Global| Jun 14 2019

Global| Jun 14 2019Italian Inflation Stays Under Wraps...but Other Pressures Don't

Summary

Italy had a long legacy as a high-inflation weak-currency country when EMU was formed. There were always questions about how the high-inflation countries would evolve. How quickly would they adapt... would they adapt? Wrapping them up [...]

Italy had a long legacy as a high-inflation weak-currency country when EMU was formed. There were always questions about how the high-inflation countries would evolve. How quickly would they adapt... would they adapt? Wrapping them up in a currency area with low inflation- traditionally hard-currency Germany was a bold real-world experiment. The ECB gave the region a single currency. While they adopted no fiscal union the EU/EMU adopted fiscal rules concerning debt-to-GDP and deficit-to-GDP parameters. Germany and France were the first two countries to run afoul of these strictures. What happened? They wriggled out of it without remedial actions ordered. But since then violators have been persecuted.

Italy had a long legacy as a high-inflation weak-currency country when EMU was formed. There were always questions about how the high-inflation countries would evolve. How quickly would they adapt... would they adapt? Wrapping them up in a currency area with low inflation- traditionally hard-currency Germany was a bold real-world experiment. The ECB gave the region a single currency. While they adopted no fiscal union the EU/EMU adopted fiscal rules concerning debt-to-GDP and deficit-to-GDP parameters. Germany and France were the first two countries to run afoul of these strictures. What happened? They wriggled out of it without remedial actions ordered. But since then violators have been persecuted.

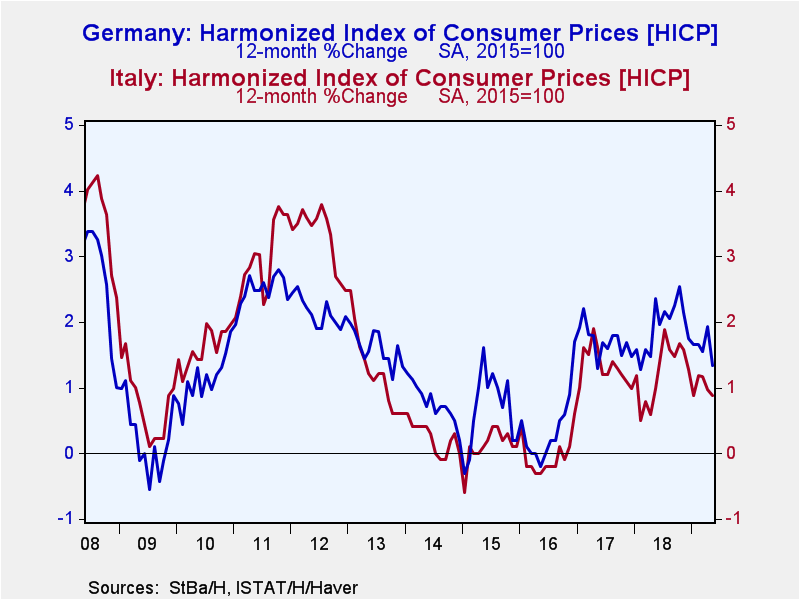

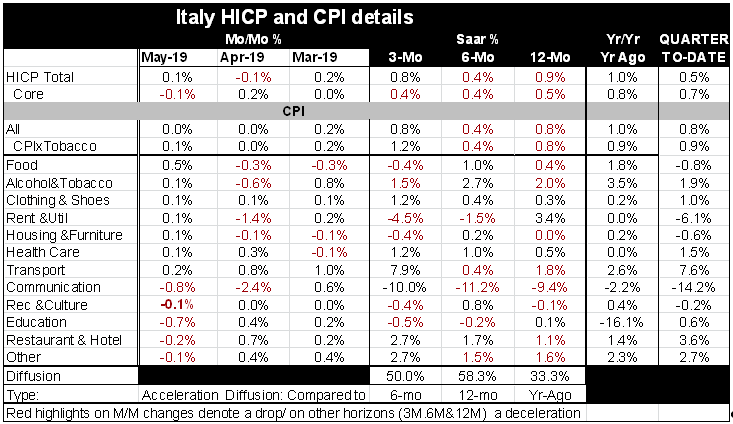

Italy underwent a horrific program of economic pressure that resulted in it getting its inflation rate in line as the exhibits in this report clearly memorialize. But for the last 10-years Italy has been unable to grow real GDP; Italy's real GDP is LOWER on balance over the last decade. That is a horrific cost.

