Global| Aug 19 2011

Global| Aug 19 2011Japan Indices Show the Profile of Impact and Rebound

Summary

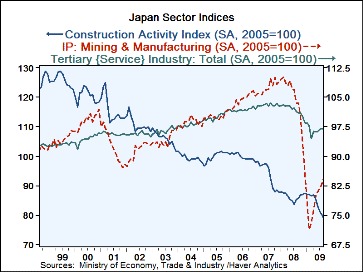

Japan’s indices are showing a rebound in its three main sectors: Manufacturing, Services (tertiary sector) and Construction. The rebound is being led by a strong recovery after a deep drop in manufacturing and mining. Services [...]

Japan’s indices are showing a rebound in its three main sectors: Manufacturing, Services (tertiary sector) and

Construction. The rebound is being led by a strong recovery after a deep drop in manufacturing and mining.

Services industries also incurred what was a large drop for those trend-driven businesses and have been

steadily climbing higher. The construction sector that is supposed to lead Japan higher as the rebuilding

gets into full swing has taken a big hit from the disasters and has been the slowest sector to recover.

Japan’s indices are showing a rebound in its three main sectors: Manufacturing, Services (tertiary sector) and

Construction. The rebound is being led by a strong recovery after a deep drop in manufacturing and mining.

Services industries also incurred what was a large drop for those trend-driven businesses and have been

steadily climbing higher. The construction sector that is supposed to lead Japan higher as the rebuilding

gets into full swing has taken a big hit from the disasters and has been the slowest sector to recover.

In the far right-hand columns, the table above shows the ranking of the various sector indices in their range of values since 1993. The services (tertiary) sector is at the relative best standing in the 60th percentile of its range but also at a stronger 75th percentile standing in its queue. The queue standing tells us that the standing is lower than this only 25% of the time. Construction is near the bottom of its queue and its range. Mining and manufacturing is a sector that is at the midpoint of its range but stands much lower in its queue or ranking. The mining and MFG sector has been weaker than its current index level only 23% of the time. It stands in the bottom quartile of its historic range and that is not good.

What we see is evidence of a rebound in Japan and one that is not yet being led by Japan’s rebuilding efforts. There are a lot of services that are being taken up and undoubtedly some of these are related to the provision of disaster relief. Japan’s manufacturing community has been working overtime to try to restore lost output capabilities. There is a strong recovery in progress there.

But much of Japan’s MFG product gets exported. Japan is a country with not just capped population growth but a shrinking population. For expansion Japan has been leaning on its exports. But with world growth tapering off or worse-falling off and possibly into recession, Japan’s growth may yet shift gears and come to rely on its construction sector which continues to lag the other sectors and to lag them badly.

| Up to Date Japan Industry Survey | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Recent Months | Moving Averages | Extremes; Range | Rank Standings |

|||||||

| Jun 2011 |

May 2011 |

Apr 2011 |

3Mo | 6Mo | 12Mo | Max | Min | %ile | %ile | |

| All Industry | 96.2 | 94.0 | 92.3 | 94.2 | 94.4 | 95.5 | 103.4 | 90.0 | 46.3% | 49.5% |

| Construction | 72.9 | 72.7 | 70.1 | 71.9 | 74.6 | 75.4 | 138.6 | 70.1 | 4.1% | 1.4% |

| Mining and MFG | 92.6 | 89.2 | 84.0 | 88.6 | 90.4 | 92.3 | 110.1 | 71.4 | 54.8% | 23.1% |

| Tertiary | 98.5 | 96.7 | 95.9 | 97.0 | 97.1 | 97.7 | 103.5 | 90.8 | 60.6% | 75.0% |

| Ranges, Max, Min and ranking standings since 1993 | ||||||||||

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates