Global| Dec 20 2007

Global| Dec 20 2007Italy’s Consumer Confidence Remains Flat After Early-in-the-Year Dive

Summary

Consumer is mostly downbeat throughout main EU nations. Italy’s consumer confidence fell early in 2007 and has remained in a narrowed lower range ever since. Despite an ongoing rise in the Euro and weaker results in other Euro-area [...]

Consumer is mostly downbeat throughout main EU nations.

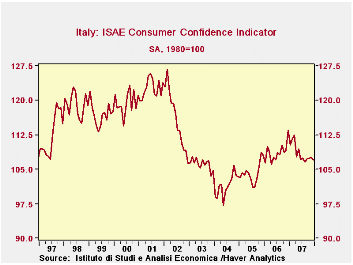

Italy’s consumer confidence fell early in 2007 and has

remained in a narrowed lower range ever since. Despite an ongoing rise

in the Euro and weaker results in other Euro-area economies, in Italy

Consumer confidence has continued to move sideways. Its drop this month

to 107 from 107.6 leaves it near the lower bound of this new range (see

plot above). Confidence is in the bottom third of its range. Italian

consumers are very pessimistic in many respects about the year ahead.

For the next 12 months ahead they rate the overall situation as the

worst in the last 100 months. Unemployment expectations are in the top

13 percent of this range. Consumers rate their financial situation in

the past 12 months as in the bottom 10 percent of its range (worse,

actually 7.5%-tile) and rate the year-ahead prospects as the worst

ever. The environment for household saving is in the top 7% currently

but for the year ahead that slips to the bottom 15 percentile. Major

purchases responses sort of break the mold for unrelenting pessimism,

as consumer feedback rates the past 12 months as being in the 23rd

percentile and the next twelve months improve to the still-poor reading

of the 38th percentile.

The rest of the EU is also experiencing some consumer angst

but not without exception. The indication by GfK that German sentiment

in January may be improving is somewhat shocking in the wake of the

weak euro figures we have been seeing. Insee reports weaker conditions

coming in France featuring concerns about consumer. The weakness in the

UK’s recent CBI retail survey and its outlook for January fits right

in. In Belgium the retail and wholesale sector index just reported a

sharp fall in December. Italy’s consumers have been struggling for some

time. It is hard to know about what the fresh and upbeat German

responses might mean. German consumers have been so negative all year

long and finally they have a Christmas that is far removed from the VAT

hike they spent to avoid last year and that impacted sales patterns so

much early in 2007. One wonders if that is part of what is going on in

Germany. In the rest of the E-zone there seems little evidence of

anything that is upbeat for consumers.

| Italy ISAE Consumer Confidence | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Since January 1999 | ||||||||||

| Oct 07 |

Sep 07 |

Aug 07 |

Jul 07 |

%tile | Rank | Max | Min | Range | Mean | |

| Consumer Confidence | 107.3 | 107.3 | 106.6 | 107.4 | 34.3 | 61 | 127 | 97 | 30 | 111 |

| Last 12 months | ||||||||||

| OVERALL SITUATION | -67 | -63 | -57 | -59 | 26.2 | 63 | -22 | -83 | 61 | -55 |

| PRICE TRENDS | -23.5 | -26.5 | -25 | -26 | 23.9 | 65 | 4 | -32 | 36 | -16 |

| Next 12months | ||||||||||

| OVERALL SITUATION | -33 | -30 | -29 | -25 | 1.7 | 99 | 24 | -34 | 58 | -13 |

| PRICE TRENDS | 26 | 31 | 22.5 | 18.5 | 45.2 | 43 | 49 | 7 | 42 | 23 |

| UNEMPLOYMENT | 2 | -2 | 0 | -3 | 82.1 | 12 | 9 | -30 | 39 | -6 |

| HOUSEHOLD BUDGET | 6 | 5 | 7 | 4 | 20.6 | 85 | 33 | -1 | 34 | 14 |

| HOUSEHOLD FIN SITUATION | ||||||||||

| Last 12 months | -44 | -39 | -37 | -34 | 7.5 | 96 | -7 | -47 | 40 | -29 |

| Next12 months | -14 | -13 | -10 | -10 | 0.0 | 100 | 14 | -14 | 28 | -1 |

| HOUSEHOLD SAVINGS | ||||||||||

| Current | 58 | 54 | 55 | 54 | 97.4 | 2 | 59 | 20 | 39 | 38 |

| Future | -42 | -33 | -35 | -34 | 0.0 | 100 | -9 | -42 | 33 | -23 |

| MAJOR Purchases | ||||||||||

| Current | -45 | -42 | -41 | -39 | 28.6 | 54 | -15 | -57 | 42 | -40 |

| Future | -66 | -65 | -68 | -68 | 22.6 | 65 | -42 | -73 | 31 | -62 |

| Total number of months: | 100 | |||||||||

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates