Global| Oct 25 2007

Global| Oct 25 2007IFO Survey Shows Weakness is Still in Train...but at Moderate Pace

Summary

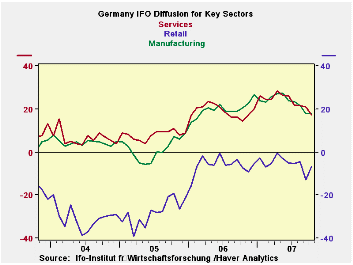

The IFO survey shows its various sectors to be well off peak. The overall index did slip again in October from +7.5 to +7.1. MFG, construction, wholesaling and services slipped on the month with only retailing getting a boost, but a [...]

The IFO survey shows its various sectors to be well off peak. The overall index did slip again in October from +7.5 to +7.1. MFG, construction, wholesaling and services slipped on the month with only retailing getting a boost, but a big one, from -12.9 to -6.8. The all-sector index still resides at the door step of the top 20th percentile of the range. Among components only MFG is above the 80th percentile at 84.8%. Retail is the relative weakest sector at 56.4% of its range, followed by construction at 59.2% of its range. Wholesaling is at the edge of the top third of its range while the service sector is nearly in the top 25% of its range. The peaking of these indexes occurred around the end of the first quarter of this year. Retailing has hovered just short of neutral since that time. The ongoing rise in the Euro has cast a certain pall over the future.

On balance, these metrics are not bad at all. But they fall short of the strength the IFO report was exuding just a few short months ago… Germany then thought it was on top of the world. And maybe it was, but the world has since rolled over, impacting Germany’s relative position. /p>

The IFO Business climate index is near the top 20% of its range. The current situation is rated in the 82nd percentile (top 20 percent). But business expectations for the next six month are decidedly softer residing only in their 68th percentile.

Now all of these are above 50% and therefore above a point of neutrality. But they date from period back to 1992, a time span in which Germany did not do so well. So a finding of neutral, which would imply ‘average’ for this period, would not be very reassuring. Germany needs to do better than this average.

Risks… The hunter: captured by the game?The clear risk and problem at the moment is the ongoing rise of the euro. Some continue to warn of this current circumstance as putting the dollar at risk to a larger correction. We prefer to point out that the dollar cannot fall unless something else can rise. And the rise of the euro is already crimping German growth and its outlook along with that for other less competitive EMU members.

Let’s remember that since the early 1970s it is the countries where prices and exchange rates went up not down that had the biggest troubles: OPEC (with rising oil prices) and then Japan with the rising yen and still lingering traces of deflation. We wonder if the real risk here is that the euro might rise, more than that the dollar might fall.

The dollar is already at a relative low point and at some point, if it moves lower, buying interest in dollars will develop. But Germany’s economy will be hurt by a much stronger euro and that will prove a more troublesome issue for Germany and for the rest of the export oriented Europe. Whatever, they say, the cross border but within Euro area transactions (intra-union same currency exports and imports) are still vulnerable to international competition especially when the euro becomes overvalued. Germans may speak with the same currency as the French and Italians but their true language and culture is at least as different as is it is to that of Americans and Japanese. Cheap dollars or yen can get over any language barrier or common currency hurdle in a hurry.

| Summary of IFO Sector Diffusion readings | ||||||||

|---|---|---|---|---|---|---|---|---|

| CLIMATE Sum | Current | Last Mo | Since Jan 1991* | |||||

| Oct-07 | Sep-07 | Average | Median | Max | Min | Range | % Range | |

| All Sectors | 7.1 | 7.5 | -8.7 | -9.5 | 16.6 | -30.6 | 47.2 | 79.9% |

| MFG | 17.9 | 18.1 | -0.9 | 0.3 | 27.5 | -35.5 | 63.0 | 84.8% |

| Construction | -20.5 | -20.8 | -29.5 | -32.2 | 0.3 | -50.7 | 51.0 | 59.2% |

| Wholesale | 2.3 | 10.7 | -14.8 | -16.5 | 23.4 | -39.5 | 62.9 | 66.5% |

| Retail | -6.8 | -12.9 | -15.3 | -14.8 | 19.0 | -40.2 | 59.2 | 56.4% |

| Services | 17.2 | 20.8 | 8.7 | 8.2 | 28.5 | -15.7 | 44.2 | 74.4% |

| * May 2001 for Services | ||||||||

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.