Global| Oct 23 2007

Global| Oct 23 2007Italy’s Retail Sales Show a Slowdown in Progress

Summary

Italys retail sales stay on a low-growth path. Italys retail sales have slowed and are staying at that slower pace. Over the past year, at 0.6%, retail sales have slowed from their previous years pace of 1.1%. On sequential growth [...]

Italy’s retail sales stay on a low-growth path.

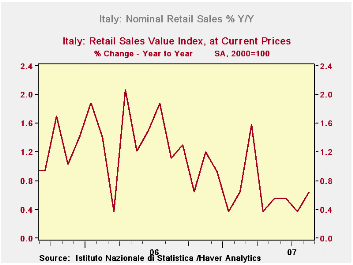

Italy’s retail sales have slowed and are staying at that slower pace. Over the past year, at 0.6%, retail sales have slowed from their previous year’s pace of 1.1%. On sequential growth rates there is a very modest up tick in growth to 1.1% over three months. Both food and clothing sales have picked up slightly on that horizon, yet both remain lower yr/yr compared to the previous year. For the new quarter, sales continue their lethargy. Nominal sales are up by almost 1% at an annual rate in the quarter with clothing lagging at a 0.6% pace and food stronger at 1.6%.

Italy’s figures are in sharp contrast with France where spending on MFG goods is up strongly by 5.8% in September from 2.9% (both y/y) in August. France’s figures for September are surprising. Italy’s results are more the sort of thing we have been seeing for some time. On balance France is the unusual signal for the whole of the Euro area since nowhere else do consumers seem to be gaining momentum. Even in France the result is in contrast to the recent industrial indicators we have seen and to the recent strike to protest a reduction in pension benefits for transport sector workers.

| Nominal | Aug-07 | Jul-07 | Jun-07 | 3-MO | 6-MO | 12-MO | Yr Ago | Q-2-Date |

| Retail Trade | 0.2% | 0.0% | 0.1% | 1.1% | 0.7% | 0.6% | 1.1% | 0.9% |

| Food Beverages & Tobacco | 0.6% | -0.1% | 0.0% | 2.1% | 1.9% | 1.3% | 1.3% | 1.6% |

| Clothing & Fur | 0.1% | -0.6% | 1.1% | 2.4% | -1.0% | -0.3% | 2.0% | 0.5% |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.