Global| Apr 04 2007

Global| Apr 04 2007India Balance of Payments Sees Dynamic Trade and Investment Flows, with Record Reserve Accumulation in 2006

Summary

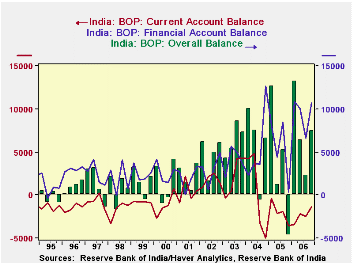

India's balance of payments shows an unusual amount of two-way flow in both current and financial accounts. In Q4 2006 this encompassed a variety of distinctive movements. The trade deficit widened, continuing to confound many [...]

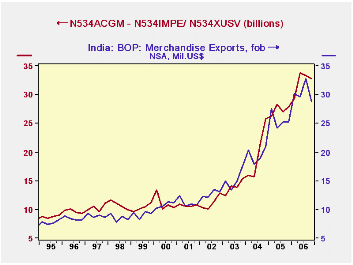

India's balance of payments shows an unusual amount of two-way flow in both current and financial accounts. In Q4 2006 this encompassed a variety of distinctive movements. The trade deficit widened, continuing to confound many observers' preconceptions that India shouldn't have a deficit in this account at all. Petroleum is apparently the main cause, as suggested by the second graph here. It shows merchandise imports less petroleum plotted with merchandise exports, and these two quantities have roughly the same magnitudes.

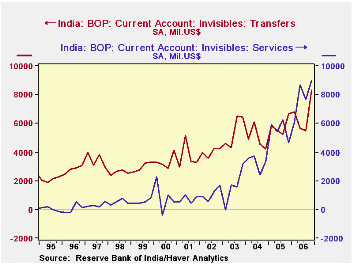

The overall current account is much more near balance, as sizable surpluses in services and unilateral transfers offset much of the trade shortfall. In fact, the net on services in Q4, right at $9.0 billion, is nearly twice as much as it was in Q4 of 2005. This is the numerical result of the "outsourcing" of many business service activities by companies elsewhere in the world. Many Indians work abroad and send money home. Private transfers in Q4 were $7.9 billion, up $1.5 billion from the same period a year ago. The balances on services and transfers were both record amounts.

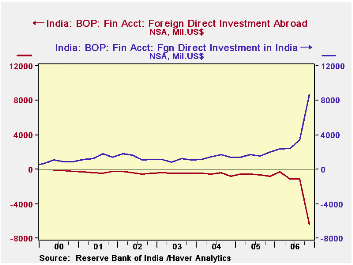

Capital accounts feature sizable -- unprecedented -- direct investment flows in BOTH directions. Foreign firms acquired Indian companies and Indian companies made acquisitions abroad. Foreign investors also increased their portfolio holdings, as they bought into the Indian stock market. Other capital account transactions, including bank loans and bank deposits and assorted other kinds of lending also showed great fluidity: Indian banks made sizable loans abroad, while nonbank lending to India grew sharply.

All together, the "overall balance" in Q4 was $7.5 billion, with a commensurate increase in foreign exchange reserves. This is sizable, and such numbers are getting to be common. For 2006 as a whole, the balance totaled $29.4 billion, also a record. Such accumulations of foreign exchange will enable more flows abroad, such as the outward investments recently seen.

Haver's data on India is contained in the EMERGEPR database.

| INDIA1: Mil.US$ | Q4 2006 | Q3 2006 | Q4 2005 | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|

| Current Account2,3 | -1,321 | -2,465 | -3,549 | -10,006 | -7,810 | +781 |

| Merchandise Trade2 | -18,251 | -14,346 | -12,400 | -63,783 | -46,872 | -28,036 |

| Services2 | +8,995 | +7,650 | +4,643 | +31,428 | +22,259 | +13,076 |

| Transfers2 | +8,282 | +5,503 | +6,631 | +26,290 | +23,234 | +19,793 |

| Direct Investment in India | +8,669 | +3,414 | +2,002 | +16,888 | +6,663 | +5,771 |

| Direct Investment Abroad | -6,388 | -1,146 | -784 | -9,029 | -2,487 | -2,179 |

| Portfolio Investment | +3,556 | +2,141 | +2,748 | +9,503 | +12,144 | +9,037 |

| Overall Balance3 | +7,507 | +2,268 | -4,672 | +29,372 | +14,460 | +23,601 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates