Global| Jan 24 2008

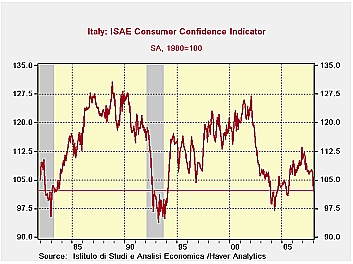

Global| Jan 24 2008Italy’s Consumer Confidence Falls Well Below Past Recession-Start Levels

Summary

Italy shivers while the Euro Area overheats: What good can come of this? Not only is PM Prodi having a difficult time, but so is the Italian consumer. Whatever fate awaits Prodi, the consumer is already giving a vote of no-confidence [...]

Italy shivers while the Euro Area overheats: What good can

come of this?

Not only is PM Prodi having a difficult time, but so is the

Italian consumer. Whatever fate awaits Prodi, the consumer is already

giving a vote of no-confidence to it. This is despite some resilient

data from elsewhere in the Euro Area. The German IFO index actually

rose in January. The ECB is thinking of hiking rates according to some

of the day’s commentary. If you are an Italian consumer however, you

must wonder if the world has gone mad. The Euro Area may be coming into

one of its really big tests. Inflation has run hotter in some EMU

countries than in others. But because of the single currency there has

been no relief for competitiveness. There is no local currency to

depreciate. Italy is one of those regions.

Since all EMU countries are pent up in the same currency area,

what will affect competitiveness within the Zone, as well as between

the Zone and other areas that is nationally different, is the local

inflation rate, as well as any productivity differences. The small

table below shows that since March of 2000 Finland is the most

competitive EMU nation with a national price index that is some 7.2%

below the EMU average for that period. Germany is next at -4.2%. Italy

ranks as seventh worst among the 12 countries ranked here with a price

level that is 1.2 percentage points ABOVE the EMU average. That would

make Italy some 5.4% less competitive than Germany for the period and

8.4% behind Finland. Ranking below Italy is The Netherlands,

Luxembourg, Portugal, Ireland, Spain and Greece.

| Is the Italian Consumer an Example of…Trouble in the Zone? | |||

|---|---|---|---|

| HICP | March 2000 | High to Low | Gap |

| Sep-07 | Rank | W/EMU | |

| Austria | 16.5% | 10 | -2.6% |

| Belgium | 18.1% | 8 | -1.0% |

| Finland | 11.9% | 12 | -7.2% |

| France | 17.1% | 9 | -2.0% |

| Germany | 14.9% | 11 | -4.2% |

| Greece | 30.2% | 1 | 11.1% |

| Ireland | 28.6% | 3 | 9.5% |

| Italy | 20.3% | 7 | 1.2% |

| Luxembourg | 25.3% | 5 | 6.2% |

| The Netherlands | 21.1% | 6 | 2.0% |

| Portugal | 27.0% | 4 | 8.0% |

| Spain | 29.0% | 2 | 9.9% |

| EMU Total | 19.1% | -- | -- |

If Italy’s problems are due to that sort of competitiveness

loss we should also find encroaching weakness in those lower ranked

countries as well.

For now, whatever the source, Italy’s consumers are feeling

the pinch. Confidence is in the bottom 20% of its range. The current

overall situation is in the bottom six percent of its range. The

expected overall situation in the next 12 months is the worst in this

period. And so on, see the percentile column in the table above. The

Italian household sees things as being bad, and as getting much worse.

It is no wonder Prodi is having trouble, and it will be a real test of

European unity to see what happens in Italy if the ECB goes ahead with

the rate hikes that the Bundesbank’s Weber was warning of today.

| Italy ISAE Consumer Confidence | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Since January 1999 | ||||||||||

| Dec 07 |

Nov 07 |

Oct 07 |

Sep 07 |

%tile | Rank | Max | Min | Range | Mean | |

| Consumer Confidence | 107 | 107.6 | 107.3 | 107.3 | 33.3 | 63 | 127 | 97 | 30 | 111 |

| Last 12 months | ||||||||||

| OVERALL SITUATION | -69 | -71 | -67 | -63 | 23.0 | 69 | -22 | -83 | 61 | -55 |

| PRICE TRENDS | -21.5 | -24.5 | -23.5 | -26.5 | 29.6 | 61 | 4 | -32 | 36 | -16 |

| Next 12months | ||||||||||

| OVERALL SITUATION | -35 | -35 | -33 | -30 | 0.0 | 99 | 24 | -35 | 59 | -13 |

| PRICE TRENDS | 28 | 25.5 | 26 | 31 | 50.0 | 40 | 49 | 7 | 42 | 23 |

| UNEMPLOYMENT | 4 | 3 | 2 | -2 | 87.2 | 8 | 9 | -30 | 39 | -6 |

| HOUSEHOLD BUDGET | 9 | 6 | 6 | 5 | 29.4 | 60 | 33 | -1 | 34 | 14 |

| HOUSEHOLD FIN SITUATION | ||||||||||

| Last 12 months | -44 | -43 | -44 | -39 | 7.5 | 95 | -7 | -47 | 40 | -29 |

| Next12 months | -14 | -12 | -14 | -13 | 0.0 | 99 | 14 | -14 | 28 | -2 |

| HOUSEHOLD SAVINGS | ||||||||||

| Current | 60 | 63 | 58 | 54 | 93.0 | 2 | 63 | 20 | 43 | 39 |

| Future | -37 | -39 | -42 | -33 | 15.2 | 97 | -9 | -42 | 33 | -24 |

| MAJOR Purchases | ||||||||||

| Current | -47 | -48 | -45 | -42 | 23.8 | 60 | -15 | -57 | 42 | -41 |

| Future | -61 | -63 | -66 | -65 | 38.7 | 41 | -42 | -73 | 31 | -62 |

| Total number of months: | 100 | |||||||||

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.