% |

| Spain | 4.3% | 4.1% | 3.7% | 0.6% | 0.8% | 8.3% | 5.2% |

| EU: Other HICP/CPI | |||||||

| UK (HICP) | 2.1% | 2.1% | 2.0% | 0.3% | 0.4% | 4.7% | 2.1% |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates