Global| Mar 31 2005

Global| Mar 31 2005Italian CPI Keeps Low Inflation Despite Higher Energy Costs

Summary

The Italian statistical agency Istat today reported that the March CPI was up 1.9% from March 2004. This result means that inflation in Italy has held at or below a 2% yearly pace for the last six months. The persistent decline to [...]

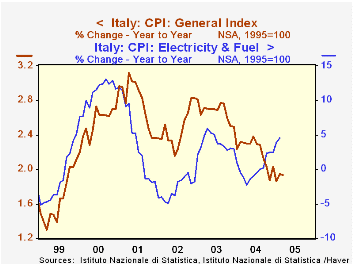

The Italian statistical agency Istat today reported that the March CPI was up 1.9% from March 2004. This result means that inflation in Italy has held at or below a 2% yearly pace for the last six months. The persistent decline to such a low rate in recent months seems impressive in light of the strong uptrend in world energy prices.

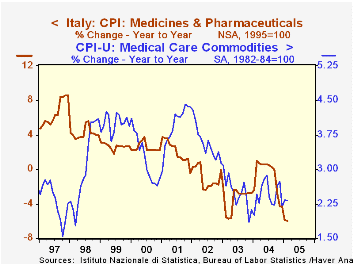

As seen in the table below, energy components of the Italian CPI array have indeed been strong, with transport-related fuel up 10% during 2004 and 7.7% in February from a year earlier (latest available for this line-item). The behavior of some other basic consumer price items suggests reasons for the moderate overall inflation: food prices in Italy are falling and clothing prices are rising very slowly. Food had seen outsized increases from 2001 through 2003, but steep declines in fruit and vegetables have led that segment down since early last year. Clothing prices are actually falling in a number of countries, and while they are rising in Italy, these increases have been progressively slower since the spring of 2003. Also, surprisingly -- at least to an American commentator -- health care prices are declining. The cost of medicine and pharmaceuticals fell at about a 6% pace in January and February. Notably, over the last couple of years, inflation rates for medications in the US have eased as well, but in Italy, these prices have been falling outright.

Thus, there are some cushions in the Italian price system against the impact of surging energy costs. So inflation may not automatically ratchet higher with every €1 increase in the price of a barrel of oil.

| Italy: Consumer Price Index Yr/Yr % Change |

Mar 2005 | Feb 2005 | Jan 2005 | December/December|||

|---|---|---|---|---|---|---|

| 2004 | 2003 | 2002 | ||||

| Total CPI | 1.9 | 1.9 | 1.9 | 2.0 | 2.5 | 2.8 |

| Food | -0.2 | -0.4 | -0.7 | -0.3 | 3.9 | 3.3 |

| Apparel | 1.7 | 1.8 | 1.8 | 1.8 | 2.6 | 3.1 |

| Transport Fuel | -- | 7.7 | 6.8 | 10.0 | 0.2 | 4.6 |

| Housing Electricity & Fuel | -- | 4.5 | 3.8 | 2.5 | 3.0 | -1.8 |

| Memo: Euro-Zone "Flash Estimate" | 2.1 | 2.1 | 1.9 | 2.4 | 2.0 | 2.3 |

| US CPI | -- | 3.0 | 3.0 | 3.3 | 1.9 | 2.4 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates