Global| Feb 16 2005

Global| Feb 16 2005Japan Economy in Renewed Slump as GDP Falls in Q4

Summary

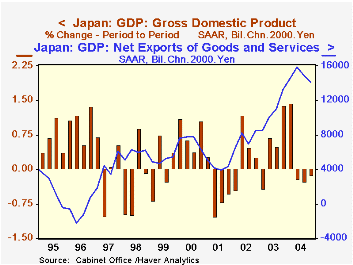

Japanese GDP, reported for Q4 today in Tokyo, badly disappointed. It fell 0.1% (0.5% annualized), compared with a 0.7% increase expected by market forecasters. Thus, after a 1.4% gain in Q1, GDP has now fallen three consecutive [...]

Japanese GDP, reported for Q4 today in Tokyo, badly disappointed. It fell 0.1% (0.5% annualized), compared with a 0.7% increase expected by market forecasters. Thus, after a 1.4% gain in Q1, GDP has now fallen three consecutive quarters, leading some to say that Japan has once again slumped into recession.

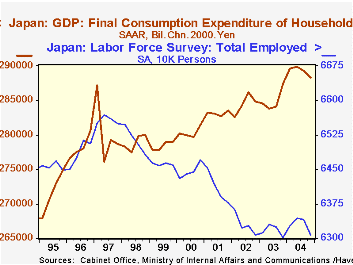

Sluggish household spending was the main culprit, down 0.3% following -0.2% in Q3. Imports also contributed with a sizable 3.1% quarterly increase. In contrast, capital spending advanced 0.5%, with gains in both dwellings and private plant and equipment. Government investment declined, but much less than in Q3.

The shallow declines, while weaker than market expectations, still left GDP well above year-earlier levels. And the growth for the year as a whole, 2.6% over 2003, was the largest since 1996. Yesterday, in discussing the shortfall in European growth, Louise Curley illustrated the constricting forces of strong currency and higher oil prices. These factors also apply in Japan. Further, employment in Japan has been weak for several years, also restraining consumer spending; the number of employed persons did recover somewhat in the first half of 2004, but then fell back, erasing those earlier increases. Thus, the Japanese economy, which had looked promising several months ago, has sagged anew, with prospects clouded for any renewal of more vigorous performance.

| % Changes | Q4 2004* | Q3 2004* | Year/Year | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|

| GDP | -0.1 | -0.3 | 3.4 | 2.6 | 1.4 | -0.3 |

| Final Consumption: Households | -0.3 | -0.2 | 0.2 | 1.5 | 0.2 | 0.5 |

| Government | 0.4 | 0.3 | 2.6 | 2.6 | 1.2 | 2.6 |

| Gross Fixed Capital Formation | 0.5 | 0.0 | -0.6 | 1.8 | 0.9 | -5.7 |

| Exports | 1.3 | 0.6 | 3.9 | 14.3 | 9.1 | 7.3 |

| Imports | 3.1 | 2.4 | 6.6 | 9.2 | 3.8 | 1.3 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates