Global| Apr 23 2014

Global| Apr 23 2014Italian Trade Trends: A One Month Back-off

Summary

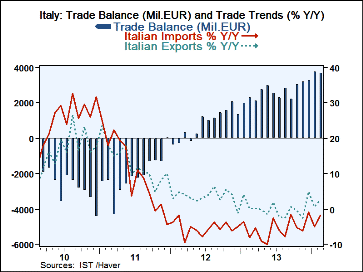

Italian exports and imports are both engaged in a longer-term trend of sweeping upward after an extended period of showing year-over-year declines (see Chart). Exports currently are up at a 3% annual rate over 12 months while imports [...]

Italian exports and imports are both engaged in a longer-term trend of sweeping upward after an extended period of showing year-over-year declines (see Chart). Exports currently are up at a 3% annual rate over 12 months while imports are still down at a 1.7% pace on that same horizon but improving nonetheless. The growth rates for progressively shorter periods of time show progressively stronger rates of growth for both exports and imports. Over three months exports are growing at an 11% annual rate; over three months imports are growing at a 2.6% annual rate. This suggests that Italy is benefiting from export-led growth as exports continue to out run imports - and by a substantial margin even though both of them are swinging toward more persistent positive growth. In February this trend was reversed, however, as imports outpaced exports rising by 6.5% and exports rose by only 1.7%. This created a one month back-off in the ongoing increase in Italy's goods surplus. That trend still would seem to be in place.

Italian exports and imports are both engaged in a longer-term trend of sweeping upward after an extended period of showing year-over-year declines (see Chart). Exports currently are up at a 3% annual rate over 12 months while imports are still down at a 1.7% pace on that same horizon but improving nonetheless. The growth rates for progressively shorter periods of time show progressively stronger rates of growth for both exports and imports. Over three months exports are growing at an 11% annual rate; over three months imports are growing at a 2.6% annual rate. This suggests that Italy is benefiting from export-led growth as exports continue to out run imports - and by a substantial margin even though both of them are swinging toward more persistent positive growth. In February this trend was reversed, however, as imports outpaced exports rising by 6.5% and exports rose by only 1.7%. This created a one month back-off in the ongoing increase in Italy's goods surplus. That trend still would seem to be in place.

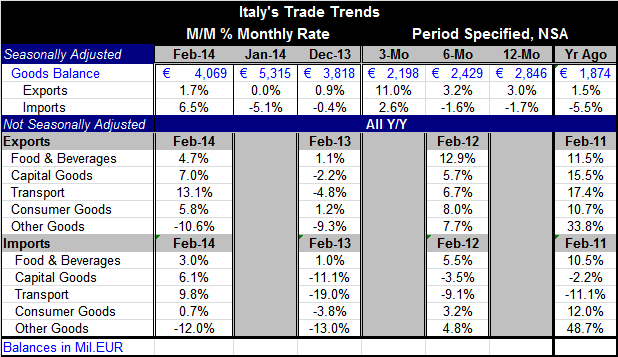

Since Italian trade figures are not seasonally adjusted for the export- and import-components, we look at various year-over-year trends by category to assess exports and imports.

For exports in February 2014, the categories, food and beverages, capital goods, transportation equipment, and consumer goods, are all showing accelerations over the last 12 months compared to their 12-month growth in February 2013. Only the "other goods" category shows a deterioration in the growth rate over 12 months compared to the previous 12 months and that deterioration is minor.

For imports in February, there is also widespread improvement compared to 12 months ago; the current 12-month growth rate is 3% for foods and beverages, up from 1% for the 12-month period of 12 months ago. Capital goods are growing by 6.1% compared to -11% previously; transportation goods are up by 9.8% compared to -19% previously; consumer goods imports are up 0.7% compared to -3.8%, previously. For imports, as for exports, the "other goods" category continues to show negative growth but for imports there is a slight improvement as the negative growth rate has improved to -12% currently from -13% in the 12-month period of 12 months ago.

The trade data for Italy are suggestive of some improvement in imports and for exports, although the substance of improvement is mostly over the last three months, making it a little bit less reliable as an indicator. Exports have surged by 11% over the most recent three months. Even so, exports' 12-month growth compared to 12 months ago is improving: it is improving for the sequential growth rates of total exports from 12-months, to 6-months to 3-months; it also shows improvement across components. Possibly Italy is going to see its exports gaining footing.

On the other hand, imports are still speculative as they are improving largely on their 2.6% growth rate over the most recent three months. While they are improving by category compared to trends of 12 months ago, the improvement of total imports from 12-months, to 6-months to 3-months is small and a lot of it hinges on the jump in February as imports rose by 6.5% but only after falling by 5.1% in January.

Imports are a reasonably good indicator of domestic demand. So far for Italy the jury is out on what domestic demand is doing. The import revival is only at a 2.6% annual rate over three months and that's its highest growth rate in a while. But the good news behind the growth rate is that it shows improvement by category across the board. This may suggest that there is going to be a real revival in Italian domestic demand. These trends may be bolstered by recent tax cuts that have been enacted to try to stimulate the economy. Even so, indicators for Italy continue to be lethargic; if Italy is turning a corner on growth, it appears to be doing it slowly and not yet methodically or decisively.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates