Global| Dec 12 2005

Global| Dec 12 2005Households' Debt Usage Surged in 3Q

by:Tom Moeller

|in:Economy in Brief

Summary

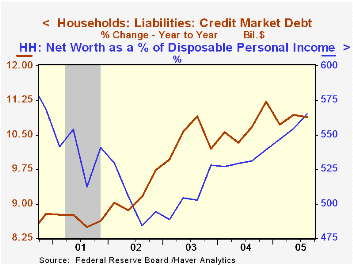

Growth in credit market debt owed by the household sector jumped at a 13.3% rate last quarter, the strongest rate in a year. A 15.5% (13.2% y/y) jump in mortgage obligations lifted the figure but consumer credit also surged at an 8.7% [...]

Growth in credit market debt owed by the household sector jumped at a 13.3% rate last quarter, the strongest rate in a year. A 15.5% (13.2% y/y) jump in mortgage obligations lifted the figure but consumer credit also surged at an 8.7% rate (4.2% y/y), the strongest this year. These gains powered overall domestic nonfinancial debt growth to its fastest of the year, 9.8% (9.2% y/y)

Growth in the federal government debt also was firm at 6.9% y/y while non-financial corporations' debt grew a faster 7.7% y/y.

Household sector asset values rose 12.8% y/y due to a 14.1% rise in the value of real estate holdings. Financial asset values rose 9.8% due to a 19.0% rise in the value of mutual fund shares but the value of corporate equities held directly rose just 3.0%.

The net worth of the US household sector in 3Q improved 2.6% (10.9% y/y) to a record $51.1 trillion. The gain lifted net worth to a historic 5.6 times income.

| Flow of Funds | % of Total | 3Q 05 (AR) |

2Q 05 (AR) |

Y/Y | 2004 |

2003 |

2002 |

|---|---|---|---|---|---|---|---|

| Total Credit Market Debt Outstanding | 8.7% | 8.8% | 8.7% | 8.4% | 8.8% | 7.7% | |

| Federal Government | 12% | 6.6% | -3.7% | 6.9% | 9.0% | 10.9% | 7.6% |

| Households | 28% | 13.3% | 12.0% | 10.9% | 11.2% | 10.2% | 9.7% |

| Nonfinancial Corporate Business | 14% | 6.5% | 8.7% | 7.7% | 5.2% | 3.4% | 0.5% |

| Financial Sectors | 32% | 6.1% | 10.7% | 7.5% | 7.5% | 10.1% | 9.2% |

| Net Worth: Households & Nonprofit Organizations (Trillions) | $51.1 | $49.8 | $48.2 | $43.9 | $39.0 | ||

| Tangible Assets | $20.8 | $20.1 | 14.1% | $18.7 | $16.4 | $15.0 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates