Global| May 24 2013

Global| May 24 2013IFO Rebounds; Beer Remains Protected

Summary

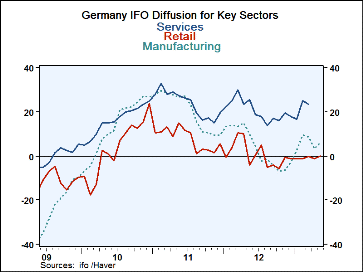

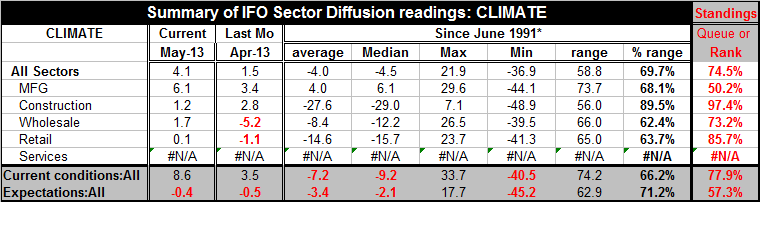

IFO gauge of German real sector activity shows a pickup in May compared April. This is the first rise following two months of declines. In the table and in the chart we present the IFO data on diffusion readings. This is the same sort [...]

IFO gauge of German real sector activity shows a pickup in May compared April. This is the first rise following two months of declines. In the table and in the chart we present the IFO data on diffusion readings. This is the same sort of presentation that is used in the Philadelphia Federal Reserve manufacturing survey and in the surveys from the other District Fed banks. Survey respondents are asked certain questions, the net result is plotted as a diffusion entry. For example in the table the 6.1 reading for manufacturing means that there were 6.1% more respondents that said manufacturing is improving than were saying that is declining. The manufacturing index, like the all sector index improved in May. The construction index was the sole reading that declined, posting a still positive 1.2 reading after a 2.8 reading in April. Both wholesaling and retailing made switches from net negative to net positive readings. Wholesaling switched strongly from a -5.2 to a +1.7. Retailing switched to a +0.1 from a -1.1 reading.

IFO gauge of German real sector activity shows a pickup in May compared April. This is the first rise following two months of declines. In the table and in the chart we present the IFO data on diffusion readings. This is the same sort of presentation that is used in the Philadelphia Federal Reserve manufacturing survey and in the surveys from the other District Fed banks. Survey respondents are asked certain questions, the net result is plotted as a diffusion entry. For example in the table the 6.1 reading for manufacturing means that there were 6.1% more respondents that said manufacturing is improving than were saying that is declining. The manufacturing index, like the all sector index improved in May. The construction index was the sole reading that declined, posting a still positive 1.2 reading after a 2.8 reading in April. Both wholesaling and retailing made switches from net negative to net positive readings. Wholesaling switched strongly from a -5.2 to a +1.7. Retailing switched to a +0.1 from a -1.1 reading.

The graph shows that manufacturing index lies above the index for services and it appears to be advancing a slightly more rapid pace. The manufacturing PMI in fact resides in the bottom 21 percentile of its historic range. For services the PMI resides in the bottom 12% of its range. Both continue to occupy extremely low positions compared to their respective histories. And as the chart suggests, the services sector actually is lagging behind the manufacturing sector.

Current Conditions VS expectations

The current conditions reading for all industries moved up sharply to an 8.6 reading from a 3.5 reading in April. Expectations, while improving slightly, remain negative at a -0.4 reading after -0.5 reading in April. So while current conditions are improving in Germany expectations continue to be impacted adversely as Germans are cautious about the future. We can only wonder how much the troubles in the Zone and the German realization of what they may ultimately mean for Germany, cause Germans to be more concerned about the future and to appreciate more fully the current environment they have in comparison with the rest of the Zone.

Percentile standings

The percentile standings are also useful for understanding exactly how much stronger or weaker the various measures are. The percentile standing use all of the historic data for each series. The calculation places the current number in the historic queue for each series expressing that number is a percentile standing. For example, if a reading was the 10th highest reading in the history of the index and if there were 100 observations that would constitute a 90th percentile standing which would otherwise be described as a top 10% standing for that variable. Because of the method of calculation we can also interpret these numbers by saying (in this hypothetical example) that this particular observation is stronger only 10% of the time and is weaker about 90% of the time. These calculations are quite different from simply taking a variable as a percentage of its high low range, but those data also are presented in the table. The high-low data are executed using only three variables from the timeseries: its current value, its highest value and its lowest value, therefore we consider the queue percentile (alternatively, rank percentile, or percentile standing) data more meaningful. Also in the percentile standing data the 50% mark also corresponds to the series median, which the value that has as many observations above it as below it, another useful metric for using percentile standings.

Our percentile results:

The all-sector observation stands basically in the 75th rank percentile, meaning it is stronger only 25% of the time making the current observation a relatively firm observation, certainly an extremely strong one by comparison with other economies in the European Monetary Union. Manufacturing is only 50-50 sitting at the 50.2 percentile space of its queue, virtually on top of its median. Construction on the other hand is extremely strong in its 97+ percentile-standing, in the top 3% of its historic range, a clearly strong reading.

Note this is true even though the raw construction index is a very mild looking 1.2. We evaluate each of these sectors according to its own history and the point of this is that each sector does have a very different history and that's the reason for calculating the statistics in this way. You get a good feeling for this simply by looking at the average and median values in the table. You cannot look at the raw net readings by sector each month and have any idea which one is really doing better. To do that you need to filter the current readings through a process such as this.

Wholesaling and retailing are firm-to-strong. Wholesaling stands in the 73rd percentile of its queue-standing retailing is an easy percentile of its historic queue. The services sector at the moment is not being updated by the IFO.

Turning to current conditions and expectations we see very different percentile standings. The current condition diffusion index stands at about the 78th percentile of its historic queue, a relatively strong reading, in the top 22% of its historic range lying in the top fourth of tis rang nearer to the boundary for the top fifth. Expectations stand only in the 57th percentile only seven percentile points above their median; clearly a more equivocal rating.

The Zone

Germany is doing much better than the rest of the countries in its monetary union. Still Germany is not an island and doesn't have any particular buffering from what's going on in the euro-Zone. Business morale did improve this month after several months of weakening. And, according to GFK, German optimism is set to reach its highest level in more than five years. But German exporters are losing their confidence about the future, partly because of the ongoing growth difficulties within the e-Zone. These countries after all are some of Germany's best customers; it shouldn't be lost on anyone that Germany was able effectively to export to these countries because German banks were willing to lend to finance the exports. With growth weaker in the rest of the Zone and with public finances more jittery and with the private sector under pressure the future for German exports certainly is challenged. In addition to that the Chinese economy is struggling and the US economy doesn't look like it's going to grow as fast as it has historically. For a country like Germany that relies on the strength of its exports this downbeat assessment of the future seems appropriate, especially after the surge in the EMU trade surplus reported in the last month as imports declined across the Eurozone.

While Germany is reporting improved business confidence Italian economic morale has weakened. Swedish economic sentiment also weakened for the second consecutive month. But in France economic confidence improved on expectations rising to an index level of 92 in May from 88 in April. France even reported a sharp increase in current production in its index, but as export orders faltered. This is going to be something to watch. It's hard to understand how French output could undergo such a switch (jumping from a -17 diffusion reading to -4) in this economic environment.

Some energy issues

With energy more in the picture and with Germany de-commissioning its nuclear plants, with Japan headed for denuclearize, (with Iran's bid for nuclearization being opposed) there is going to be more pressure on fossil fuels demand in the future. But the Middle East is looking like it's becoming even more unstable as the influences of the Arab Spring seem to have interacted with global warming and other unpredictability. But the US had turned to develop alternative energy sources from oil shale using the technology called 'fracking' to unlock a whole new source of energy. Meanwhile, Germany and all of Europe is reliant, at least for its natural gas supplies, on feeder pipelines from Russia.

But Germany has some of the same geological formations as the US. It has within its grasp the opportunity to use fracking technology to develop its own natural gas supplies. But so far the national consensus is against it because of fears that it could contaminate water supplies. The most recent twist in this battle has come as Germans have voiced not so much 'environmental concerns' but concerns about how fracking might affect their BEER quality...that's right BEER QUALITY. A letter was sent to several ministries in Berlin in which brewers express concern that developing shale gas could contaminate water supplies and violate the beer purity law of 1516 (Word! source). I am not making this up. I guess sometimes a country just has to choose between the security of its energy supply and the quality of its beer. I'm sure the Germans are happy that they're making the right choice.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates