Global| Nov 08 2007

Global| Nov 08 2007Japan Orders Remain Weak

Summary

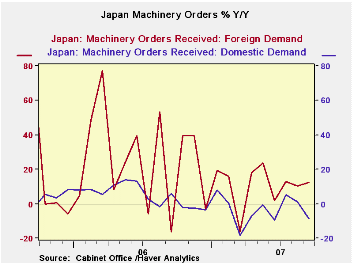

Japan’s machinery orders do show some improvement in the pattern for sequential growth rates for core orders. That series omits the most volatile components of the orders series. Still the current readings remain negative (m/m 3-mo, [...]

Japan’s machinery orders do show some improvement in the

pattern for sequential growth rates for core orders. That series omits

the most volatile components of the orders series. Still the current

readings remain negative (m/m 3-mo, 6-mo and Y/Y). Foreign demand for

the overall orders series is oscillating at a moderate reading up by

4.8% over three months and down by 7.8% in September, after a strong

August. Domestic demand, however, shows still weak trends with a dive

in the Yr/Yr growth rate in September.

| Japan Machinery Orders | ||||||

|---|---|---|---|---|---|---|

| m/m % | Saar % | |||||

| SA | Sep-07 | Aug-07 | Jul-07 | 3-Mos | 6-Mos | 12-Mos |

| Total | -14.5% | 7.1% | -0.6% | -31.4% | 8.9% | -1.2% |

| Core Orders* | -7.6% | -7.7% | 17.0% | -0.6% | -6.4% | -6.6% |

| Total Orders | ||||||

| Foreign Demand | -7.8% | 23.0% | -10.8% | 4.8% | 17.9% | 12.3% |

| Domestic demand | -9.6% | -4.2% | 6.7% | -27.0% | 20.8% | -8.7% |

| * Excl ships and electric power | ||||||

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates