Global| Jun 27 2007

Global| Jun 27 2007Hints of Improvement in Japanese Retailing as May Sales Show Gain from Year-Ago

Summary

We fret over the Japanese economy: is it improving or not? Is it finally breaking out of 1990s stagnation enough so that deflation will go away? We're never quite sure. So when one figure is favorable, even by a little bit, we tend to [...]

We fret over the Japanese economy: is it improving or not? Is it finally breaking out of 1990s stagnation enough so that deflation will go away? We're never quite sure. So when one figure is favorable, even by a little bit, we tend to get excited about it.

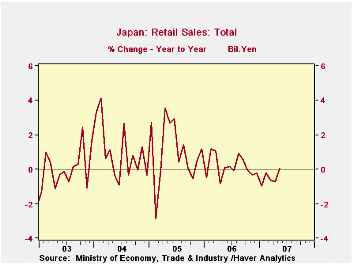

Today it is retail sales. In May, consumer purchases of goods in stores rose 0.1% from a year ago. The Bloomberg news service reports that of the 23 economists in its Japanese forecast survey, only 1 predicted a positive outcome for this indicator. It was the first 12-month increase since last September.

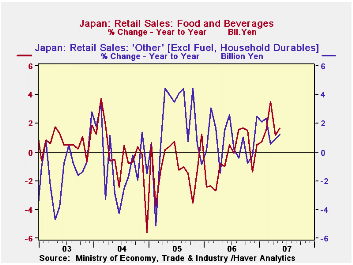

We thought perhaps rising fuel prices had been the main mover. This had certainly been the case from about mid-2004 through mid-2006. But fuel purchases have slowed recently and for May they actually edged down from May 2006, by 0.4%. Excluding fuel, retail sales were still up 0.1%.

The largest single gain was in food and beverages, which rose 1.7%. Other categories of stores -- motor vehicle dealers, clothing, household durable goods and general merchandise -- all still saw year-on-year decreases. So it's the "all other" segment that helped push up the total: books, sporting goods, personal care items. These increased 1.3% over the year ago.

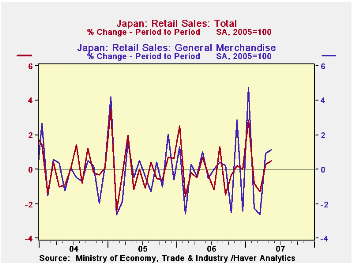

The narrow scope of the May sales increase might suggest that it will turn out to be fleeting. However, the Ministry of Economy, Trade and Industry (METI) also calculates an index, which they seasonally adjust. As shown in the table below, this index rose 0.5% in May from April, which had been up 0.3% from March. By this measure, general merchandise store sales were up in May, as were clothing stores and "other", suggesting that recent uptrends have been broadening, giving a more optimistic view going forward. Thus, Japanese consumers, who face an increasing positive employment situation and the lowest unemployment since early 1998, might be starting to spend more freely. The threads of evidence from this retail sales report are thin, but they look to be braiding a stronger rope.

| JAPAN: Retail Sales | May 2007 | Apr 2007 | Mar 2007 | Year Ago | Monthly Averages|||

|---|---|---|---|---|---|---|---|

| 2006 | 2005 | 2004 | |||||

| Total (Bil.¥) | 11,012 | 11,177 | 12,077 | 11,005 | 11,271 | 11,255 | 11,143 |

| % Change | 0.5* | 0.3* | -1.3* | 0.1 | 0.2 | 1.0 | 1.0 |

| ex Fuel | 0.1 | -0.6 | -0.2 | 0.4 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates