Global| Jan 18 2008

Global| Jan 18 2008Japan MFG and Service Sectors still growing…but slower

Summary

Japans tertiary (services) sector index is a fresh release and it signals a modest rebound in activity in November as the sector index edges up to 100.6 form 100.5. Its growth rate (y/y) rises to 1.1% for a 0.9% in November, but is [...]

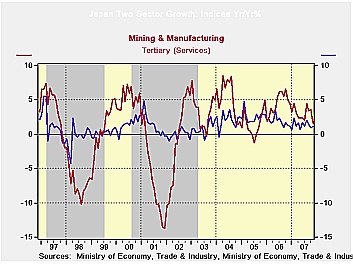

Japan’s tertiary (services) sector index is a fresh release and it signals a modest rebound in activity in November as the sector index edges up to 100.6 form 100.5. Its growth rate (y/y) rises to 1.1% for a 0.9% in November, but is still slower than it has been much of the year previously. It is also above its three-month average. The mining and MFG sector is growing faster that the service sector over the past year with a growth rate of 1.6% compared to the 1.1% for services. Still, MFG sector growth by this index peaked at 4.5% in Februaru and at 4.4% in August. Since August the MFG slowdown has been pronounced. The slip in MFG growth to 1.6% November is from 3.6% on October.

The chart on the left shows that one signal of a slowdown in Japan is when the MFG and Mining sector index grows slower than the service sector index. There are three examples of that happening since 1997 and two of them were in recessions. So far Japanese officials are still upbeat about the economy. The slowing in the MFG sector and crawling growth rate in services are reminders of how close Japan remains to the edge that separates slow growth from contractions.

| Recent Months | Moving Averages | Extremes; Range | |||||||

| Nov-2007 | Oct-2007 | Sep-2007 | 3-Mo | 6-Mo | 12-Mo | Max | Min | %-Tile | |

| Mining and MFG | 110.4 | 112.2 | 110.3 | 111.0 | 110.2 | 109.0 | 112.2 | 87.7 | 92.7% |

| Tertiary | 110.6 | 110.5 | 109.2 | 110.1 | 110.3 | 110.0 | 111.2 | 91.0 | 97.0% |

| Ranges, Max, Min since 1993 | |||||||||

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.