Global| Apr 30 2020

Global| Apr 30 2020Initial Jobless Claims Top 30 Million in Last Six Weeks

Summary

• Initial jobless claims declined to a still extremely-elevated 3.839 million in the week ending April 25. • Over the last six weeks 30.3 million people or 18.6% of the labor force have filed new claims. • Eleven states had over [...]

• Initial jobless claims declined to a still extremely-elevated 3.839 million in the week ending April 25.

• Over the last six weeks 30.3 million people or 18.6% of the labor force have filed new claims.

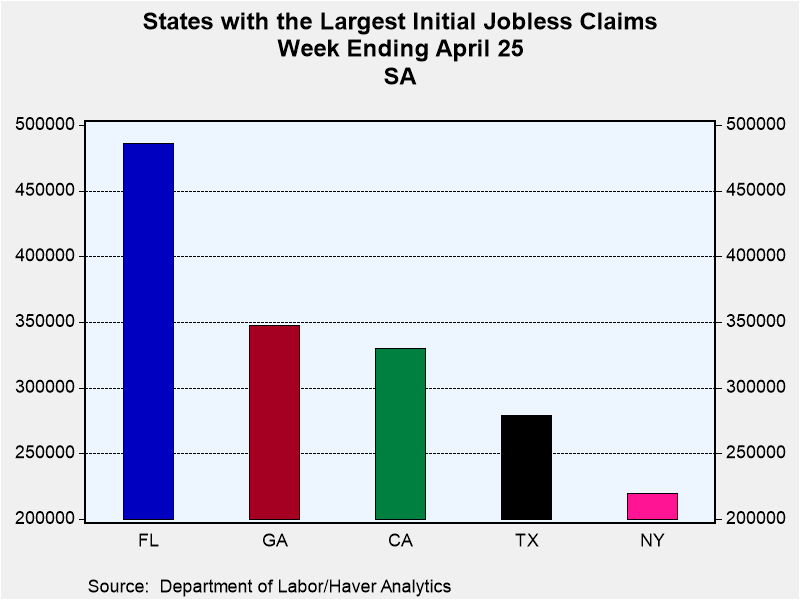

• Eleven states had over 100,000 new claims, led by Florida's 486,134.

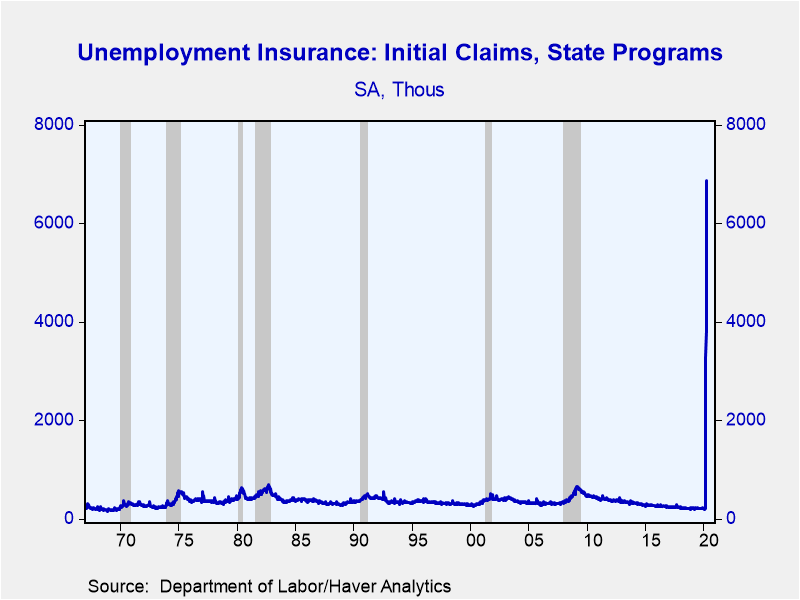

Initial jobless claims for unemployment insurance declined to 3.839 million during the week ending April 25 from an upwardly-revised 4.442 million in the previous week (was 4.427 million). During the last six weeks 30.3 million people or 18.6% of the labor force have filed new jobless claims. The Action Economics Forecast Survey anticipated 3.3 million claims.

The four-week moving average of initial claims, which smooths out week-to-week volatility, but is less important at the moment because of the rapidity of changing conditions, declined to 5.033 million from 5.790 million.

Eleven states had over 100,000 in new claims in the week ending April 25, led by Florida (486,134), Georgia (347,393), California (330,155) and Texas (278,849). Claims increased the most in Washington (74,309 or 88.6% week-on-week) and Georgia (54,839 or 18.7% w/w). Meanwhile, California (-173,477 or -34.4% w/w), Florida (-78,275 or -13.9% w/w) and New Jersey (-68,299 or -49.5% w/w) showed notable declines. The state numbers are based on seasonally-adjusted data calculated by Haver Analytics. The Department of Labor notes that advance claims are not directly comparable to claims reported in prior weeks and a number of states, including Florida and Michigan, indicated these numbers are only estimates. A more accurate picture of state claims in the week ending April 25 will be available next week.

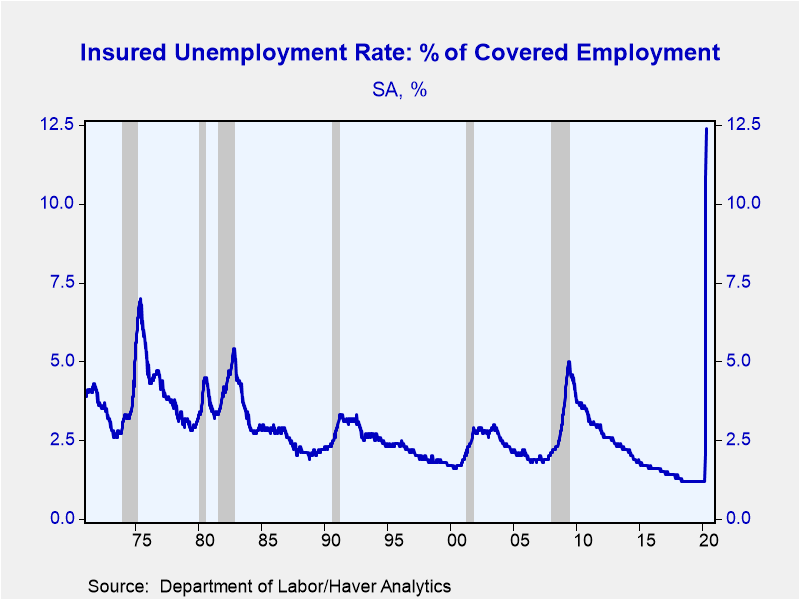

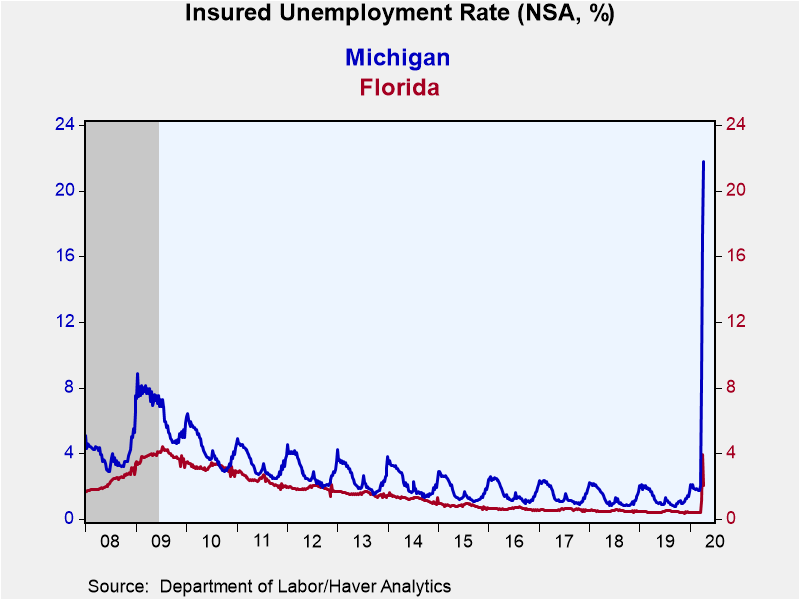

Continuing claims for unemployment insurance increased to a record 17.992 million in the week ending April 18, from a downwardly-revised 15.818 million (was 15.976 million). The insured rate of unemployment jumped to a new high of 12.4% (data goes back to 1971). The state insured rates of unemployment continued to show wide variation with Florida at just 2.06% and Michigan 21.8%. Twenty-six states had rates over 10%, with Vermont also above 20% (21.2%). The state rates are not seasonally adjusted.

Data on weekly unemployment claims going back to 1967 are contained in Haver's WEEKLY database, and they are summarized monthly in USECON. Data for individual states are in REGIONW. The expectations figure is from the Action Economics Forecast Survey, carried in the AS1REPNA database.

| Unemployment Insurance (SA, 000s) | 04/25/20 | 04/18/20 | 04/11/20 | Y/Y % | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| Initial Claims | 3,839 | 4,442 | 5,237 | 1,569.1 | 218 | 221 | 244 |

| 4-wk Average | 5,033.25 | 5,790.25 | 5,506.50 | -- | -- | -- | -- |

| Continuing Claims | -- | 17,992 | 15,818 | 969.7 | 1,701 | 1,756 | 1,961 |

| 4-week Average | -- | 13,292.50 | 9,559.25 | -- | -- | -- | -- |

| Insured Unemployment Rate (%) | -- | 12.4 | 10.9 |

1.3 |

1.2 | 1.2 | 1.4 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.