Global| Nov 01 2019

Global| Nov 01 2019ISM Manufacturing Index Increases But Stays Below 50-Growth Level

Summary

The ISM manufacturing index increased to 48.3 in October from September's cycle low of 47.8. The Action Economics Forecast Survey anticipated an increase to 49.0. According to the ISM press release, the October reading is consistent [...]

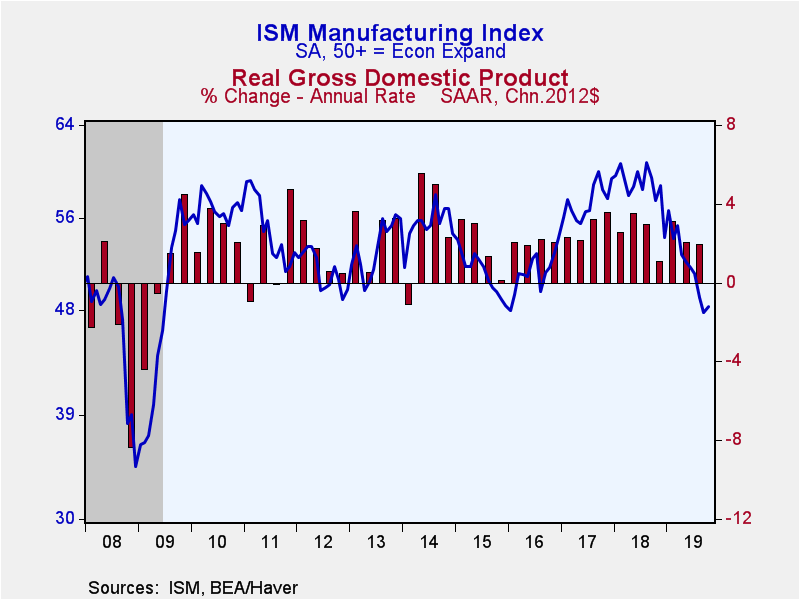

The ISM manufacturing index increased to 48.3 in October from September's cycle low of 47.8. The Action Economics Forecast Survey anticipated an increase to 49.0. According to the ISM press release, the October reading is consistent with real GDP growth of 1.6%.

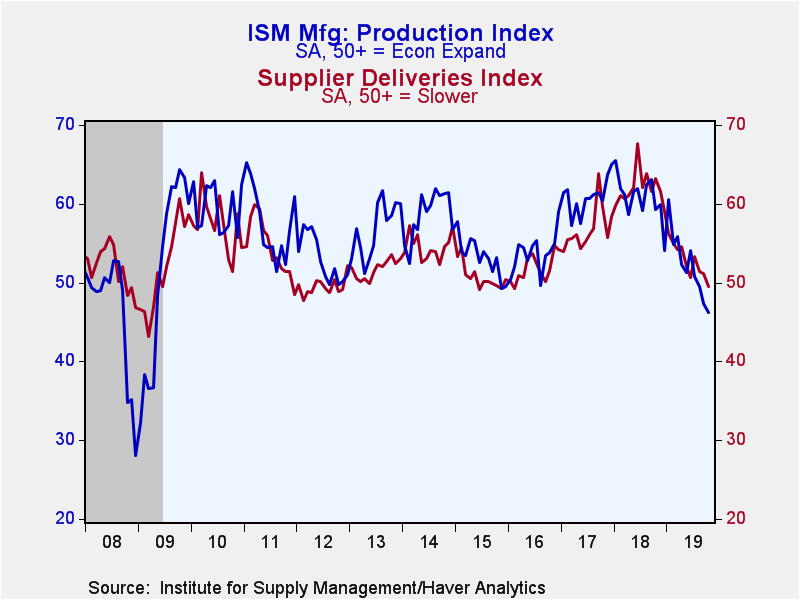

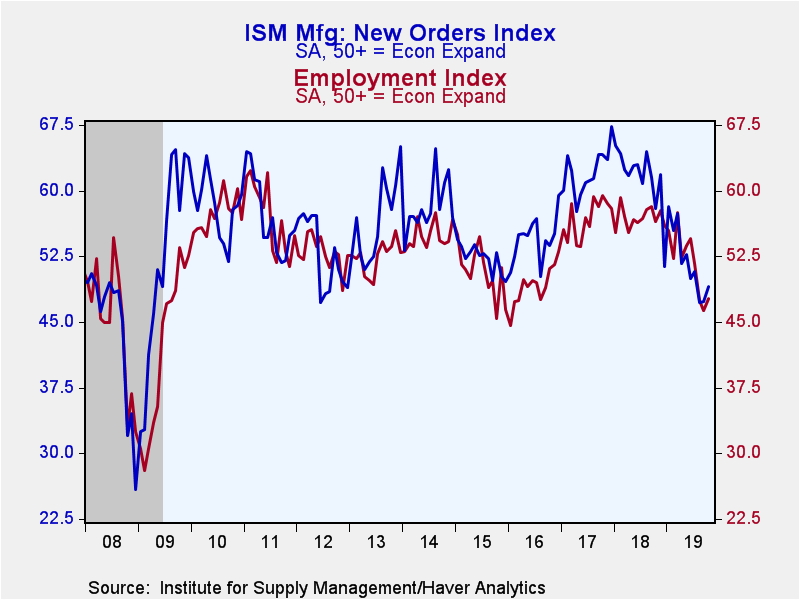

All of the subcomponents of the headline index were below the 50-growth level, with supplier deliveries falling below that level for the first time in three-and-a-half years. The production index continued its slide, declining to a cycle low of 46.2 from 47.3. Meanwhile, new orders, employment and inventories rose. The new export orders index, which is not a component of the headline measure, increased to 50.4, but imports fell to 45.3, the lowest level in 10 years.

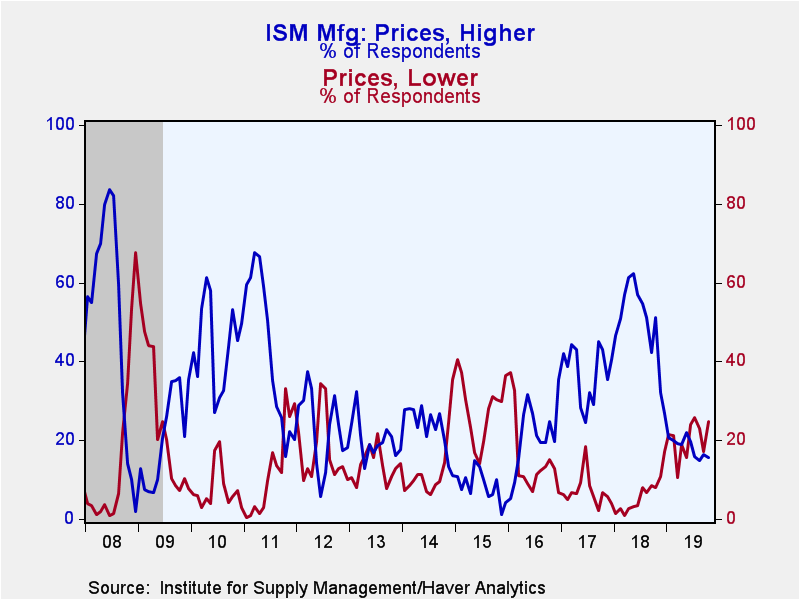

The prices paid index -- which is not seasonally adjusted -- fell to 45.5 in October, more than reversing September's increase. Only 15.7% of respondents reported paying higher prices while 24.7% reported lower prices.

The ISM figures are diffusion indexes where a reading above 50 indicates expansion. The figures from the Institute for Supply Management can be found in Haver's USECON database; further detail is found in the SURVEYS database. The expectations number is available in Haver's AS1REPNA database.

| ISM Mfg (SA) | Oct | Sep | Aug | Oct'18 | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|

| Headline Index | 48.3 | 47.8 | 49.1 | 57.5 | 58.8 | 57.4 | 51.3 |

| New Orders | 49.1 | 47.3 | 47.2 | 58.0 | 61.5 | 62.2 | 54.5 |

| Production | 46.2 | 47.3 | 49.5 | 59.3 | 60.7 | 60.9 | 53.8 |

| Employment | 47.7 | 46.3 | 47.4 | 56.5 | 56.9 | 56.8 | 49.1 |

| Supplier Deliveries | 49.5 | 51.1 | 51.4 | 63.2 | 62.0 | 56.8 | 51.8 |

| Inventories | 48.9 | 46.9 | 49.9 | 50.7 | 52.9 | 50.4 | 47.5 |

| Prices Paid Index (NSA) | 45.5 | 49.7 | 46.0 | 71.6 | 71.7 | 65.0 | 53.1 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.