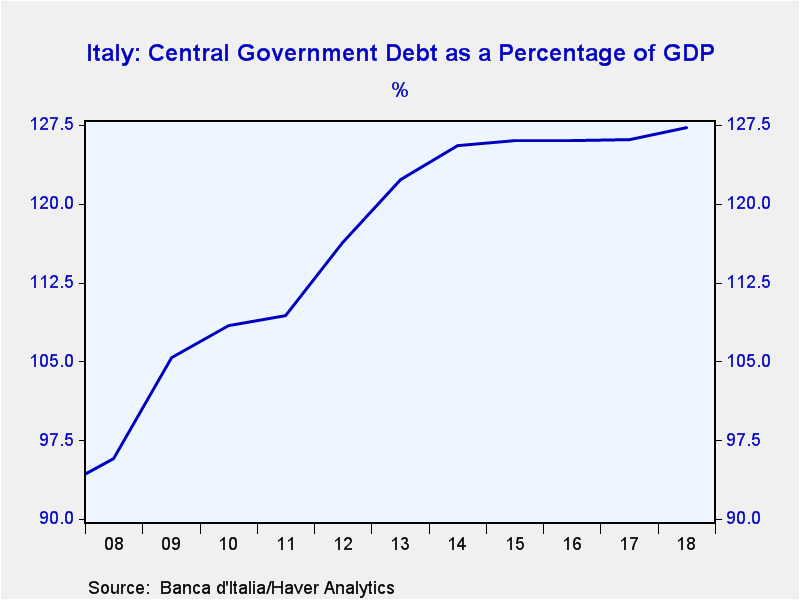

Italy has an excess debt-to-GDP ratio. What else is new? Over the last decade when real GDP was being suppressed it would have been very hard to reduce that debt to GDP ratio. The chart below shows that from 2008 to 2014 the debt ratio rose strongly but since then it has been flat and high.

Italy has an excess debt-to-GDP ratio. What else is new? Over the last decade when real GDP was being suppressed it would have been very hard to reduce that debt to GDP ratio. The chart below shows that from 2008 to 2014 the debt ratio rose strongly but since then it has been flat and high.

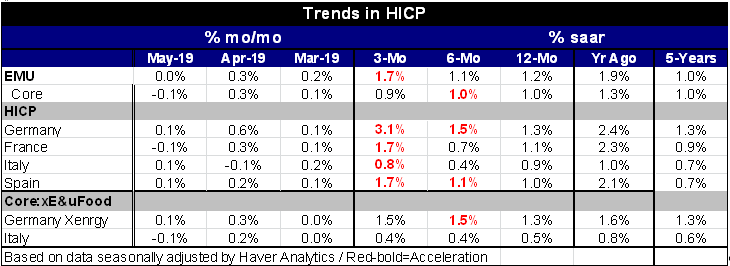

Italy has achieved low inflation; its inflation rate now is below the German pace and has been lower than Germany on average for the last five years.

Whatever codes were written into Maastricht, Italy certainly has to be looked upon as a special case or its economy is headed for devastating ruin. Italy's banks are in bad shape and there are no federal resources to help address that problem either.

EU policies crushed Greece. While Greek inflation is also under control, Greece is still trying to establish a viable economy.

Italy is a large country one the four largest EMU economies and EU/EMU debt rules are trying to batter it further while stuffing Italy full of the migrants no one else wants using rules that maroon migrants in their country of first entry. Is it any wonder that a contrary and defiant political movement took root in Italy?

There is no surprise that there have been populist uprisings in Greece and Spain and Portugal and Italy in the wake of the imposed austerity programs. The question after some upsetting but not transformative European elections is whether Europe can find a new way forward that is less heavy handed. One might think that the UK leaving sent a message. But apparently it did not.

The question of what is next for Europe for the EU for EMU are just as big a set of questions as what is next for Italy. Will the EU Commission really impose more austerity and fines on Italy after all it has gone through? The EU Commission has just agreed that Italy should face debt action for its economic plan. And the Italian cabinet has just rejected calls to revise its budget. It has been said that the EU is a rules based organization and that is because rules are all that it is, and all it has. And as we acknowledge that, we should also acknowledge that it is an organization that makes the rules up and changes them as it goes along and that the elite that run the EU design those rules to cut slack for the anointed counties of their EU hierarchy. The EU has played favorites. But what has marked recent history is the willingness of members to leave or to butt heads over rules they find unacceptable or anti-cultural. That is a challenge to EU authority and the EU is fighting it wherever it crops up. So far countries have their opposition set on idiosyncratic differences with the EU. But, in time, this could morph into a more coordinated opposition. Despite Germanys attempt to push all of the square pegs of Southern Europe though the round hole of the North to make them all in the likeness of Germany there is resistance to such draconian demands. And Europe is beginning to show the strain and to realize the cost of this internal antagonism.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.