Global| Sep 12 2007

Global| Sep 12 2007India's Industrial Sector Downshifts in July After Spring Acceleration

Summary

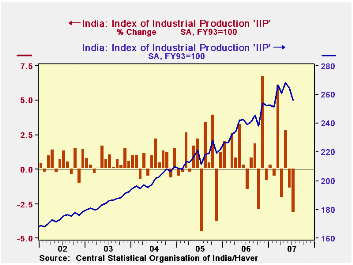

Industrial production in India has declined for two months now, with the July data out today showing a 3.2% drop from June in figures seasonally adjusted by Haver Analytics. This pulled July's year-on-year growth to 7.1% (not [...]

Industrial production in India has declined for two months now, with the July data out today showing a 3.2% drop from June in figures seasonally adjusted by Haver Analytics. This pulled July's year-on-year growth to 7.1% (not seasonally adjusted) from 10.4% in Q2 and 12.5% in Q1. The peak individual growth month was November 2006, which was a striking 15.8% above November 2005.

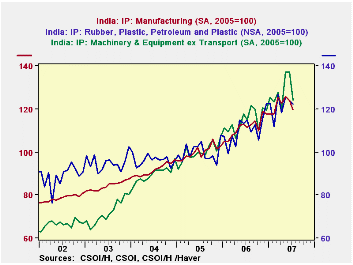

In the manufacturing sector, which makes up 79% of this index, a variety of industries have participated in this recent slowing. Wood products are perhaps most notable: including furniture and fixtures, this group lurched upward dramatically from December through March and moved irregularly after that, falling nearly 24% in July. The same pattern, though less extreme, is found in machinery production. It fell in the latest month by 9.5%, but, as seen in the second graph, it had expanded greatly in May, by 14.5% in fact, to an elevated level. We plot it here along with total manufacturing and another leading industry, rubber, plastics and petroleum. To see their movements in relation to each other, we can use Haver's DLXVG3 "scale option" to put all of these series on some convenient index base; here, if we use 2005, we see that overall, the broad manufacturing sector along with the machinery industry and the rubber & plastics products group have grown along very similar trends since 2005. The July decline in machinery only just brought it back in line with the others.

Not all industries show this exact behavior, up in the previous few months and then down in July. Others seem to be plateauing following an earlier run-up. Examples cut across industry types: basic metals, nonmetallic mineral products and chemicals. Only transportation equipment appears to be in an outright downtrend.

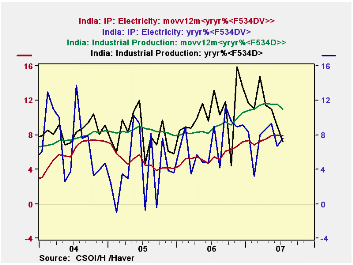

The one sector among Indian industries that is growing persistently is electric utilities. Electrical output was up 7.5% in July from a year ago. As the final graph shows, year-to-year growth rates are highly volatile. So, using DLXVG3's new nesting capability, we've averaged them over 12-month periods to find the trend. The July value of this measure is 7.9% and was 8.0% in June. These two months are the strongest since Q1 of 1996, more than 11 years ago. Overall industrial production grows faster, but notably in recent months, as the broader measure has gyrated, the electricity sector has moved more steadily higher. This means that non-industrial users are finding new ways to utilize electric power, taking up the slack when industry slows.

| INDIA, 1993/94 = 100* | July 2007 | June 2007 | May 2007 | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|

| Index of Industrial Production | 256.2 | 264.6 | 268.4 | 239.6 | 216.7 | 200.8 |

| Mo/Mo % Change | -3.2 | -1.4 | 2.8 | -- | -- | -- |

| Yr/Yr % Change | 7.1 | 9.0 | 10.9 | 10.5 | 7.9 | 8.5 |

| Manufacturing Index | 273.6 | 283.8 | 287.7 | 255.0 | 228.7 | 209.8 |

| Yr/Yr % Change | 7.2 | 9.9 | 11.7 | 11.5 | 9.0 | 8.9 |

| Electricity Index | 220.1 | 215.3 | 217.5 | 201.5 | 188.0 | 180.7 |

| Yr/Yr % Change | 7.5 | 6.8 | 9.4 | 7.2 | 4.0 | 7.2 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates