Global| Dec 26 2002

Global| Dec 26 2002Initial Jobless Insurance Claims Dropped

by:Tom Moeller

|in:Economy in Brief

Summary

Initial claims for unemployment insurance fell much more than expected last week. Claims in the prior week were revised slightly higher. Seasonal adjustment difficulties have contributed to the erratic behavior of initial claims in [...]

Initial claims for unemployment insurance fell much more than expected last week. Claims in the prior week were revised slightly higher.

Seasonal adjustment difficulties have contributed to the erratic behavior of initial claims in recent weeks, according to the Labor Department.

The four-week moving average of initial claims rose to 404,500, down 2.6% y/y.

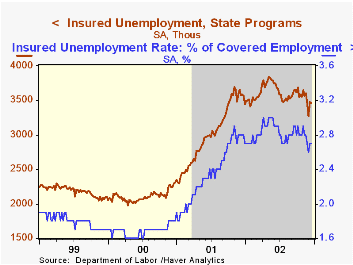

Continuing claims for unemployment insurance fell slightly w/w. That followed the sharp increase in the week prior, but the trend remained down. Continuing claims in the latest week were down roughly 10% from the highs this past Spring.

The insured rate of unemployment was stable at 2.7%.

| Unemployment Insurance (000s) | 12/21/02 | 12/14/02 | Y/Y | 2001 | 2000 | 1999 |

|---|---|---|---|---|---|---|

| Initial Claims | 378.0 | 438.0 | -8.5% | 405.8 | 299.8 | 297.7 |

| Continuing Claims | -- | 3,464 | -3.4% | 3,021 | 2,114 | 2,186 |

by Tom Moeller December 26, 2002

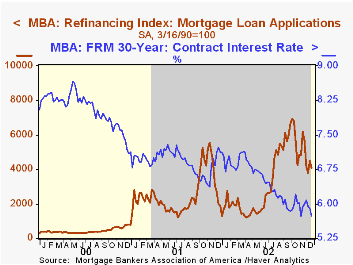

The index of mortgage applications, compiled by the Mortgage Bankers Association, fell in the latest week and remained down sharply from the highs of this past Fall.

Mortgage applications to refinance fell and are down by over one third from the highs.

The recent contract rate on a conventional 30 year mortgage rose slightly in the latest week to 5.74% but was still down versus 6.09% at the end of November.

Mortgage applications for home purchase fell in the latest week but the trend has remained firm relative to refi's.

| MBA Mortgage Applications (3/16/90=100) | 12/20/02 | 11/15/02 | 2001 | 2000 | 1999 |

|---|---|---|---|---|---|

| Total Market Index | 908.3 | 1,200.2 | 625.6 | 322.7 | 352.0 |

| Purchase | 359.4 | 345.0 | 304.9 | 302.7 | 275.8 |

| Refinancing | 4,101.0 | 6,174.1 | 2,491.0 | 438.8 | 795.2 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates