Global| Sep 21 2007

Global| Sep 21 2007Japan is Losing Momentum Across Sectors

Summary

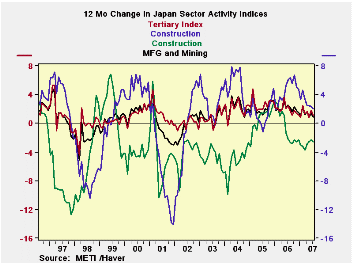

Construction sector is on its LIFETIME LOW since 1993. The chart on the left shows the 12-month momentum in Japans various key sectors. Among them, only construction is contracting and it has been doing that since mid -2006. [...]

Construction sector is on its LIFETIME LOW – since 1993.

The chart on the left shows the 12-month momentum in Japan’s various key sectors. Among them, only construction is contracting and it has been doing that since mid -2006. Construction is at the its lifetime low point. Other sectors are relatively high in their respective ranges – in their 90th percentiles. But momentum is fading across these sectors. MFG is only gradually losing momentum while the tertiary sector (services) has less momentum to start and is also losing it faster. The all industry measure tracks the tertiary sector closely.

| Japan Main Industry Surveys | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Recent Months | Moving Averages | Extremes: Range | |||||||

| Jul 2007 |

Jun 2007 |

May 2007 |

3Mo | 6Mo | 12Mo | Max | Min | %-Tile | |

| All Industry | 107.1 | 107.5 | 107.3 | 107.3 | 107.2 | 106.9 | 107.6 | 93.1 | 1.0 |

| Construction | 78.7 | 80 | 81.6 | 80.1 | 80.3 | 80.4 | 124.6 | 78.7 | 0 |

| Mining and MFG | 108.1 | 108.5 | 107.1 | 107.9 | 107.8 | 107.9 | 109.6 | 87.7 | 0.9 |

| Tertiary | 109.7 | 110.3 | 110.2 | 110.1 | 110.0 | 109.5 | 110.7 | 91 | 0.9 |

| Ranges, Max, Min since 1993 | |||||||||

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.